DATs, Hyperliquid

Key Takeaways

Digital Asset Treasuries (DATs) convert tokens into productive balance sheets, enabling long-duration, on-chain operating entities.

Their growth is fueled by a structural capital gap: crypto’s native investor base is saturated, while institutions with over $36 trillion in assets lack compliant channels for exposure.

Hyperliquid provides one of the clearest environments for DATs to operate at scale, with real revenue, programmable assets, and on-chain business primitives.

Hyperion DeFi (~1.7M HYPE) and Hyperliquid Strategies Inc. (~12.6M HYPE + $305M cash) are the earliest HYPE-focused treasuries, together anchoring roughly 7% of circulating supply.

Every market eventually institutionalizes. In equities, it happened through holding companies; in credit, through securitization. In crypto, DATs stands out as one emerging pathway.

These vehicles are permanent-capital vehicles designed to hold, compound, and operationalize crypto assets through staking, liquidity provision, and governance. In practice, they resemble holding companies, except their product is the balance sheet itself.

What’s emerging is an architecture where tokens function as working capital. They produce yield, fund validators, and can even be leased for on-chain utility. The result is a category that sits between protocol and investor, businesses that exist to own, operate, and grow digital assets.

Among current ecosystems, Hyperliquid provides a clear lens for studying this model. This memo looks at how DATs work, why they’ve gained traction, and how Hyperliquid’s architecture has made it the most advanced environment for their growth.

1. Understanding DATs

A DAT is a company whose purpose is to own and compound digital assets over long periods. Unlike a fund, it doesn’t promise redemptions or benchmark performance. Its mandate is to accumulate, earn yield, and expand the number of tokens per share.

The treasury holds core assets (often native tokens of a specific network) and deploys them where they’re productive (e.g. staking validators, supplying liquidity, or participating in governance). The income they generate is reinvested, creating a self-reinforcing balance sheet that compounds both yield and influence.

Structurally, a DAT resembles a closed-end fund with the freedom to act like an operator. Shares trade on public exchanges while the underlying assets sit transparently on-chain. Investors buy the equity; the company handles custody, deployment, and compliance. This solves a practical problem for institutions — they can hold crypto exposure without directly managing wallets or dealing with on-chain risk.

Permanent capital is what gives DATs their distinctive shape. Without the pressure of quarterly withdrawals, they can buy during drawdowns, stake through volatility, and treat liquidity as a resource. When their shares trade above net asset value (NAV), they issue more equity to grow holdings; when discounts appear, they wait or buy back shares. Financing remains flexible (PIPE, convertibles, token-linked loans, or secondary placements) but the end goal is always to buy more tokens per share.

The model’s earliest expression came in 2020, when MicroStrategy converted its corporate treasury into Bitcoin. That move proved that a public company could operate as a compliant, liquid wrapper for digital exposure, and that permanent capital fit volatile assets better than short-term mandates. MicroStrategy now holds more than 641,000 BTC, and its stock functions as a tradable proxy for Bitcoin itself.

By 2025, the approach had spread across crypto. DATs collectively managed about $105 billion in on-chain assets, with participants such as BitMine Immersion, which has accumulated more than $4.9B worth of ether and targets 5% of supply, and SharpLink Gaming, chaired by Ethereum co-founder Joseph Lubin, which holds a large ETH reserve.

2. The Capital Gap

The surge in DAT formation stems from a widening divide between institutional demand and direct access. Large investors want exposure to digital assets but face regulatory and operational barriers that prevent them from holding tokens outright.

As Paradigm’s Matt Huang noted, institutional capital (especially in the U.S) is increasingly interested in ecosystems like Hyperliquid but lacks compliant pathways to participate. DATs bridge that gap. They are auditable, exchange-listed structures that fit inside existing portfolio mandates, allowing exposure to crypto through conventional equity instruments.

At a macro level, Ethena founder Guy Young describes a broader structural constraint. After two full cycles, the total altcoin market cap has hovered near $1.2 trillion, suggesting that the industry has largely exhausted its native capital base. To grow further, crypto must attract outside allocators (pensions, endowments, and asset managers) that together control roughly $46 trillion in U.S. retirement assets as of mid-2025.

For these institutions, DATs feel familiar. They combine the permanence of closed-end funds, the capital flexibility of REITs, and the compounding discipline of holding companies such as Berkshire Hathaway. They raise equity, list publicly, and employ straightforward financial tools (convertibles, loans, and yield programs) to scale. Their results are measured not in dollars, but in crypto units: more ETH per share, more HYPE per share.

The benefits extend to the protocols themselves. DATs bring patient, non-speculative capital to functions that require scale (e.g. staking, liquidity provision, governance). On Hyperliquid, where staked tokens reduce trading fees and can be leased through HAUS agreements, DATs even monetize alignment directly.

3. Hyperliquid as the Proving Ground

Hyperliquid offers a clean environment for observing how a DAT operates at scale.

3.1 Durable and Auditable Revenue

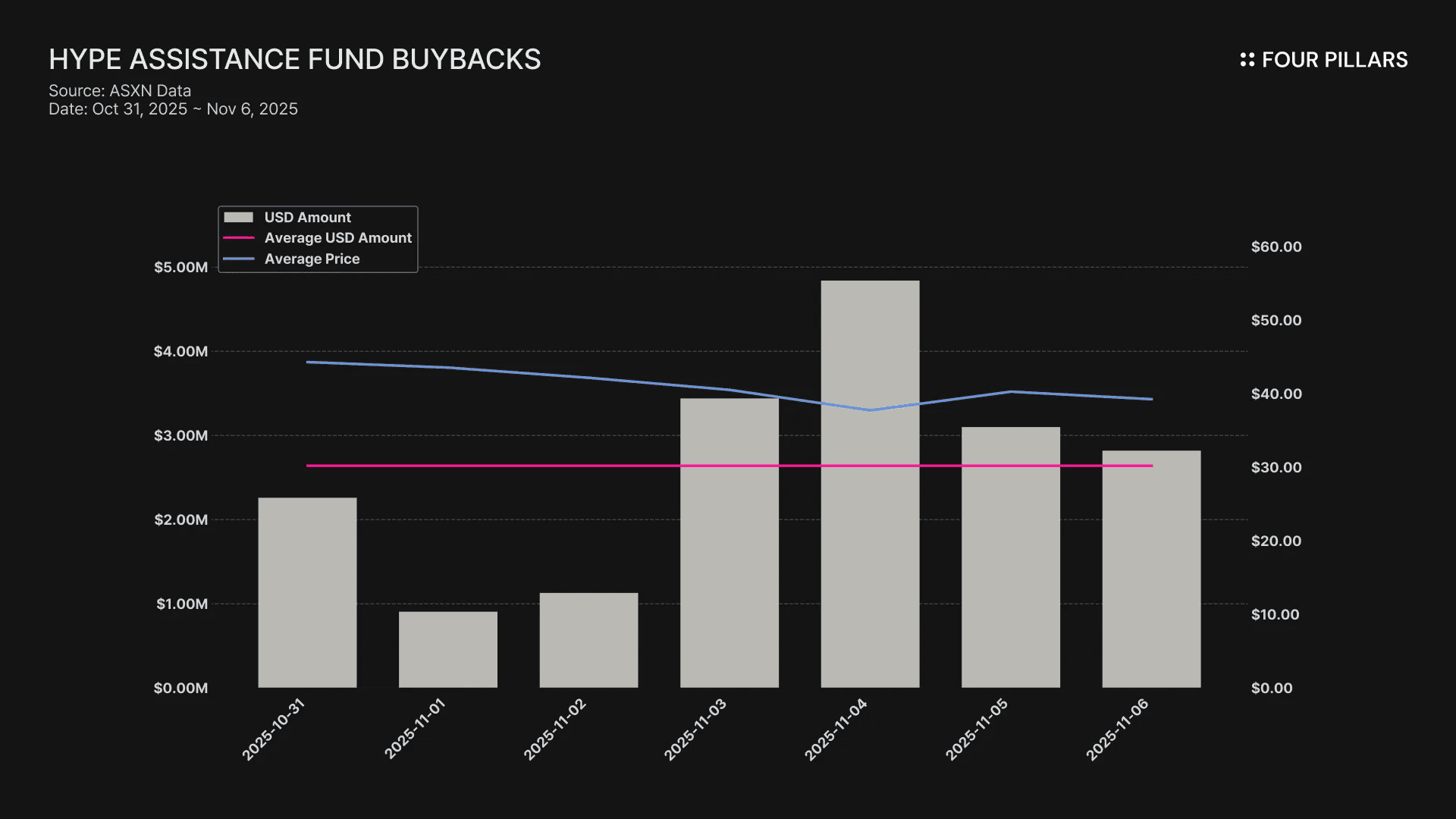

The foundation is Hyperliquid’s fee engine. Trading fees, paid in stablecoins across perpetual and spot markets, are used to fund on-chain buybacks. As of November 12, 2025, cumulative trading volume stands at roughly $3.2 trillion, with 828,000 users and about $9 billion in open interest. Cumulative fees total around $789 million, while the Assistance Fund (AF) holds 34.1 million HYPE (roughly $1.36 billion at $40 per HYPE). Because these flows arise from actual trading activity instead of short term incentives or emissions, they create a verifiable stream of income. For a DAT, this distinction is crucial since the cash flow can be modeled, audited, and reported in conventional terms.

This is where HYPE diverges from the broader token landscape. Much of the industry still depends on yield funded by inflation or incentives. Hyperliquid’s revenues, by contrast, originate from recurring user behavior. For treasuries governed by boards and auditors, that reliability makes HYPE an investable, defensible asset.

As institutional allocators enter the sector, they will demand the same standards of disclosure and performance measurement that exist in equities or credit. Few tokens can meet that threshold today, but HYPE already does. It produces consistent protocol revenue, enabling DATs to present genuine income statements, NAV updates, and yield analyses.

3.2 Holders → Operators

Because assets like HYPE are programmable, treasuries can deploy them directly into productive on-chain use. HYPE can be staked, lent, or used to power HAUS agreements. Large holders can operate validators, supply liquidity to vaults, or partner with trading firms to recycle capital through the network, all while retaining the core exposure that drives NAV growth.

The biggest DATs will look less like funds and more like digital operating companies, using scale to capture yield, support ecosystem infrastructure, and extract spreads across the protocol’s economy.

This evolution is also what preserves value. DATs that merely accumulate tokens will see their premiums to NAV erode as novelty fades. Those that operate (deploying capital to earn, provide services, or bootstrap new primitive) will sustain premiums because they generate incremental return on assets. Hyperliquid’s architecture allows for this type of activity, giving DATs the tools to become ecosystem businesses.

3.3 Market Access and Structural Demand

HYPE’s limited presence on (centralized) exchanges creates a rare structural advantage for DATs. Institutional investors who want exposure to Hyperliquid face an access bottleneck: the token trades primarily on its native chain, beyond the reach of most compliance frameworks. Unlike BTC and ETH, which now have ETF structures providing straightforward institutional access, HYPE lacks any equivalent product. Yet strong demand exists.

Hyperliquid DATs solve that problem. By structuring HYPE ownership inside publicly traded, audited vehicles, they offer the only scalable way for regulated investors to gain exposure. This scarcity of access relative to demand can sustain persistent NAV premiums, turning DATs into the de facto exchange-traded proxies for HYPE.

4. Case Studies: Hyperion DeFi and Hyperliquid Strategies Inc.

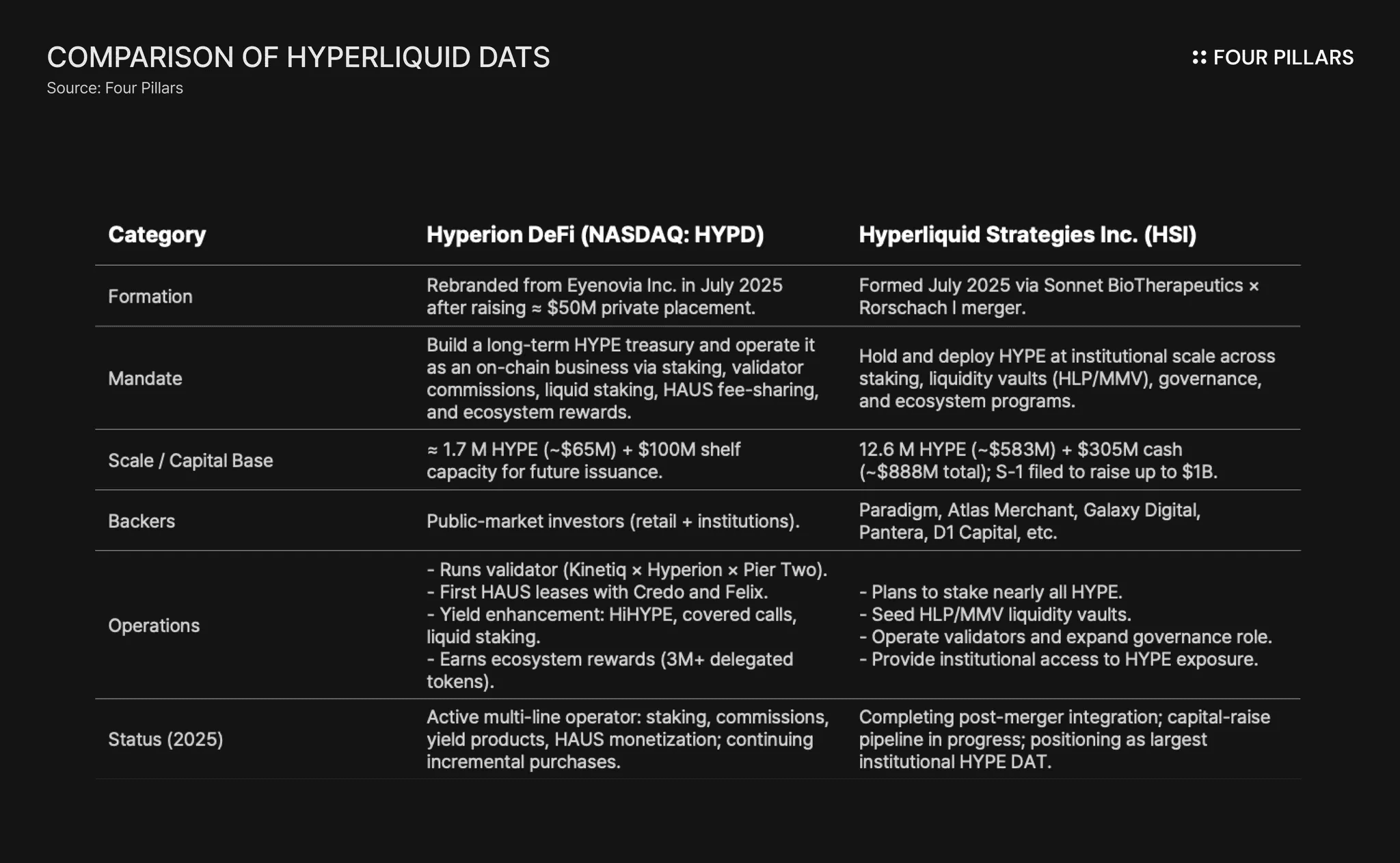

Two treasuries on Hyperliquid show how the DAT model scales across different levels of capital. Hyperion DeFi represents the incremental, public-market path, Hyperliquid Strategies Inc. (HSI) represents the institutional, balance-sheet model. Both are early experiments in whether treasuries can operate.

4.1 Hyperion DeFi (NASDAQ: HYPD)

Hyperion DeFi began as Eyenovia, Inc., a medical-device company listed on Nasdaq. In July 2025, it rebranded, raised roughly $50 million through a private placement led by accredited investors, and shifted its focus entirely to building a HYPE denominated treasury.

Deployment began immediately. On July 14, Hyperion purchased $5 million of HYPE (1,427,178 tokens at $35.38 each), followed by another $5 million on July 28, and a third $10 million tranche in September, bringing total holdings to about 1.7 million HYPE.

What has become clearer with Hyperion’s Q3’25 earnings is that the company is slowly starting to resemble a small on-chain operating business built around its HYPE balance sheet. Its Q3 disclosures show six active revenue lines:

Staking rewards from its HYPE treasury.

Validator commissions earned through a joint validator agreement with Kinetiq and Pier Two.

Yield enhancement, including:

The HiHYPE liquid staking token,

Covered call strategies, and

Additional liquid-staking deployments.

DeFi monetization through Hyperion’s proprietary HAUS (“HYPE Asset Use Service”) platform, with Credo (September) and Felix (October) as early fee sharing users.

Ecosystem rewards, including over 3 million tokens delegated from the Hyperliquid Foundation to the Hyperion validator.

Legacy life sciences operations, now peripheral to the company’s thesis

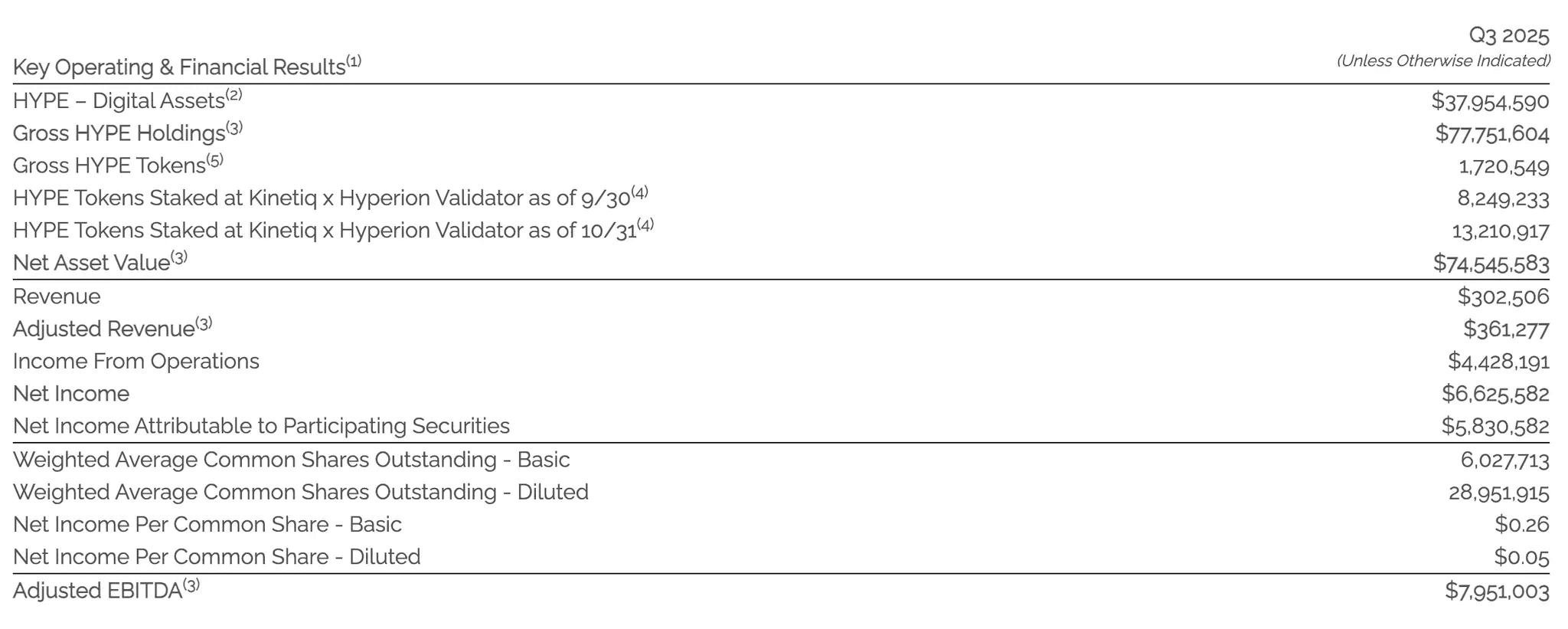

For Q3 2025, Hyperion reported:

Source: Hyperion DeFi Q3 2025 Earnings Supplement

Revenue: $302,506

Adjusted revenue: $361,277

Income from operations: $4.43M

Net income: $6.63M

Adjusted EBITDA: $7.95M

These numbers are small in absolute terms but they demonstrate a DAT actually generating recurring on-chain income. It is too early to know whether this model can scale or survive a full downturn, but Hyperion’s disclosures show what an operator-style treasury looks like in practice. With a $100 million shelf registration in place, the company continues to issue equity opportunistically to expand its treasury.

4.2 Hyperliquid Strategies Inc. (HSI)

In July 2025, Sonnet BioTherapeutics Inc. (NASDAQ: SONN) announced a definitive merger with Rorschach I LLC, affiliates of Atlas Merchant Capital and Paradigm, to form HSI, a listed DAT intended to hold and deploy HYPE at scale.

At closing, the transaction contemplated a contribution of 12.6 million HYPE alongside $305 million in cash, representing the initial capital commitments from the merger parties. These figures describe the pro forma contribution base, not the company’s live net asset value.

HSI’s governance and investor base signal its institutional orientation. Investors include Paradigm, Galaxy Digital, Pantera, D1 Capital, Republic Digital, and 683 Capital. The board is chaired by Atlas Merchant Capital co-founder Bob Diamond, with CIO David Schamis serving as CEO and former Boston Fed President Eric Rosengren joining as an independent director.

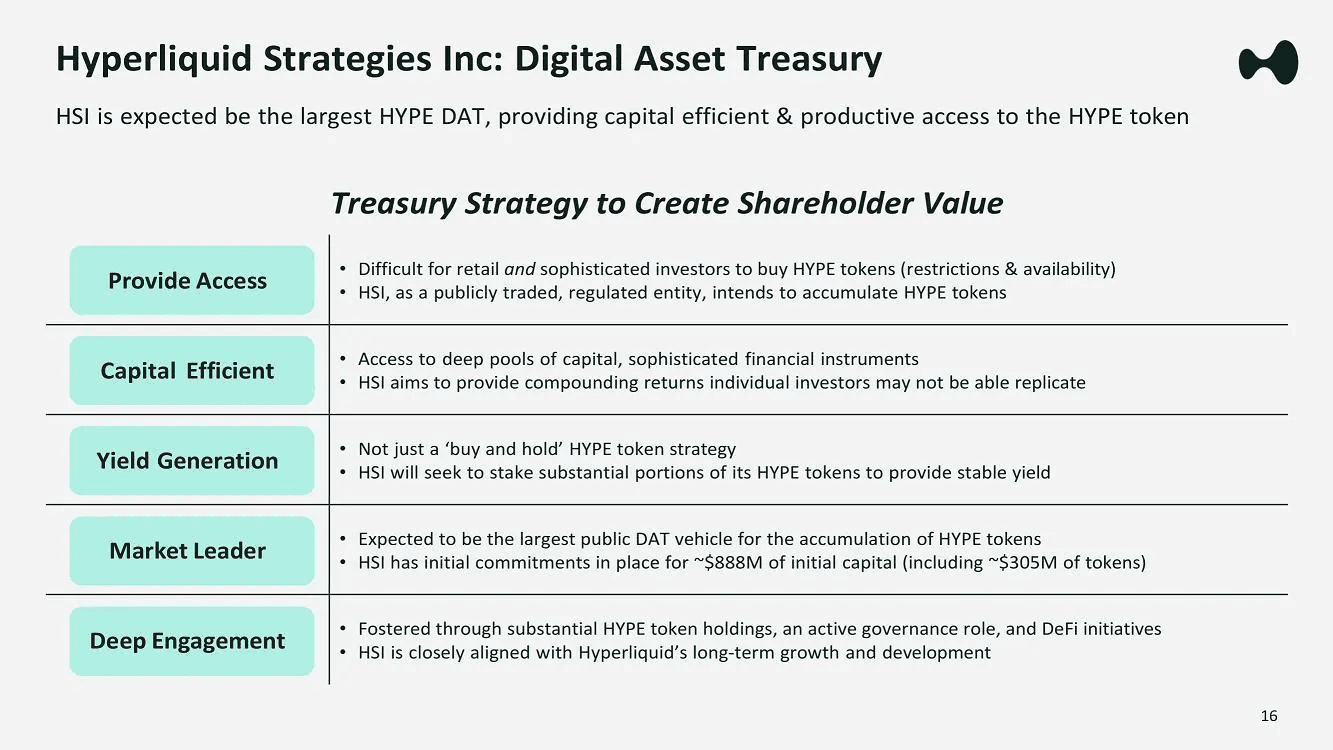

HSI’s newly released investor presentation clarifies its strategy. It emphasizes five pillars:

Source: SEC

Access: removing institutional barriers to acquiring HYPE, given its limited CEX listing footprint.

Capital efficiency: using financing tools unavailable to individuals, including large-scale equity issuance.

Yield generation: explicitly not a “buy and hold” treasury — staking, liquidity provisioning, and fee-based activities are central.

Market leadership: aiming to be the largest public DAT focused on HYPE, backed by roughly $888M in commitments.

Deep engagement: active governance, validator operation, and hands-on participation in ecosystem development.

In October 2025, HSI filed an S-1 to raise up to $1 billion more in equity for further HYPE accumulation and operating activities across the network. The strategy is to scale the treasury, deploy the balance sheet across staking and liquidity programs, and use size to integrate into the core mechanics of the network.

Where Hyperion tests a validator plus yield business, HSI is attempting to industrialize the same concept at institutional scale.

4.3 Comparison & Synthesis

Together, Hyperion and HSI outline what a DAT can look like on Hyperliquid.

Hyperion DeFi demonstrates that a lean, public company can steadily accumulate HYPE and convert it into multiple income streams (staking rewards, validator commissions, yield strategies, DeFi monetization, and ecosystem participation).

HSI shows how the model scales upward, using institutional capital and governance structure to become a major balance-sheet participant and potential anchor of ecosystem liquidity.

Collectively, these two entities already hold between roughly 7% of HYPE’s circulating supply, providing long-duration ownership at a scale that is unusual for a network this young. How durable that ownership becomes (and whether operational activities can eventually support NAV premiums) remains an open question.

Taken together, their approaches highlight a deeper point: the significance of a DAT is not measured by the absolute size of its holdings, but by whether each share is accumulating more crypto over time.

That is why, across the DAT universe, the cleanest way to judge performance is to observe if crypto per share is rising or not. Issuance at a premium is not inherently bad; it is accretive if treasury growth outpaces dilution. The problem children are the “infinite ATM” operators that treat equity as a bottomless source of spot-buying ammo, allowing crypto per share to collapse while management talks about “expanding the treasury”. For Hyperion and HSI, the long-term test will not be how large their HYPE balances get, but whether each marginal share issued over the next few years buys more HYPE than it dilutes.

5. Risks

Permanence is tested in every market cycle. DATs’ resilience depends not only on the quality of the assets they hold, but also on how they manage capital structure, leverage, and investor sentiment.

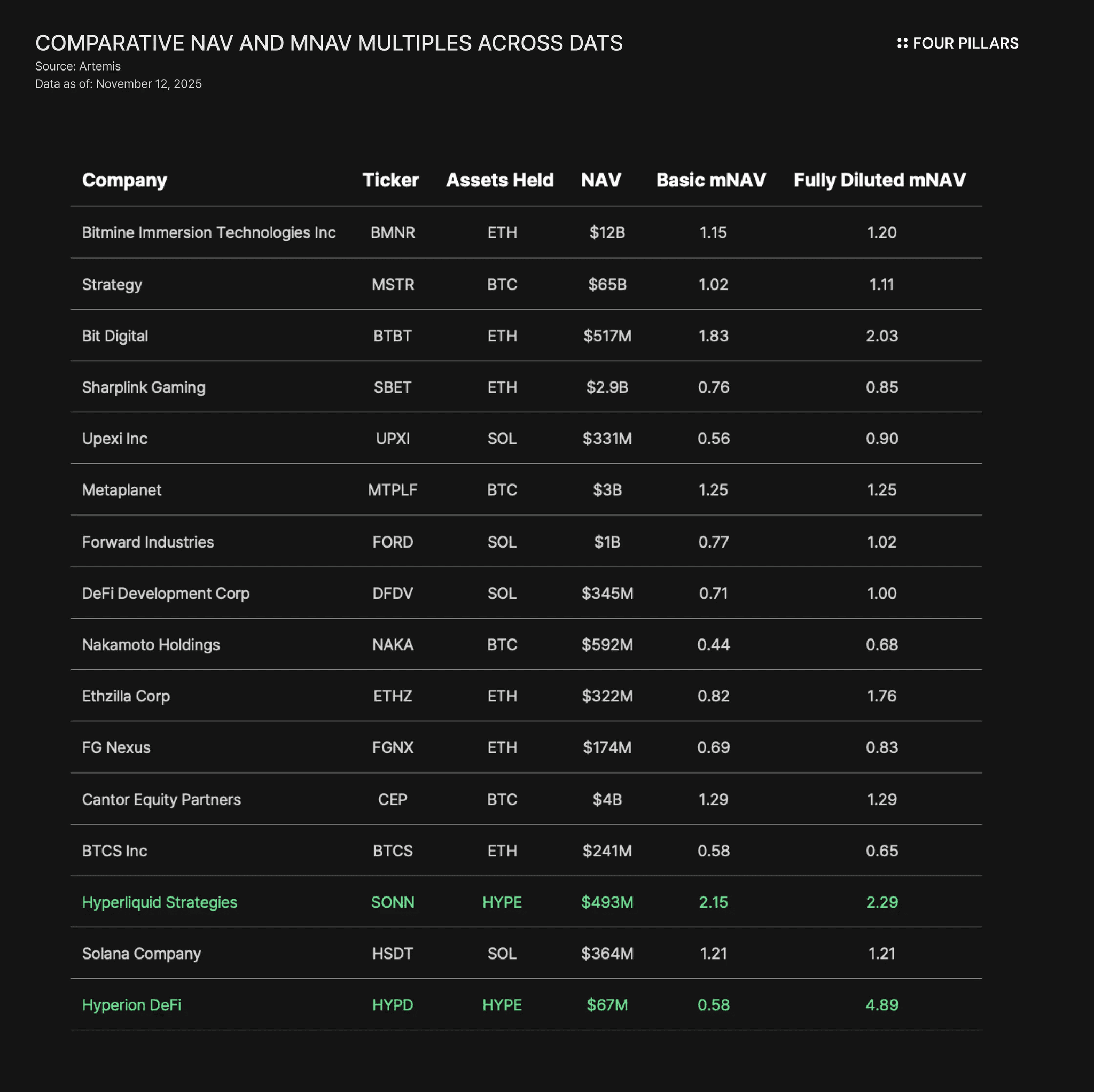

5.1 mNAV Premiums & Discounts

DAT equities trade relative to their mNAV, and sentiment drives the spread. In optimistic periods, premiums expand, enabling accretive share issuance and treasury growth. In risk-off markets, those premiums compress or turn to discounts, cutting off capital inflows and forcing discipline.

Even MicroStrategy, the bellwether for balance sheet exposure, saw its premium shrink from 4× mNAV at its peak to roughly 1x by late 2025. For smaller DATs built around newer tokens, volatility will be greater still. Persistent discounts can erode confidence, leaving companies unable to grow or forcing restructuring. Each treasury will need mechanisms such as buybacks, capital conversions, or controlled liquidations to manage its equity-trading dynamic without undermining its mandate.

ETHZilla provides a recent example. After its mNAV fell to around 0.62× in October 2025, the company sold roughly $40 million in ETH to repurchase shares, an attempt to close the discount and stabilize investor confidence.

That said, premiums and discounts are only the surface layer. The mechanics underneath determine whether a DAT is actually compounding value.

While mNAV is the cleanest shorthand for sentiment, it is a blunt tool. What actually compounds or destroys value is the interaction of three variables: the underlying token price, crypto-per-share, and the mNAV multiple on top of that. A DAT that grows crypto-per-share but sees its mNAV compress is still creating fundamental value; one that issues heavily into premiums without growing its treasury is just burning investor leverage. In that sense, mNAV < 1 is a symptom, not a root cause. The core questions are whether per-share holdings are rising and whether management halts issuance and protects that metric when sentiment turns.

Issuance is also not limited to common equity. Some DATs will experiment with preferred shares or similar fixed-rate instruments that behave like credit. These structures add another layer to the mNAV dynamic: the DAT raises capital at a predictable annual cost and uses the proceeds to accumulate more of the underlying token.

What matters is the relationship between that cost of capital and the token’s long-term CAGR. Preferred buyers are yield-seeking investors who cannot or will not hold the token directly, allowing the DAT to tap funding at rates below the asset’s expected long-term growth.

If the token compounds faster than the financing cost, crypto-per-share rises even if the stock trades below mNAV. If it compounds slower, the structure destroys value. The spread between those two numbers determines whether this kind of capital structure enhances or erodes the treasury over time.

5.2 Leverage & Funding

Leverage inside DATs is a double mirror. Some treasuries issue convertible notes or borrow against crypto collateral to accelerate accumulation. The risk emerges when liabilities are denominated in dollars but assets in tokens. If token prices fall, the company still owes fixed dollar debt, forcing liquidations at poor prices.

MicroStrategy has limited leverage to roughly 12% of asset value with a 20% cap. DATs tied to smaller-cap tokens will need even stricter boundaries. Equity-funded growth is slower but safer; dollar liabilities can quickly trigger downward spirals. The difference between a compounding balance sheet and a forced seller often lies in a single overextended bond issue.

5.3 Asset Quality

A DAT’s durability begins and ends with the assets on its balance sheet. Treasuries anchored to tokens with shallow or reflexive demand will erode during bear markets. The first wave of DATs has centered on BTC, ETH, SOL, HYPE, BNB, and ENA—large, liquid tokens that provide a starting point for experimentation. But even among these, many DATs will fail. As the model spreads to smaller or less liquid tokens, fragility will multiply.

6. Looking Forward

DATs are still early. They offer one possible path for crypto ownership to mature, but they have yet to prove they can compound through full cycles or sustain investor interest. Their design borrows familiar corporate mechanics and applies them to an asset class that, until now, has been driven more by liquidity, incentives, and momentum than by durable cash flow.

A key implication is that not all DAT bases are equal. Bitcoin DATs obviously sit on the safest and most institutionally demanded asset, but they are structurally constrained: BTC does not natively offer staking economics, validator commissions, or on-chain liquidity programs.

Most BTC treasuries are effectively levered long vehicles with limited ways to earn incremental yield. ETH, SOL, HYPE are closer to programmable money. They can be staked, lent, restaked, or used to power market-structure programs like HAUS. Over a full cycle, that difference in programmability may prove more important to sustaining mNAV > 1 than any single narrative.

Hyperliquid is an especially useful place to watch this play out because it gives DATs something most networks cannot: real protocol revenue, auditable yield, and on-chain mechanisms that allow treasuries to act as operators. Those features make it plausible to run a DAT as an actual business. Hyperion DeFi and Hyperliquid Strategies are early attempts to test that idea.

For now, DATs should be viewed less as a finished model and more as an early effort to turn large, long duration treasuries into operating entities—ones that aim to use scale and programmability to run real businesses on-chain.