Hyperliquid’s Fundamentals Update

Keisan has been one of the most prominent voices when it comes to Hyperliquid, building valuation frameworks, analyzing financials, and projecting growth. He has consistently shared deep insights on Hyperliquid. Today, Keisan is sharing a short fundamental update.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analyst (Keisan) behind this research owns $HYPE. Full disclaimer and disclosure here.

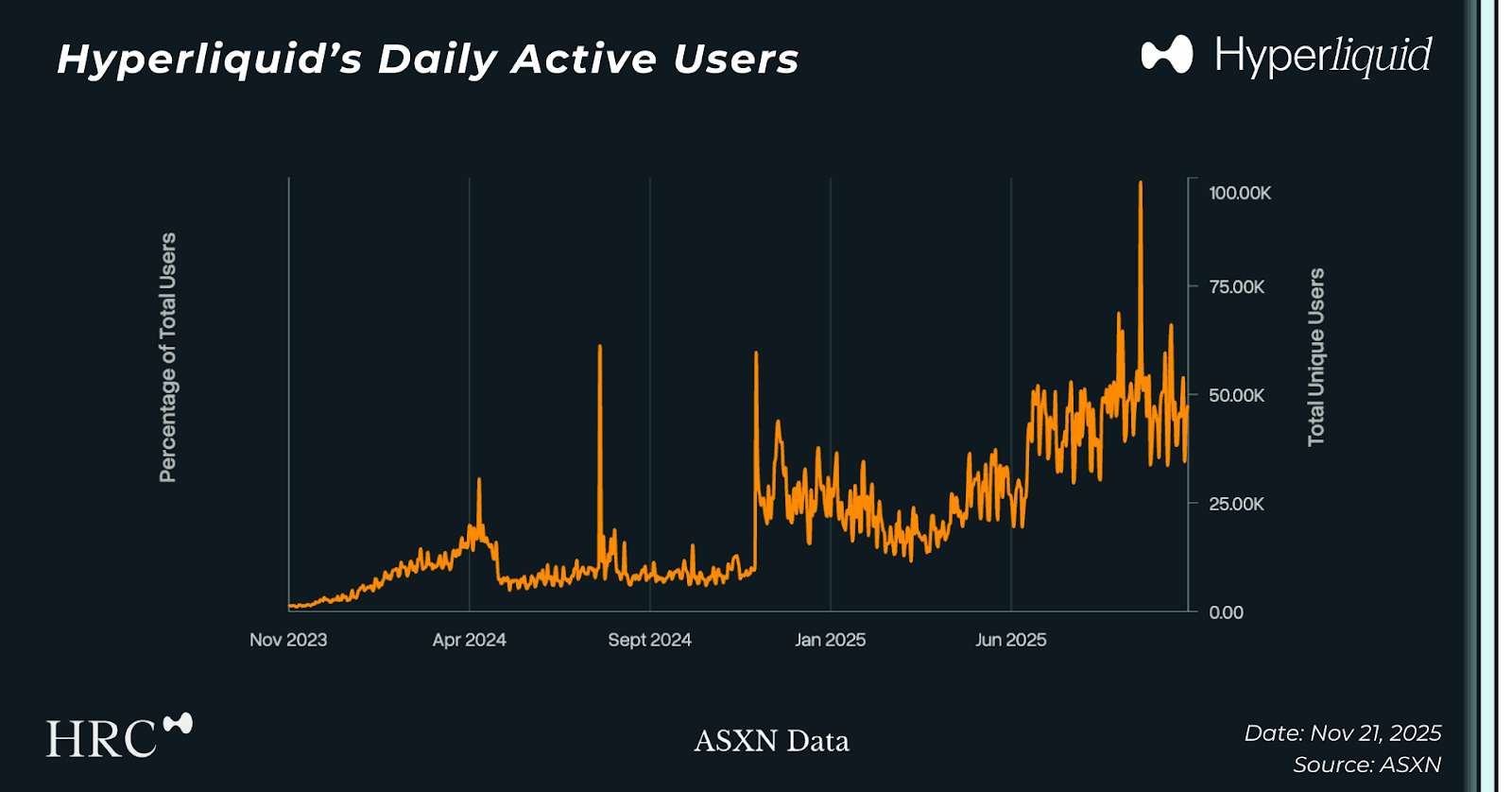

Hyperliquid Daily Active Users

Daily active users (DAUs) are one of the most important metrics to track for any software / fintech company.Hyperliquid DAUs? Up and to the right.

More charts below, the data should speak for itself.

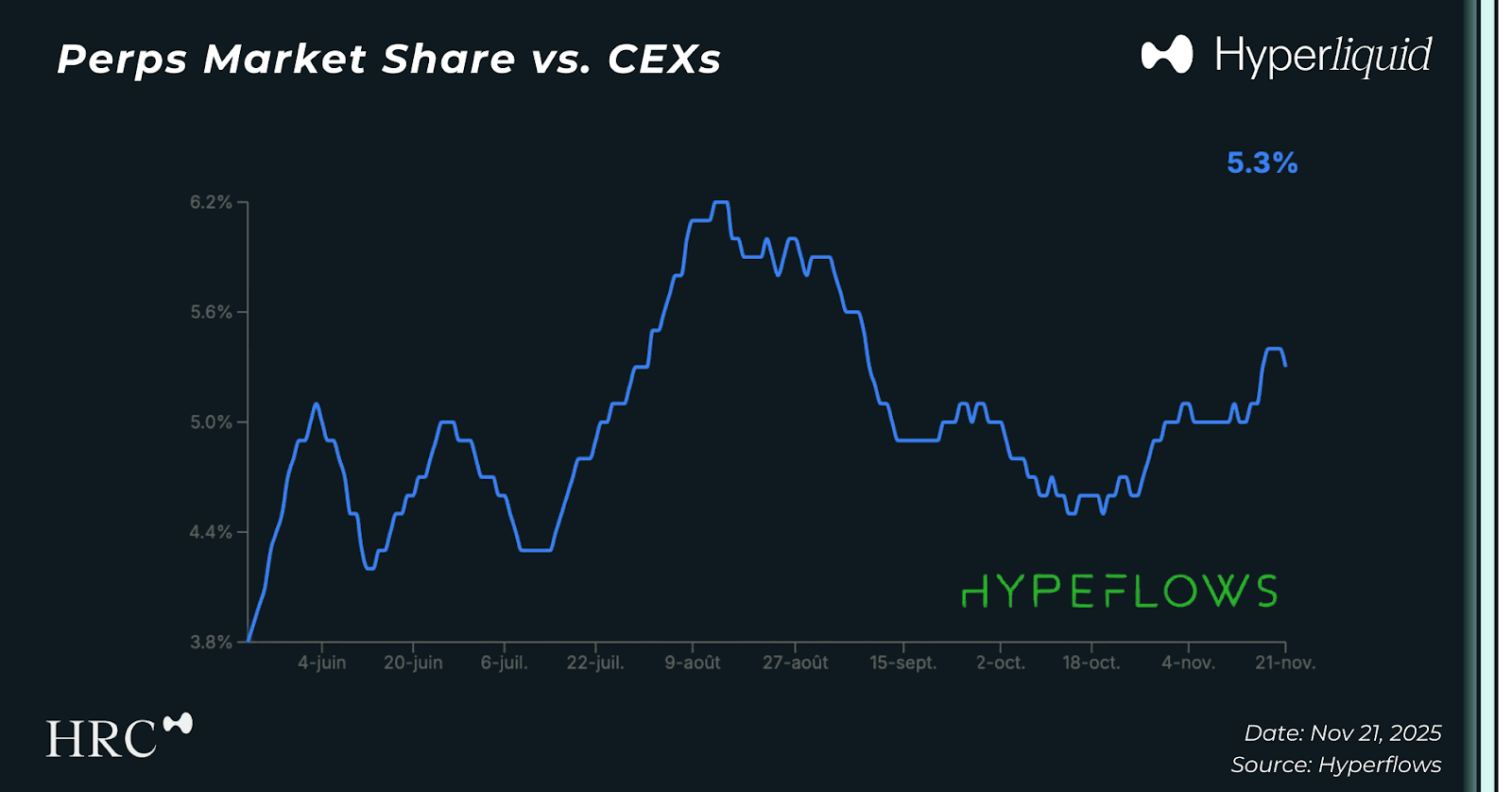

Perps Market Share vs. CEXs

It continues to trend up, bottoming ~ 10/10. Users continue to realize that Hyperliquid is the single best place to trade.

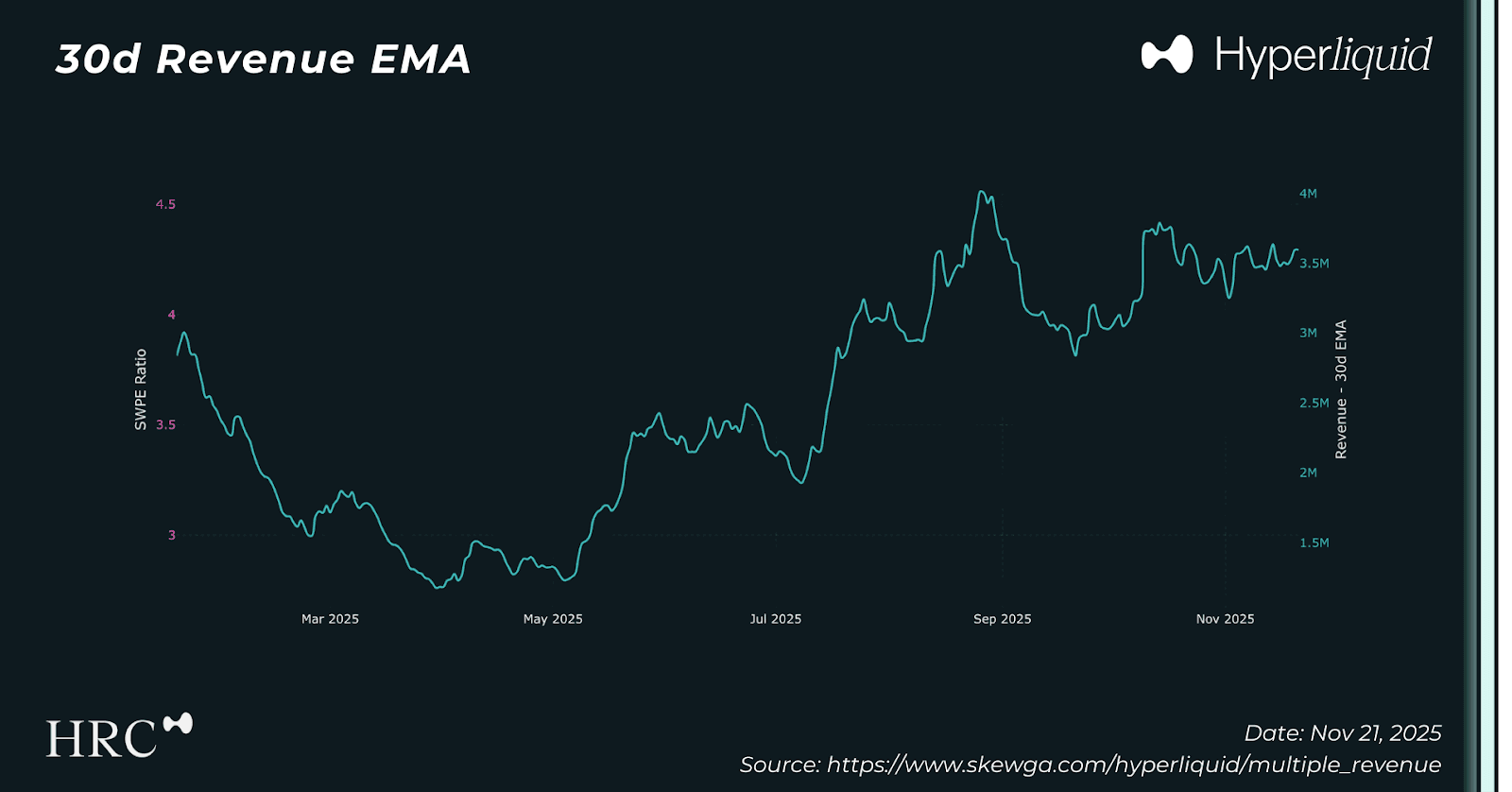

Hyperliquid’s Revenue 30d EMA

SWPE* is nice. But I want to focus here on the revenue EMA. We have held ~$3.5M/day which is ~$1.3Bn annualized revenue per year, despite worsening market conditions.

More users adds to the stability of revenues and sets a floor. When bull market conditions resume, I expect revenue to trend much higher due to added users.

*SWPE is a tool developed by Skewga and is a supply weighted P/E ratio. It compares HYPE’s float-adjusted market cap to protocol earnings. Since earnings are used to buy back HYPE, they drive consistent demand while shrinking circulating supply. Source.

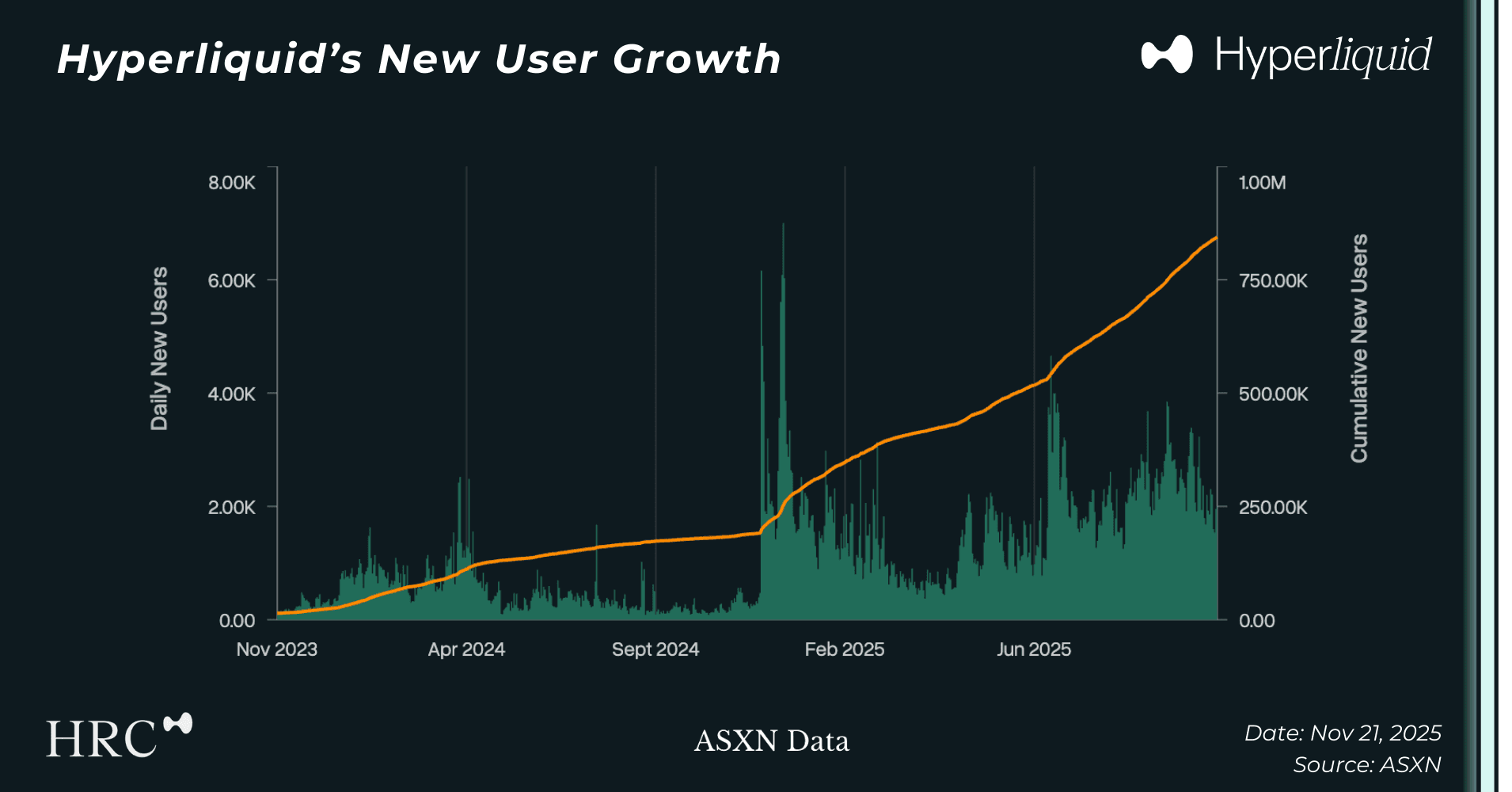

Hyperliquid’s New User Growth

User growth has been extremely strong since the start of the summer, averaging ~3k users per day in September and October.

With a product as good as Hyperliquid, my assumption is that most of these users stay. The lifetime value (LTV) of these users is likely quite high, with $0 CAC “Customer Acquisition Cost” from the Hyperliquid team. These are metrics that VCs dream of.

Never Ending Catalysts

The biggest selling point for Hyperliquid to me has always been the team. This team ships A+ products and at a rapid pace. HIP-3 is being adopted as we speak and I expect this to be a massive onboarding event for retail traders. USDH is growing. BLP (portfolio margin?) likely being launched, and much more.

The Hyperliquid story is not done here. We are less than one year post-TGE which was really the revelation of Hyperliquid to the masses. The growth since then has been astronomical and it is showing no signs of slowing down. Yet still, most people want to underwrite $HYPE as if current revenues won't sustain. I am in the opposite camp and believe this is a complete growth story that few people are underwriting correctly.

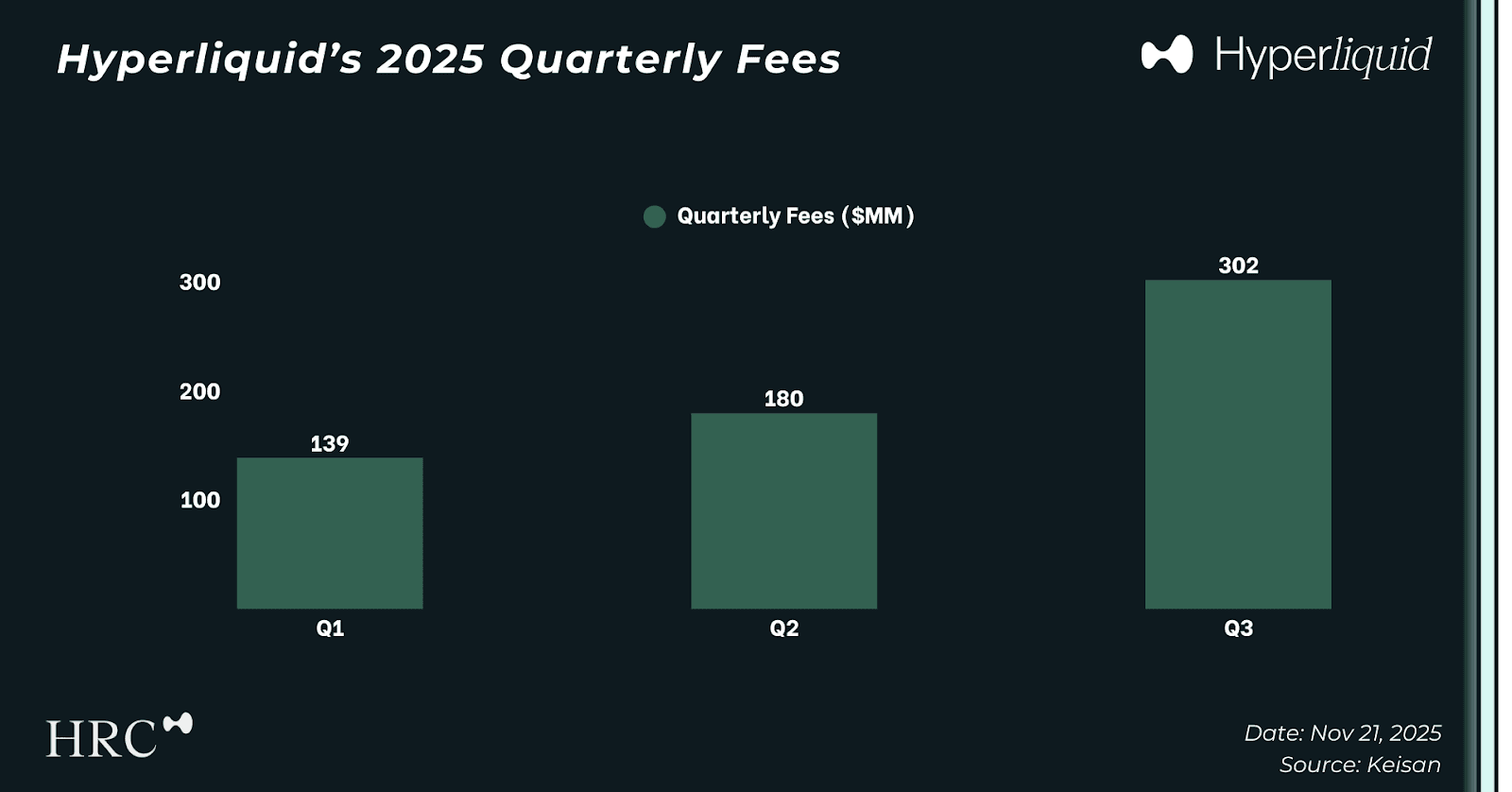

I'm excited to update this chart in Q4, and for many years to come.

Hyperliquid.