Price Discovery Onchain

The New York Stock Exchange is open 6.5 hours per day, five days per week. That is 27% of total weekday hours. For the remaining 73% of Monday-Friday, the machinery stops. How do we fix this?

This piece is done in collaboration with @desh_saurabh

Every weekday brings more than 17 hours where the answer to "what would someone pay for this right now" globally is unknowable because the infrastructure to discover that answer has been deliberately switched off. This creates a paradox at the base of modern trade. An asset you can trade any time is worth more than an identical asset you can only trade in six hours--the value of liquidity. There is value in being able to enter or exit a position when information arrives, and later in this article, we'll demonstrate how not having the option to enter when opportunity costs traders directly. Yet, we have built multi-trillion dollar markets on a system that keeps traders from accessing liquidity more than 70% of the time.

But the strange thing is that it’s not that the technology can’t support continuous or longer market hours. The gap between what technology is capable of achieving and what markets actually deliver has never been wider. We can message someone on the other side of the planet instantly. We can settle peer-to-peer payments in seconds. But if you are chatting with friends about Tesla and its future on a Saturday night and one friend wants to buy Tesla stock at 3AM, this is not going to happen. Not because sellers do not exist. Not because the technology to facilitate the transaction is unavailable. But because the rails markets run on were designed when information traveled by telegraph and settlement required physical certificates to change hands.

This matters because every hour markets stay closed, information accumulates, earnings reports drop after the bell, geopolitical events unfold overnight, company announcements arrive on weekends, etc. All of this information has value, and that value gets compressed into the first minutes of the next trading session. The result is prices gap, volatility spikes, and the cost of this inefficiency is not evenly distributed across market participants, but it flows to the trader who lacks the tools to protect himself.

The assumption that markets must close is so deeply embedded that most participants never question it. Why should the ability to discover the fair price of an asset depend on what time zone you live in or what day of the week it is? The answer reveals a system optimized for decades-old constraints that we will explore in this piece along with the solution of bringing price discovery and markets onchain.

Overnight Gap Problem

The inefficiency of market closures shows up in data as a persistent, measurable drag on returns. Study after study has documented the same anomaly: most of the gains in US equity markets happened when markets were closed.

From 1993 to 2018, the S&P 500 delivered cumulative overnight returns that exceeded intraday returns by an average of 2.75 basis points per day. If you compound that over a year, you arrive at ~7.2% in annual return differential. Nothing to scoff at.

But it gets worse when you zoom in on a certain time slice. Between 1993 and 2006, the entire equity premium in US markets was earned overnight. If you had bought at the close and sold at the open every day, you would have captured all the gains. If you had bought at the open and sold at the close, your returns would have been zero or negative. The market delivered nothing during actual trading hours. Everything accrued in the gaps.

Traders have known this for decades. Statistical arbitrage strategies that exploit overnight price movements have delivered annual returns above 51% with Sharpe ratios exceeding 2.38. Between 1998 and 2015, researchers documented 2,128 overnight gaps in the S&P 500 alone. The pattern is consistent and exploitable, which tells you the market is not pricing risk correctly. If it were, the opportunity would not persist.

Negative gaps are larger and more volatile than positive gaps. When bad news hits after hours, the market overreacts. Prices fall further overnight than they rise, and the standard deviation of negative gaps exceeds that of positive gaps by a measurable margin. This creates tail risk that does not show up in intraday trading. Hold a position overnight and you face downside exposure that cannot be hedged because the market is closed.

This is not how efficient markets are supposed to work. In theory, prices should reflect all available information at every moment. In practice, prices can only reflect information when markets are open to update them. The downtime hours create blind spots. Information arrives but prices cannot adjust, and by the time they do, the moment has passed and the opportunity to trade at the fair value is gone.

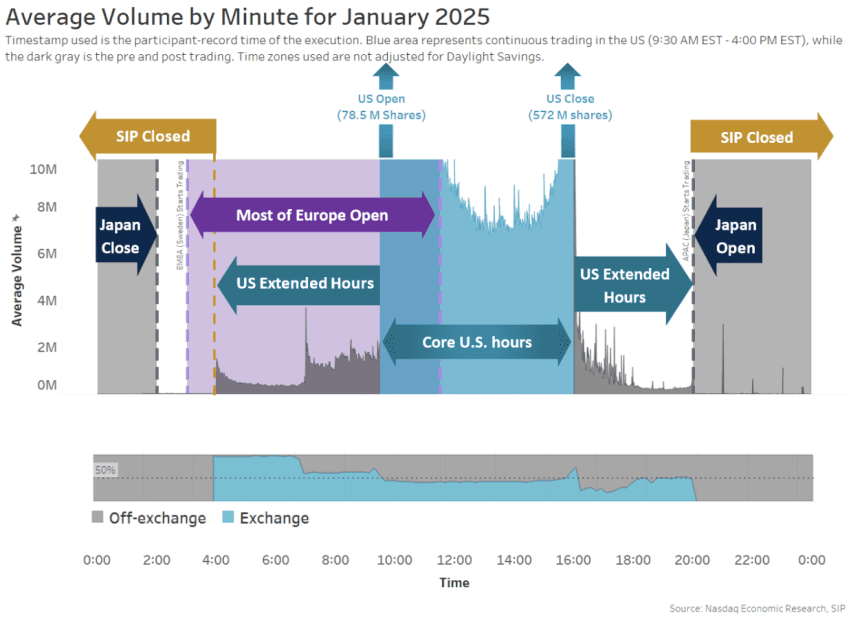

The few investors who can trade after hours face a different problem. Extended-hours trading accounts for only 11% of total daily volume, and overnight trading between 8pm and 4 am represents just 0.2% of market activity. This scarcity of liquidity creates predictable costs.

Volume / Minute Jan 2025 - Nasdaq

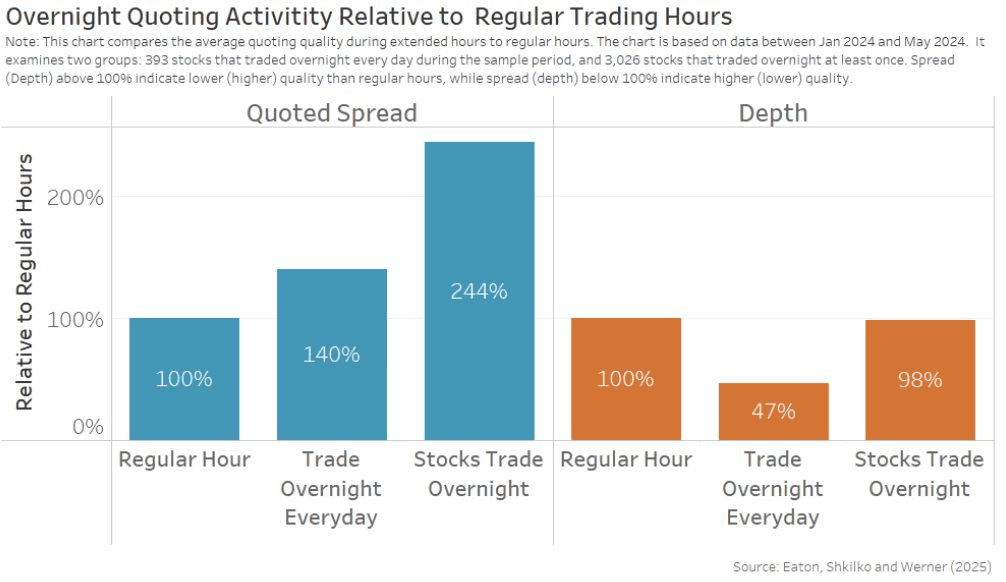

Spreads widen dramatically when exchanges go dark. For stocks that trade every day overnight, quoted spreads run roughly 40% wider than during regular hours. For less liquid stocks, spreads balloon to 144% wider. Market depth collapses to 47% of normal levels for the most active names. The result is that effective spreads on retail orders executed overnight run three times higher than during the day, and price impact increases sixfold.

Overnight Quoting - Eaton, Shkilko, and Werner

The costs of trading are significantly different as well. Extended-hour trading costs run four to five times larger than regular hour costs. Most overnight executions happen at or worse than the best quoted price. Who trades in these conditions? According to NASDAQ, ~80% of overnight volume comes from the Asia-Pacific region, with roughly half originating in Korea. The remaining 20% consists primarily of US retail investors. These are mostly individual traders trying to react to information in real time, paying multiples of normal trading costs for the privilege.

Retail investors bear the brunt of this structural failure from both directions. They lack access to good pre-market trading infrastructure. They cannot adjust positions after hours without paying dramatically inflated spreads. When the market gaps open in response to overnight news, they are the ones holding positions that moved against them while they slept. Professional traders with 24/7 infrastructure capture the gains. Retail investors eat the losses.

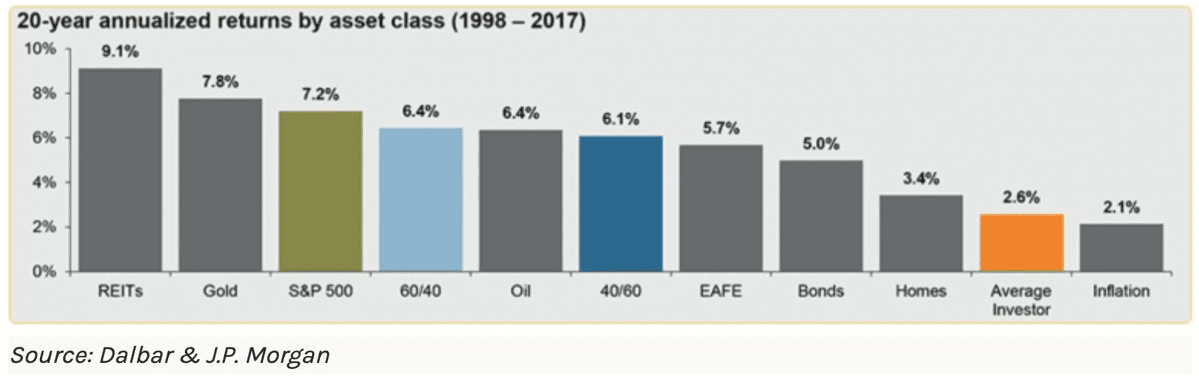

The magnitude of this transfer is substantial. The average retail investor has underperformed the S&P 500 by 5.2% annually.

20yr annualized returns across assets - Dalbar and J.P. Morgan

When overnight returns consistently outpace intraday returns by 7% annually, and retail investors systematically miss that premium because they cannot hold positions optimally, the compounding effect over time is clear. If you think about it, it’s not just about market timing or stock picking skill: this is a structural disadvantage baked into the architecture of the market itself.

Geographic Fragmentation

Temporal fragmentation is just one dimension of the problem too. Markets also fragment across space. The same asset trades at different prices in different countries at the same time. Not solely because one market's participants have better information than another's but because infrastructure prevents prices from converging.

Bitcoin traded at an average premium of roughly 10% in Japan compared to US exchanges during 2017-2018. We famously saw this in the Japan BTC arbitrage that Sam Bankman-Fried infamously executed in 2018 before launching FTX. This mismatch in pricing was solely because of outdated and disconnected rails in an ever-increasingly connected world.

This phenomenon was even more pronounced in South Korea. Between January 2016 and February 2018, Bitcoin prices averaged 4.73% higher on Korean exchanges than on US exchanges. The premium reached as high as 54% in January 2018. At the peak, you could buy bitcoin in the United States for $10,000 and simultaneously sell it in Korea for $15,000.

Why did the premium exist at all? South Korea enforces strict capital controls, thus moving money into the country is straightforward. Moving it back out requires navigating complex regulations designed to prevent money laundering and capital flight. These restrictions made it difficult to exploit the price differential at scale, even when the opportunity was obvious to everyone. The infrastructure to arbitrage the gap simply did not exist for most participants.

This is not unique to cryptocurrency though. Traditional equities exhibit the same patterns. Dual-listed companies, which trade on two exchanges, exhibit persistent price deviations that can persist for months or years. Royal Dutch Shell famously traded at premiums over UK listings. Rio Tinto maintained significant price spreads between its Australian and London listings despite offering identical dividends and capital rights to shareholders.

These spreads should not exist. If markets were truly efficient and globally integrated, arbitrageurs would eliminate any price differential immediately. Buy where cheap, sell where expensive, earn the difference.

The cause is geographic fragmentation. Someone in Utah cannot buy an Indian equity at 2 AM. Again, not because sellers do not exist in India, not because the asset is unavailable. Buyer wants to buy and the seller wants to sell, but the infrastructure doesn’t allow them to meet very often. Markets remain siloed by geography even though technology has long since eliminated any technical barrier to global, instantaneous trading.

When cryptocurrency trading volumes surged in 2017-2018, the total potential arbitrage profit between the United States, South Korea, Japan, and Europe exceeded $2 billion. The infrastructure at hand did not allow for its capture. This is the cost of fragmentation. Price discovery happens in isolated pockets rather than globally, liquidity fragments across regions, and the investor who happens to be in the wrong geography at the wrong time pays a premium purely because markets refuse to treat identical assets as identical.

Private Markets Are Even Worse

Public markets close for 73% of each week. Private markets never open at all.

The private capital universe has swelled to roughly $13.1 trillion in assets under management as of June 2023. Companies that once rushed to go public now linger in private hands for a decade or more. The average time from founding to IPO stretched from four years in 1999 to over ten years today. By the time retail investors can access these companies through public markets, much of the value creation has already occurred behind closed doors.

Secondary markets for private shares exist, but calling them markets is generous. Transactions typically take around 45 days to close. T+2 days settlement of equity markets now feels like speed at this pace. Price discovery happens through backroom conversations between parties who may or may not have accurate information about the underlying asset. When SpaceX was valued at $210 billion by some secondary buyers in June 2024, it had been trading at $180 billion just six months earlier.

Stripe experienced similar volatility. Secondary market transactions put the company valuation anywhere from $65 billion to $70 billion depending on which buyer you asked and when they transacted. The absence of continuous price discovery means valuations drift rather than converge.

The cost of this illiquidity shows up in persistent discounts. Secondary transactions for pre-IPO shares traded at average discounts of 16% relative to the last funding round in the first quarter of 2025. That is the price you pay for being able to exit. The inability to transact continuously means every transaction requires giving up substantial value just to access your own capital.

More than $50 billion sits trapped in pre-IPO companies. Capital committed but inaccessible. Valuations uncertain, exit timelines undefined. The infrastructure to make these assets liquid simply does not exist within the current system. Investors hold positions they cannot price and cannot sell, watching opportunities pass while their capital remains locked away.

The gap between what technology enables and what private markets deliver is even wider than in public equities. We have the capability to make any asset tradable, to enable continuous price discovery, to eliminate geographic barriers. Instead we maintain a system where access depends on who you know, pricing depends on backroom dealing, and liquidity depends on the decision of those in control.

Infrastructure Mismatch

The inefficiency persists because the infrastructure was never designed for the world we live in now.

When the New York Stock Exchange opened in 1792, settlement required physical certificates to change hands. Buyers and sellers needed time to deliver paper, verify authenticity, record ownership changes in ledgers maintained by hand. The mechanics of settlement dictated the rhythm of markets. Technology advanced but the fundamental architecture remained largely unchanged.

Today, when you buy a stock, settlement still takes two business days. This is known as T+2, shortened from T+3 in September 2017, as if moving from three days to two represented revolutionary progress. The trade executes instantly. Your account shows the position immediately. But the actual settlement, the moment when ownership formally transfers, and the transaction becomes final, waits 48 hours.

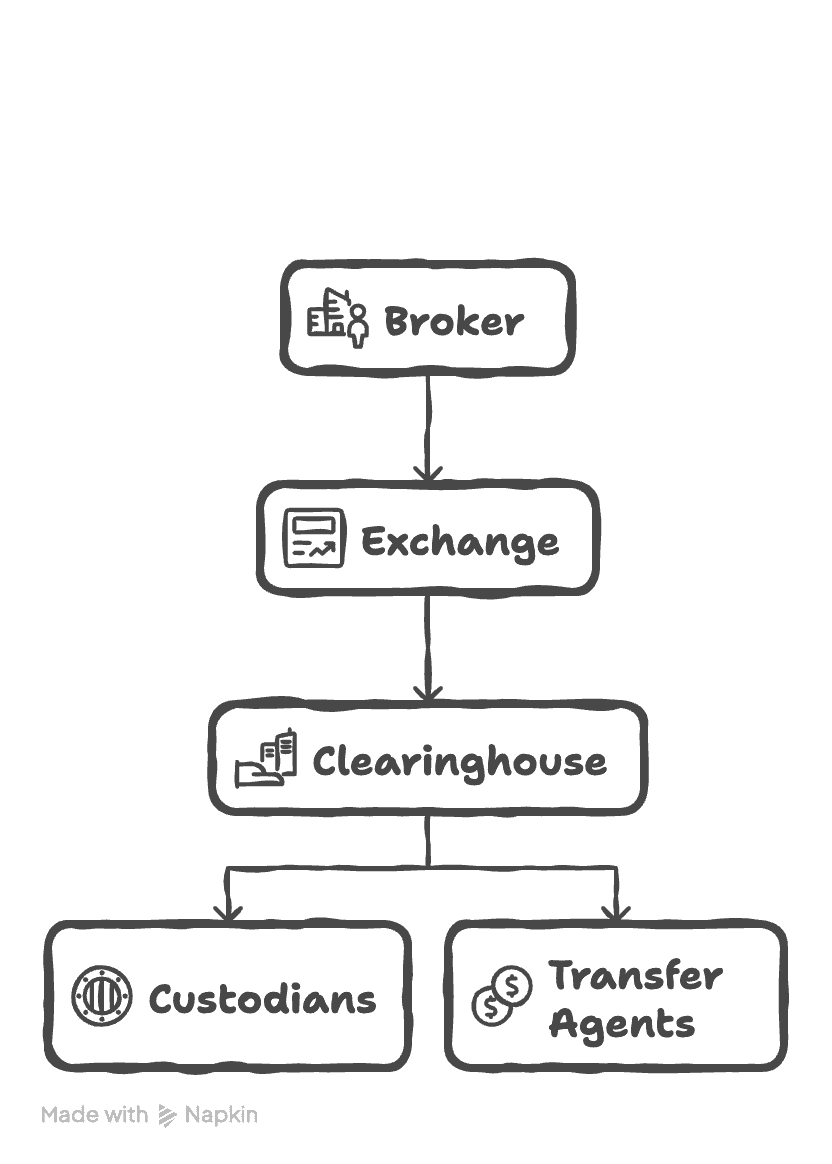

Why does this delay persist when the technology to settle instantly has existed for decades? Because the current system involves a cascade of intermediaries, each adding latency. Your broker sends the order to an exchange. The exchange matches buyer and seller. The trade information flows to a clearinghouse. The clearinghouse becomes the counterparty to both sides, taking on the risk that either party might fail to deliver. Custodians hold the actual securities. Transfer agents update ownership records. Each entity operates its own systems on its own timeline, processing transactions in batches rather than continuously.

Layers of Infra

This layering of intermediaries also means layering of costs. Clearinghouses charge fees. Custodians charge fees. Transfer agents charge fees. The infrastructure itself extracts value from every transaction. The capital gets tied up, which could have been used elsewhere. Transactions that should be atomic are instead split across days and intermediaries. The appearance of digital markets conceals the reality that settlement still follows patterns designed for physical certificates and telegraph communications.

What would markets look like if settlement were truly instant? If ownership is transferred atomically at the moment of trade execution? If no intermediary is needed to stand between buyer and seller, because the transaction itself was cryptographically guaranteed to complete or fail as a single unit? The infrastructure exists to build that system. The question is not technical capability. The question is whether markets will migrate to rails that match what technology now enables.

An Architecture for Continuous Markets

The promise of continuous markets extends beyond simply keeping exchanges open longer. True continuous markets represent a fundamental reimagining of how price discovery operates, where trading infrastructure remains perpetually active without the constraints of business hours, geographic boundaries, or settlement delays.

In a continuous market, when news breaks at 3 AM Eastern time, markets respond instantly rather than building pressure that releases violently at the 9:30 AM open. The overnight gap problem disappears entirely because there is no overnight.

Settlement occurs with near-instant finality rather than the two-day cycles that characterize traditional infrastructure. An investor closing a position at 2 PM eliminates their exposure immediately, not 48 hours later when the settlement finally clears. This removes the risk windows where portfolio exposure persists despite executed trades. Capital locked in the clearinghouse margin becomes available immediately for redeployment rather than sitting idle during multi-day settlement periods.

Onchain infra makes this possible by maintaining a globally synchronized ledger that operates continuously. Platforms like @HyperliquidX demonstrate this technical feasibility at scale, with sub-second settlement finality and 24/7 uptime. The infrastructure handles hundreds of thousands of orders per second while maintaining full transparency of every trade. Participants access the same liquidity regardless of their location or the local time, with trades settling through consensus rather than multi-day batch processing between intermediaries.

The key breakthrough involves replacing the layered architecture of traditional markets with unified execution. Modern exchanges coordinate between brokers, clearinghouses, and depositories through systems built for an era when physical stock certificates changed hands. Onchain systems collapse these layers into a single settlement mechanism where trade execution and final settlement happen atomically. The same transaction that matches buyer and seller also transfers ownership with cryptographic finality.

What becomes possible transforms how markets function. Retail investors avoid the systematic disadvantage of overnight gaps that deliver outsized returns to institutional traders with after-hours access. A Japanese pension fund rebalancing its portfolio at 10 AM Tokyo time trades against the same liquidity as a California hedge fund operating at 5 PM Pacific, with both orders matched from the same global pool. This is the price discovery we want. Just because someone is in Korea, they shouldn’t have to pay a 50% premium to buy bitcoin compared to someone in the US.

Enabling Perpetual Price Discovery Onchain

The infrastructure already supports applications that extend beyond crypto-native assets. Tokenization companies like @OndoFinance have created blockchain-based versions of heavily traded global equities including Tesla and Nvidia. These tokenized versions trade 24/7 with instant settlement on-chain while market makers arbitrage any pricing differences with traditional venues to maintain 1:1 parity. The arbitrage mechanism keeps tokenized equity prices aligned with their off-chain counterparts, but the direction of price leadership will likely reverse as on-chain liquidity deepens and update speeds surpass traditional markets. Eventually, market makers will quote based primarily on the onchain pricing rather than treating blockchain venues as derivative markets that follow traditional exchange prices.

This shift eliminates the need for centralized ownership databases entirely. Trusted interfaces like Fidelity or Charles Schwab could build advisory businesses and user-friendly frontends on top of blockchain rails where the actual asset trading and settlement occurs transparently in the backend. Tokenized assets would become productive capital that serves as collateral in lending markets or gets deployed in yield strategies, all while maintaining continuous tradability and transparent ownership records accessible to any participant.

The implications extend further into markets that currently operate with even less transparency than public equities. Private markets for secondary shares and pre-IPO assets suffer from information asymmetry driven largely by geography and proximity to potential counterparties. Blockchain infrastructure opens these opaque markets to global participation and continuous price discovery.

Protocols building on Hyperliquid's infrastructure are enabling perpetual futures contracts on both public and private equities. @Ventuals offers leveraged perpetual exposure to pre-IPO companies including OpenAI, SpaceX, and Stripe, allowing traders to take long or short positions on these private assets with leverage. @Felixprotocol and @tradexyz provide similar perpetual contracts on publicly-traded equities, bringing continuous 24/7 trading to stocks that traditionally only trade during exchange hours. These equity perps settle on-chain with the same instant finality and transparent execution as crypto-native assets, eliminating the settlement delays and geographic restrictions that characterize traditional equity derivatives.

Currently, these platforms use oracle systems that aggregate pricing data from various sources off-chain before bringing that information on-chain for settlement. For pre-IPO assets, oracles piece together fragmented information from secondary markets, tender offers, and recent funding rounds to establish reference prices. For public equities, oracles pull pricing from traditional exchanges during trading hours and operate a more self-referential pricing system during off-hours. But as more equity trades migrate onto onchain rails for primary execution, these oracle systems become unnecessary. The onchain orderbooks themselves will provide continuous price discovery, with perp platforms able to offer leveraged exposure directly from that transparent pricing data.

These applications share a common structure. Traditional markets fragment liquidity across time zones, restrict access based on geography or accreditation status, and delay settlement through multi-party coordination processes. Onchain trade infrastructure unifies liquidity globally, provides open access to any participant with connectivity, and settles trades atomically through cryptographic consensus. The result is continuous price discovery for assets that previously traded sporadically through opaque bilateral negotiations or during limited exchange hours.

Market makers provide continuous liquidity across all hours rather than withdrawing during volatile periods or scheduled maintenance windows. The infrastructure supports order book depth throughout all sessions rather than thinning when regional participation drops. Bid-ask spreads narrow as competition intensifies across a global participant base that never fragments into isolated trading windows.

These capabilities already exist and operate at meaningful scale. The infrastructure processes hundreds of billions in monthly volume while maintaining sub-second settlement and continuous uptime. Extending this architecture from crypto-native assets to tokenized equities and eventually to private market instruments requires primarily regulatory adaptation rather than technical innovation. The technology proves that markets can operate as unified global mechanisms rather than collections of regional exchanges with scheduled handoffs.

Continuous markets eliminate the artificial constraints that legacy infrastructure imposes on price discovery. They replace fragmented regional trading sessions with perpetual global access, multi-day settlement cycles with instant finality, and opaque private negotiations with transparent order books. The technology exists and operates at scale today, demonstrating that markets no longer need to close and assets no longer need to trade in darkness. Bring price discovery onchain.