Why HYPE DATs Can Win

Over the past couple months, I’ve been exploring the DAT space and what it could mean (or not mean) for DeFi and particularly credit opportunities on-chain. In this exploration, I inevitably found myself reading into the primary BTC/ETH/SOL DATs as well as the two current HYPE DATs (Hyperion and Hyperliquid Strategies). What makes these DATCOs unique? What is edge in the DAT space? And what gives HYPE DATs a unique position relative to the bubbling landscape of treasury companies across crypto? In this brief piece, I’ll walk through a bit of my understanding of the DAT landscape from a high level view and explore why I think HYPE DATs have a unique position.

NB: DATs can be solely an access vehicle, but are they the most efficient vehicle for this, or why not go through a more standard vehicle like an ETF if just looking for crypto exposure/accesss? I will leave the access piece aside even though, before ETFs enter, it remains a key value-prop for some assets like HYPE and ENA as buying some of these assets (especially HYPE) in a firm-compliant manner can be difficult to say the least. However in this piece, I am focusing on the ways DATs create unique value, aside from just serving as a mode of crypto asset exposure on tradfi rails.

Brand, Financing Power, Yield Generation

From how I see the DAT space, there are three primary ways DATs win over one another, and the three aspects all tend to flow together. These three modes are 1) brand, 2) ability to raise capital and finance further accumulation of the underlying asset effectively, and 3) ability to put the asset to work in order to generate further yield and accumulate more of the asset without taking on debt, thus increasing the equity/debt ratio. Most DATs will be null at the third point and thus will need to focus fully on points 1 and 2. This is not necessarily the death of a DAT as seen most clearly by MicroStrategy, which has built a brand and the ultimate DAT brand moat over years, with this brand moat allowing Saylor to continue to raise debt, purchase more BTC, and trade at a significant premium to NAV (a 2.7x premium to NAV).

However, BTC for Saylor and for MicroStrategy is a store of value vehicle, so MSTR’s premium to NAV is inherently reliant on brand and ability to raise capital, as a pure store of value will not, in most cases, double as a productive asset. The space of BTC yield remains in its infancy, and even if it is to gain traction, it’s difficult to see MSTR becoming a significant player in the BTC yield space with any substantial size given Saylor’s positioning as a Bitcoin store of value maximalist. One could attempt to argue that BTC mining could be the viable path for these BTC-focused DATs to increase NAV per share without raising capital, but that is not the core competence/business of the financiers that tend to construct these DAT entities, nor is it a unique market approach with multiple public BTC mining co’s already listed on NASDAQ/NYSE (Marathon, Riot, TeraWulf, etc). Let alone the time cost of ~860,000 kilowatt hours to mine one BTC now (electricity cost, infrastructure, and hardware dependent).

Are ETH/SOL DATs an Answer?

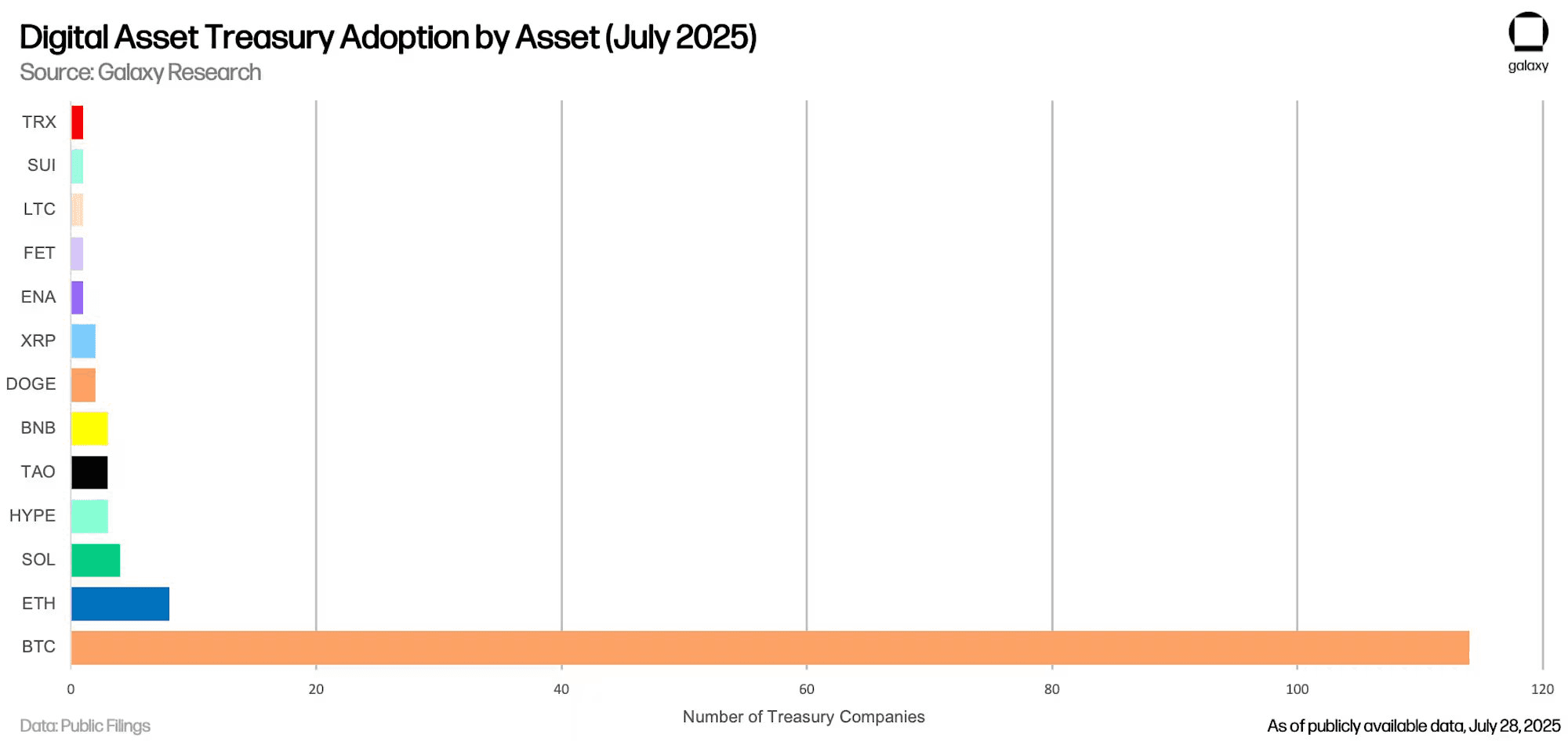

This leaves an opening for alternative DATs, firstly ETH and SOL DATs. However, for two assets that have been in existence since long before the DAT meta rose, DAT adoption relative to BTC for ETH/SOL has been relatively restricted.

DAT Adoption Across Assets - Galaxy

This could be in large part due to the fact that BTC continues to be the crypto asset of choice for large capital globally that is looking to buy these assets (Vanguard, as a case in point, is now the largest holder of MSTR, holding over 20m shares of the stock). It could also be that, potentially as a result of this lack, these ETH and SOL DATs have had less success establishing brand and raising capital.

The solution it seems would be for them both to turn to the path of productivity for their assets in order to put aside the capital raising question, help establish brand, and then return to capital raising once able to demonstrate returns from asset productivity. But this will likely not push the needle for ETH/SOL that significantly either. If we think through the ways that one could generate risk-adjusted yield on ETH or SOL (staking it natively: 2% for ETH, 5% for SOL), lending it (2% for ETH on Aave, 6% for SOL on Kamino), or executing some form of LST looping strategy (borrow rate on SOL and ETH is currently higher than staking yield, so maybe could do this off-chain but at that rate it doesn’t make sense for the lender), there is really no clearly viable path.

Basically, the treasury company strategy for these assets only makes sense as an exposure play currently, but it does not appear there is anything necessary in the pooling of these assets in a DATCO that creates a network effect or brand<>capital raise flywheel. They provide access and maybe a bit of staking yield but little else compared to an ETF. This is until a brand can be built and more capital can be raised, but this seems unlikely given their lack of productivity (relatively) and their lack of portrayal as a store of value like BTC.

TLDR: SOL/ETH DATs can likely ride BTC DAT coattails for investors looking for a slightly different exposure profile, but it's difficult to see them carving their own sizable market share currently.

HYPE DATs and HIP-3

This brings us to HYPE DATCOs and why they may be uniquely positioned to generate outsized returns for holders if executed correctly. To cut to the point, this will all come down to HIP-3; however, there is a caveat here too on scale, which we will come to shortly. I have mapped out this basic return profile math for HIP-3 stakers in a couple tweets now, but the breakdown is essentially that on 1M HYPE, HYPE HIP-3 stakers can realistically expect a 24% APY for staking (not including any additional points or incentives from Hyperliquid or the respective HIP-3 exchange(s)). If we assume 1M staked HYPE, a 50/50 fee split determined between the exchange and the HYPE stakers for this exchange, an average fee of around 0.00025 * the Volume generated by the exchange, and $5bn of monthly volume, that would be roughly a 19% APY on HYPE to HIP-3 stakers for this exchange. And then on the builder code side, if we say that a player like Phantom can generate $4m in revenue per month, and this is also split 50/50 between Exchange and HIP-3 HYPE stakers, this could result in a shift in that APY from 19% to 24% APY on HYPE. For the buyer of these DATs, a 24% return on an asset trading near an 8-9x P/E multiple in a space primed for growth is almost too good to be true, but recreating trading infrastructure globally is quite a valuable endeavor, so this does not seem to be snake oil.

The caveat I would add with respect to scale is that I'm not expecting there to be hundreds of exchanges doing billions of dollars per month consistently on new HIP-3 markets. This would go against market dynamics we have seen in exchanges thus far, putting geographic differences aside. But even there we see a clear concentration of volume–see the top four major stock exchanges (Shenzhen Stock Exchange, NASDAQ, NYSE, Shanghai Stock Exchange) that dominate exchange volume globally. And there is no incentive I can see for an exchange to want to accept more than 1M HYPE (aside from maybe a small percentage more for handling withdrawals from stakers). So HYPE DATs will be essentially forced to take a venture bet on the exchanges they want to back and do everything possible to back and grow that exchange.

However if this can be executed properly, the returns will likely dominate any alt-DAT and potentially come for MSTR’s crown. This is why I see HYPE DATs having a unique position on the trifecta of DAT success. We will see how this plays out.

Thanks to @fiege_max and @hyunsujung_ for the feedback on this piece