HYPE: The Alignment Vehicle

In crypto, tokens are useful for coordinating two phenomena: social alignment and economic alignment, often with the two reinforcing each other. In this piece, I’ll walk through my thesis on why HYPE has quickly emerged as the dominant asset for both social and economic coordination among crypto assets and why the majority of my PA has remained in HYPE since launch.

Hyperliquid Coordinating Social Alignment

The original idea for this piece and the thought around social alignment stemmed in large part from an idea Mike Novogratz shared on a recent pod with @JasonYanowitz: “What’s so interesting about crypto is that the value proposition…is community. It’s not the technology that makes Bitcoin worth something…it’s the community.” Community is now embedded as part of the value proposition of financial markets globally, and is that not truly what anything financial is meant to be in the first plane? An interaction between two or more people exchanging some value, and some asset used to denominate or account for that value. Now, in the case of Hyperliquid in particular (and arguably BTC as well), there is clear value to the technology that is not just a fungible commodity, but the reality stands that community plays a wildly crucial role in the success of any value system, particularly in crypto where no sovereign power can declare X, Y, or Z valuable.

Coming back to HYPE: through building a great product, Hyperliquid Labs created the base layer for a community to be built. By then giving ownership to that community at scale, HL secured a userbase that became more than just perps traders on another exchange. As we know, the core difference here was rewarding that token to real users of the platform as opposed to mercenary market makers or VCs that would arguably have achieved their end goal once the token was live (not to say that all MMs or VCs are mercenaries to be clear). However, users instead were able to see beyond the initial value of their TGE allocation, and band with the community around them in visceral social alignment. The .HL was solidified.

And one can only speculate how much value gated Telegram chats like the Hyperliquid Whales chat and Hyperliquid Fat Cats played in the early success of HYPE’s price chart by fostering a sense of togetherness in ways that other assets just have not been able to do (at least potentially not since the early days of BTC or ETH when people became pariahs for even caring about these assets and thus banded together for safety in numbers).

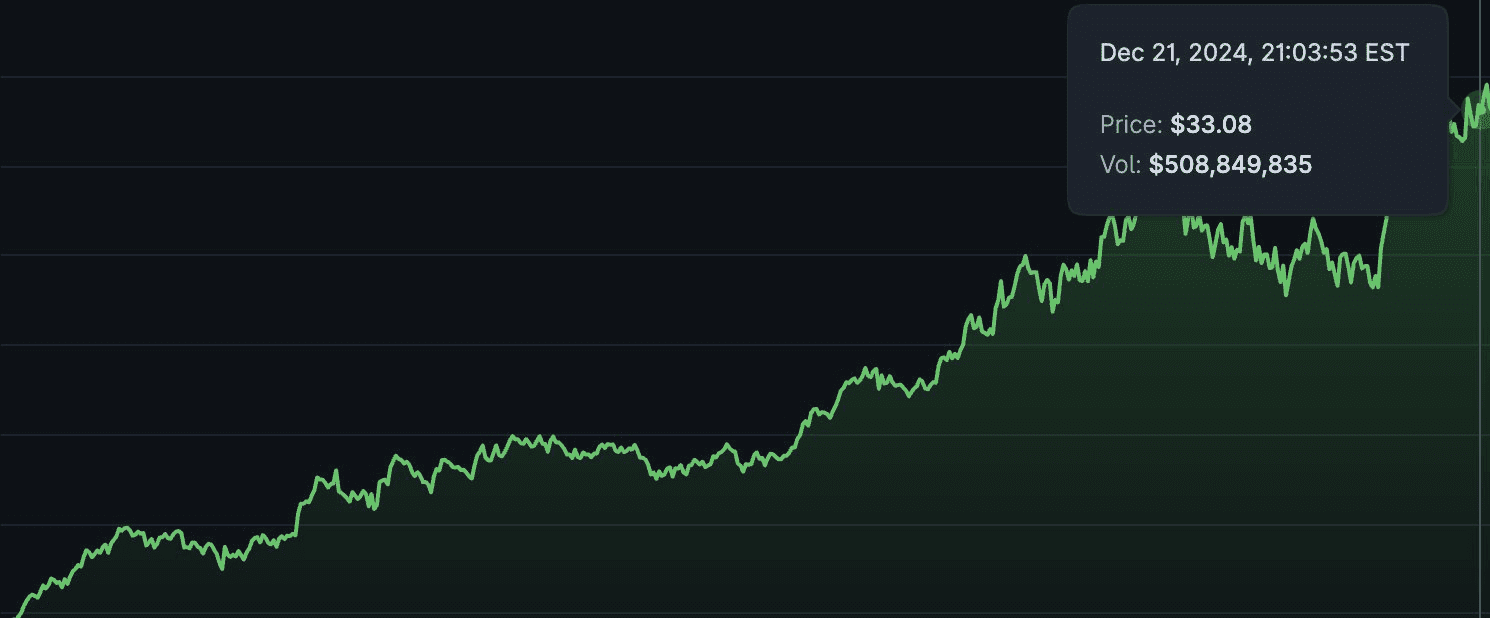

Social alignment is difficult to build without a doubt, but it must come first from product excellence. One must remember that Hyperliquid was already the most successful perps DEX at the time of the HYPE TGE; it did not become that as a result of releasing a token, a mistake too many teams seem to make time and again. With that being said, Hyperliquid created not just social driving forces for the token but clear modes of economic alignment that are bringing new life to the role a native token can play in an ecosystem. We will dive into those economic alignment forces that will continue to propel HYPE forward next.

Snapshot of the result of an excellent product and optimal alignment - CoinGecko

Hyperliquid Coordinating Economic Alignment

What are the clear ways through which HYPE drives economic alignment among its holder base and participants in the Hyperliquid ecosystem?

Here is a non-comprehensive list:

Native staking to earn yield on HYPE and secure the network

HIP-3 staking to back novel exchanges deploying perp markets on HyperCore

Staking for new spot quote asset deployments

Staking for Hyperliquid-aligned stablecoin deployments

Hyperliquid-aligned stablecoins allocating at least 50% of their yield to HYPE buybacks

Staking for fee discounts when trading on Hyperliquid with size

Utilization of protocol fees to buy back more HYPE via the Assistance Fund

HYPE used as gas token for all L1 actions

>Native staking to earn yield on HYPE and secure the network

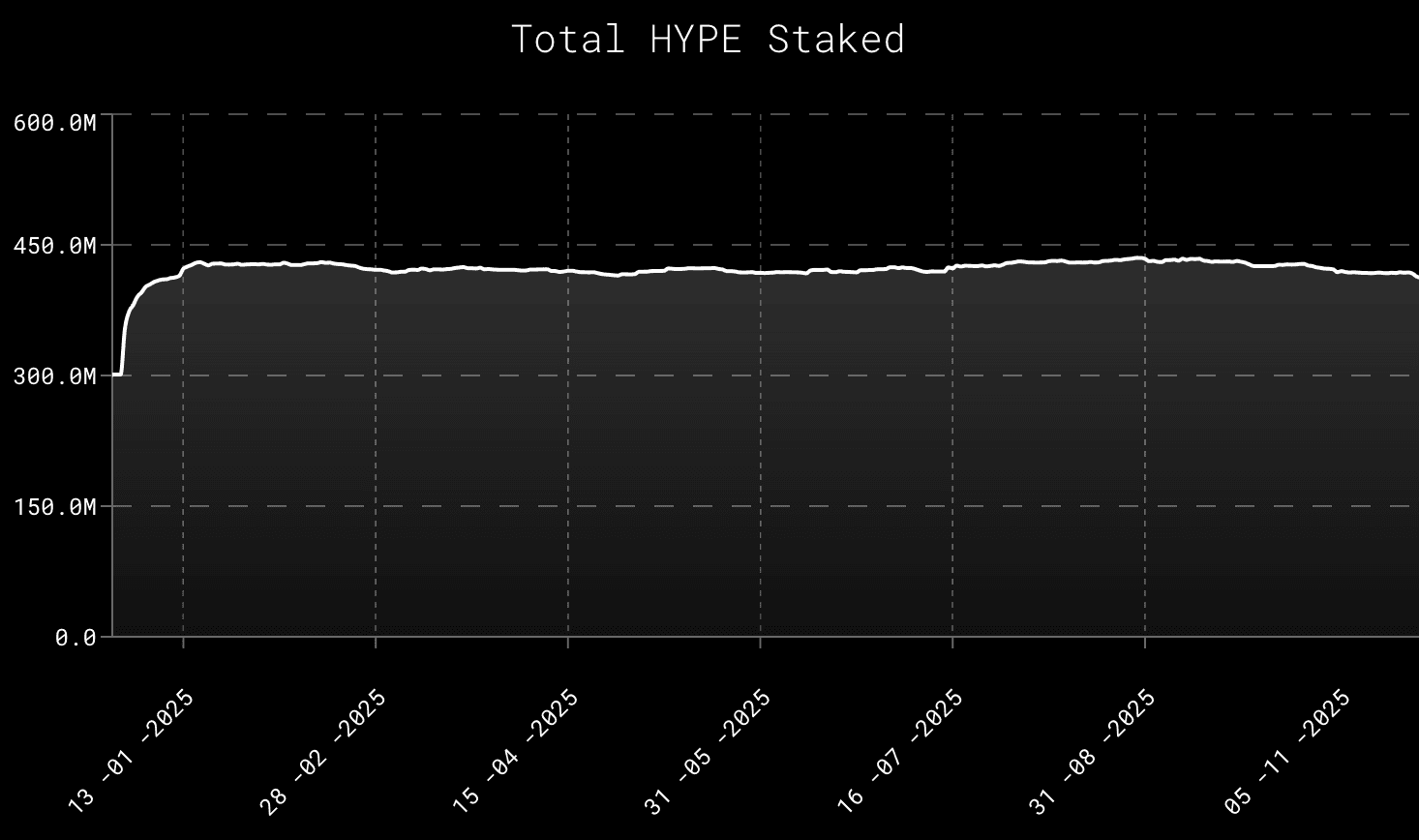

Native staking for yield on HYPE is the way most users put HYPE to work and gain further economic alignment with Hyperliquid’s success. There is roughly 420m HYPE staked at time of writing, making up about 41% of the total HYPE supply. The amount of staked HYPE continues to remain consistently high as demonstrated by the chart below due to the various benefits of staking HYPE, some of which we will dive into below.

Total HYPE Staked - ASXN

>HIP-3 staking to back novel exchanges deploying perp markets on HyperCore

To deploy a HIP-3 exchange, which enables teams to deploy novel perp markets on Hyperliquid’s orderbook infrastructure (and now to be displayed on HL.xyz as well under the HIP-3 tab), teams must stake 500k HYPE, which will be slashed if so voted by validators (likely if the exchange’s markets or their price feeds are parameterized improperly). That's roughly $20m in HYPE at current prices that every HIP-3 deployer must secure to launch their markets.

>Staking for new quote asset deployment

Hyperliquid allows novel spot quote assets to be deployed permissionlessly. This can enable an asset deployer to partner with a stablecoin of their choice as their quote asset and list their asset on Hyperliquid paired with this stable, potentially with other liquidity or incentive benefits. To offer a permissionless quote asset, teams must stake 200k HYPE, about $8m in HYPE at current prices.

>Staking for Hyperliquid-aligned stablecoin benefits

In September, the concept of Hyperliquid-aligned stablecoins was introduced by @chameleon_jeff after the conclusion of the USDH ticker vote. This proposal enables 20% lower taker fees, 50% better maker rebates, and 20% more volume contribution toward fee tiers for users of these HL-aligned stables that will likely gain traction through HIP-3. Offering cheaper cost of trade + a way for MMs to gain further profitability and thus become incentivized to provide more liquidity at tighter spreads. To achieve Hyperliquid-aligned stablecoin status, stablecoin deployers must stake 800k HYPE, another ~$32m per deployer at current HYPE prices.

>Hyperliquid-aligned stablecoins allocating at least 50% of their yield to HYPE buybacks

Part of being a Hyperliquid-aligned stablecoin is agreeing to use at least 50% of the revenue generated from holding the treasuries backing the stablecoin to buy back HYPE. This creates additional buy pressure on HYPE from teams that want to offer the cheapest markets on HL through taking advantage of the benefits of being a Hyperliquid-aligned stablecoin.

>Staking for fee discounts when trading on Hyperliquid with size

Another reason Hyperliquid traders will stake HYPE at scale is to earn trading fee discounts on Hyperliquid, which can become costly if executing many trades at scale. A wallet in the Diamond staking tier receives a 40% discount on trading fees. To achieve Diamond tier, a wallet must stake at least 500k HYPE, about $20m in HYPE per wallet at current prices. (Keep in mind that this staker will also be earning the staking yield of about 2% currently, or an additional ~10k HYPE per year)

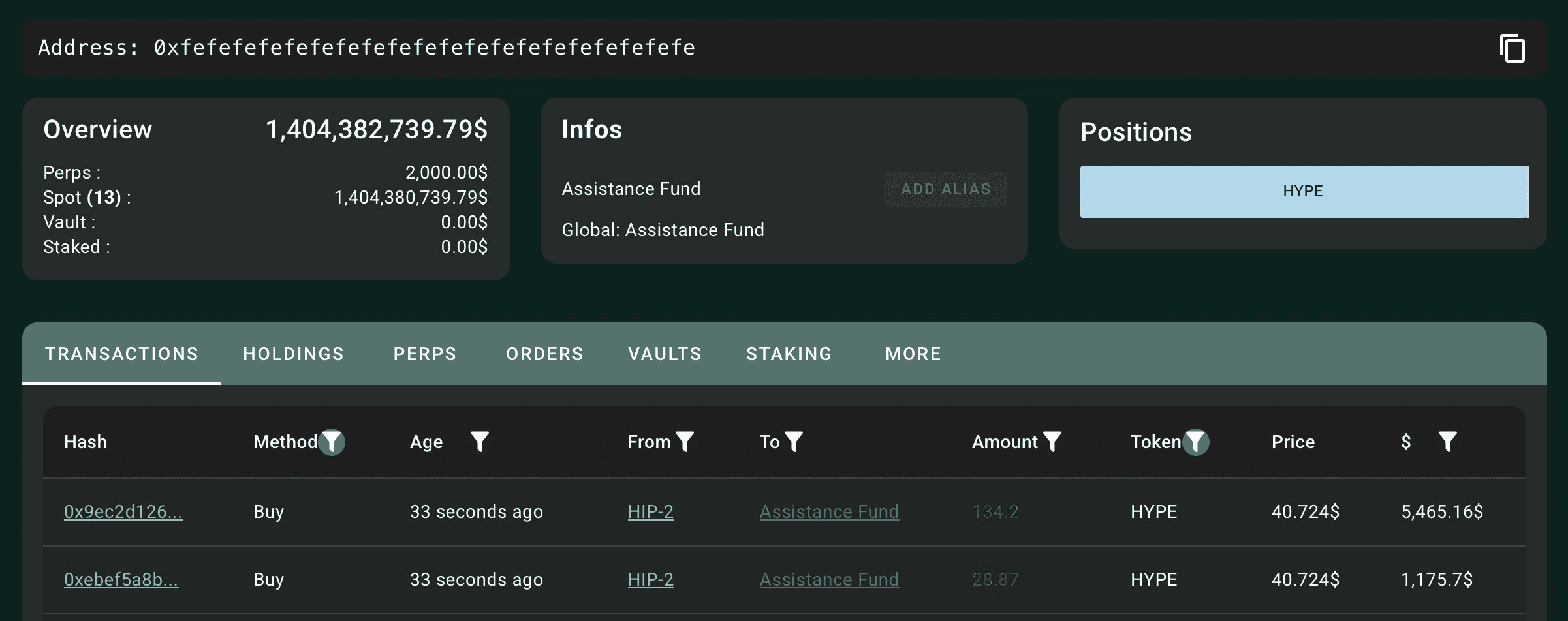

>Using protocol fees to buy back more HYPE via the Assistance Fund

Currently 99% of protocol fees are sent to the Hyperliquid Assistance Fund and used to purchase HYPE. This has now led the Assistance Fund to hold over 34.5m HYPE or roughly $1.4bn at current prices. Due to the amount of fees Hyperliquid is generating daily (typically $2m-4m), this leads to a constant, daily buying of HYPE, and this is not even 1 year since the launch of the HYPE token.

Hyperliquid Assistance Fund - HypurrScan

>HYPE used as gas token for all L1 actions

And finally, the typical use case of HYPE as the gas token for all actions across Hyperliquid, particularly all activities on HyperEVM, which drives further need and demand for HYPE (over 43m HYPE currently on HyperEVM).

What do all these modes of HYPE utilization mean for HYPE as the ultimate coordination layer? Simply put, HYPE has become an economic alignment machine. It feels that on a quarterly basis almost, there is a new reason for teams looking to benefit from Hyperliquid to buy and stake hundreds of thousands of HYPE. In the future, I could see a proposal for Hyperliquid-aligned Builder Code Apps that help accelerate HL adoption globally and stake HYPE in order to reduce trading fees on their interfaces–an idea for another piece though.

Hyperliquid Alignment

If crypto is a mechanism for global coordination with both social and economic alignment, it is difficult to see an asset and ecosystem that executes on this better than HYPE and Hyperliquid as of now. It's for this reason that I continue to view HYPE as a pure alignment vehicle and, as always, look forward to the future of HL.

h/t to my co-founder @arnx813_ and @novogratz for inspiring many of the ideas in this piece