Hyperliquid Fee Growth – “YTD Performance” By Keisan

Hyperliquid is rapidly becoming one of the most remarkable growth stories in crypto, combining record-breaking fees, strong financials, powerful onboarding events, and sticky user adoption, all achieved without a dollar spent on marketing.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analyst (Keisan) behind this research owns $HYPE. Full disclaimer and disclosure here.

Key Takeaways

Fees exploding: +121% YTD, 290% CAGR, 3 record months in a row, 3.67M USD avg daily in August.

Financial momentum: Best month ever in August, Q3 on track for 332M USD fees (+88% QoQ).

Catalyst-driven growth: $PUMP launch, Phantom perps, HyperEVM and whales pushed inflows to ~6B USD (3x since Jan).

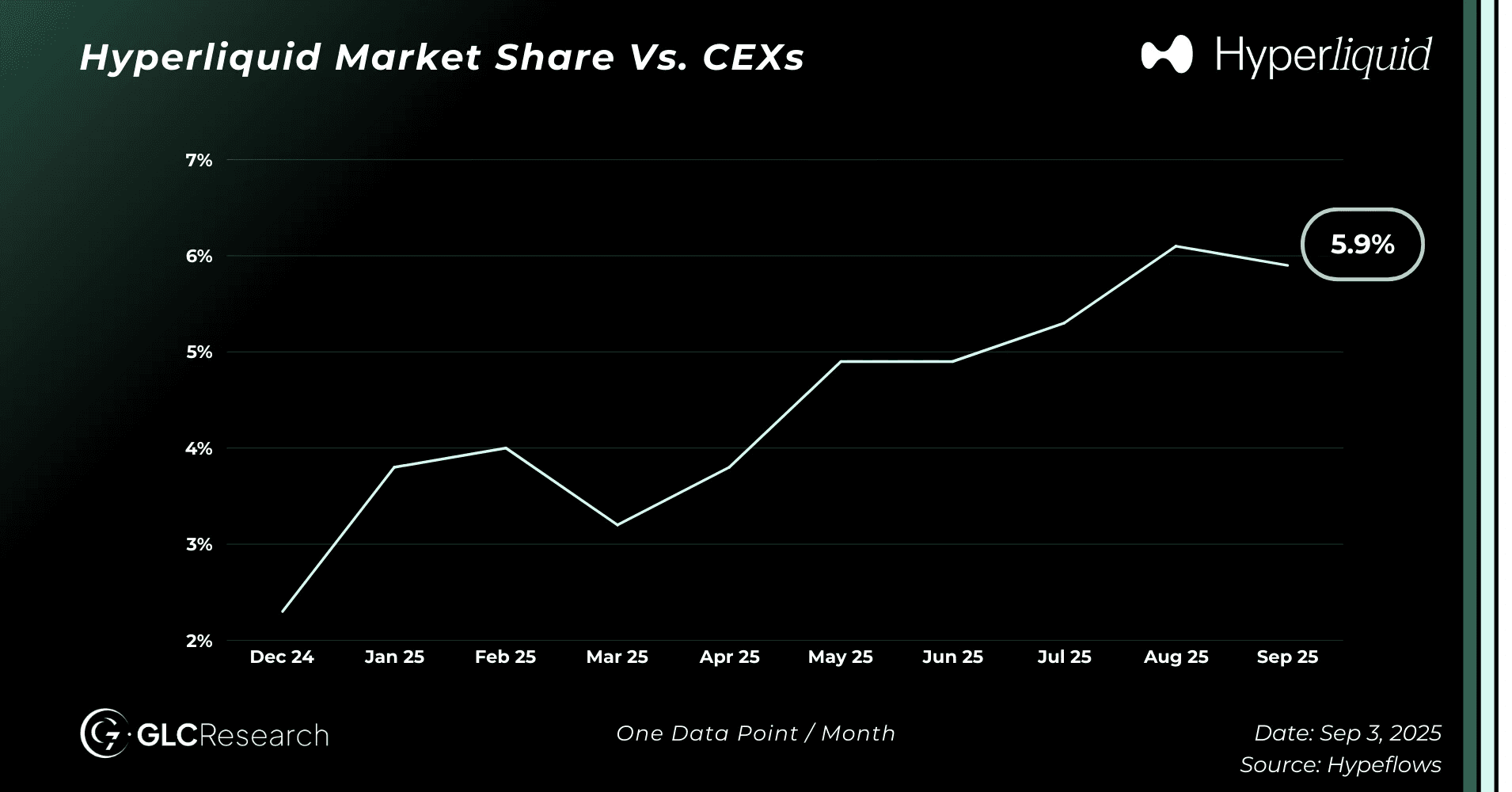

User stickiness: OI and volume nearly tripled vs CEXs, market share now ~6%.

Pure momentum: 2,000 new users daily, no marketing spend, only word of mouth + execution.

This article was written by Keisan, a former investment banker with experience in hedge funds and private equity.

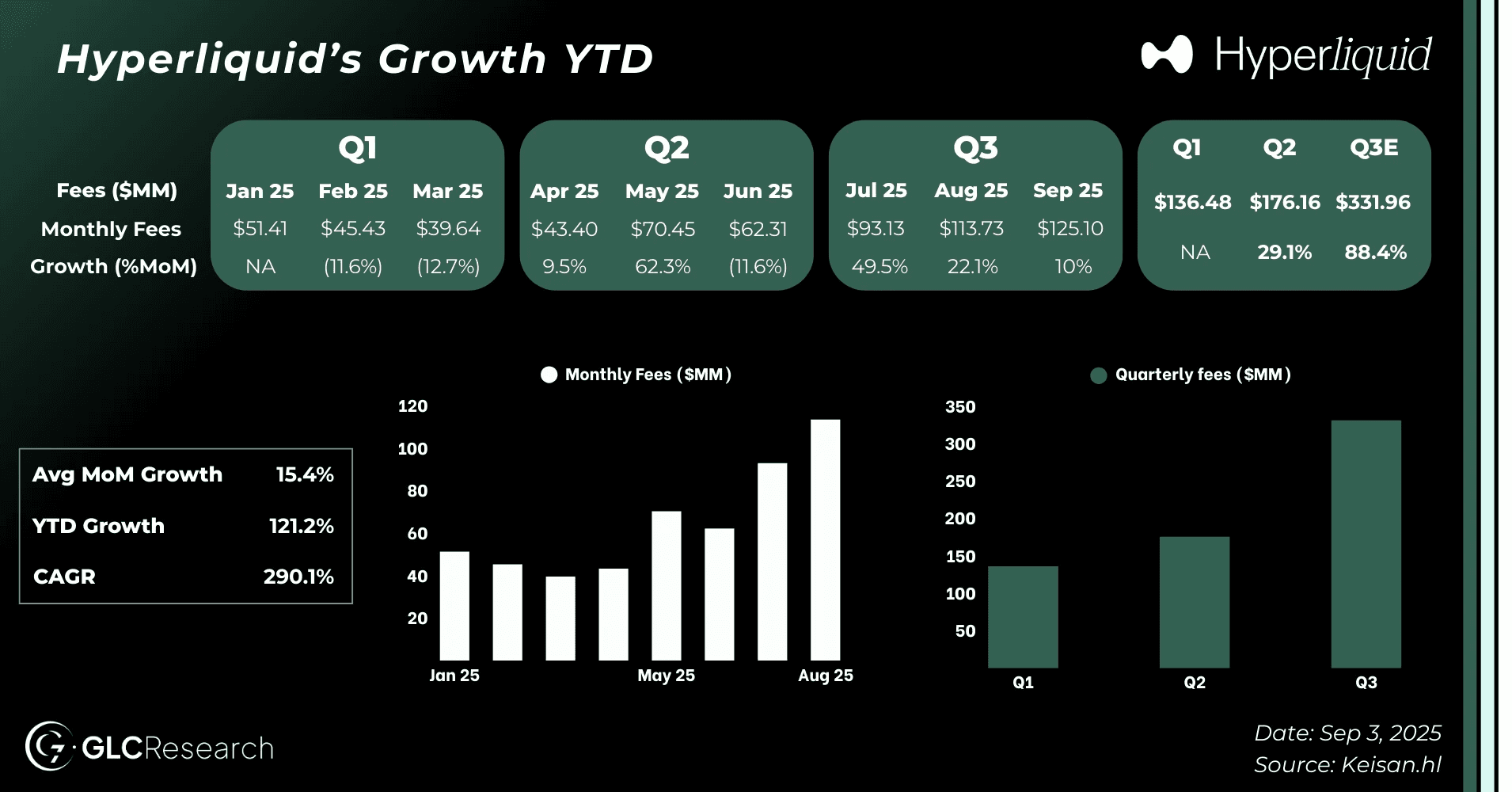

Hyperliquid Fee Growth YTD 2025

15.4% avg MoM growth

121.2% growth from January –> August

290.1% annualized CAGR

$3.67M avg daily fees in August

3 record fee months in a row

No signs of slowing down.

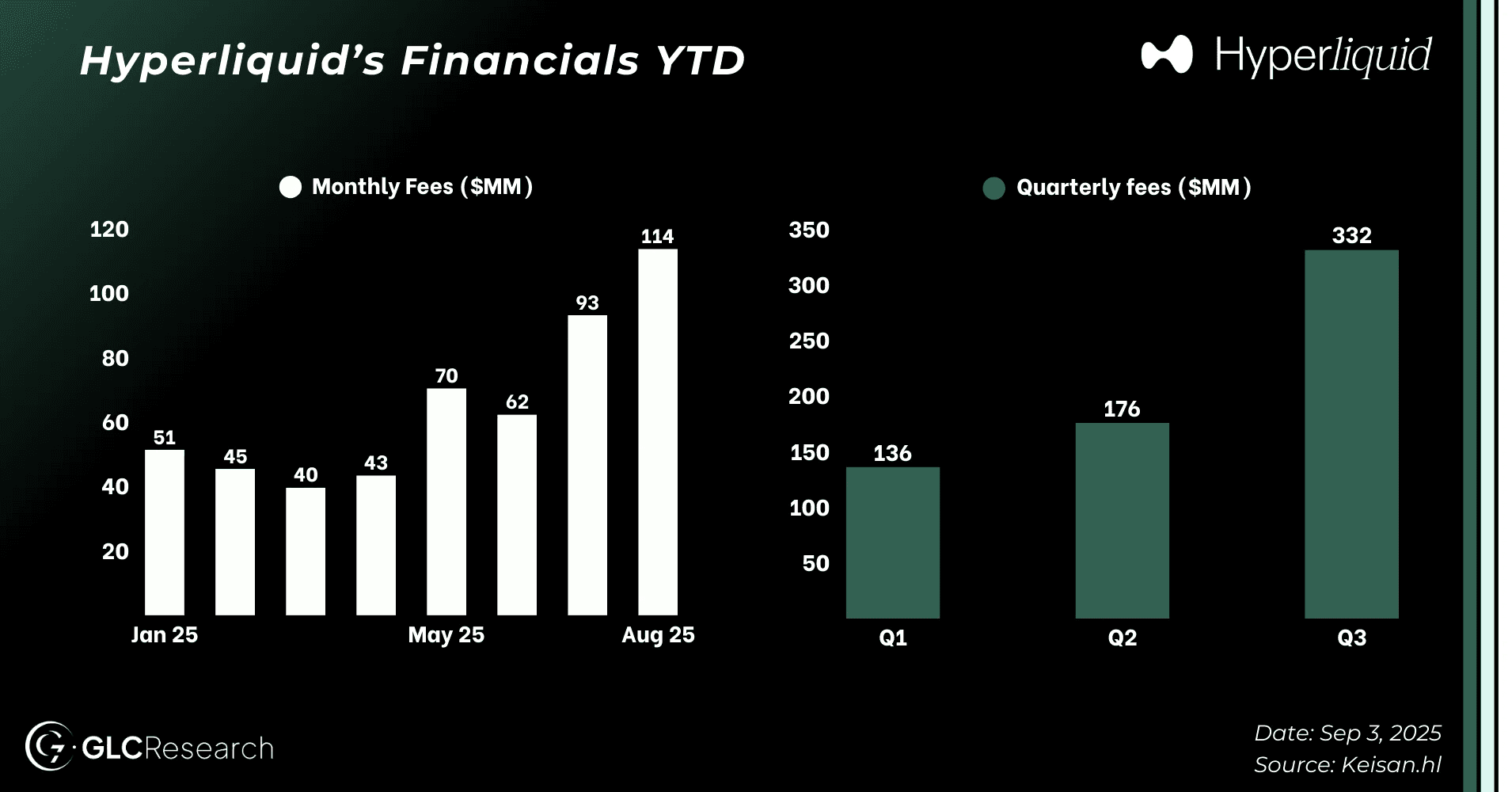

Hyperliquid’s Financials YTD

Hyperliquid put in its best fee month since inception — during August — historically one of the slowest trading volume months in the entire year.

Not only did Hyperliquid put in its best month, but this was 22% higher than July (the previous record month), and was Hyperliquid’s third record month in a row.

To get an idea of Q3, I conservatively assume September will be 10% higher than August, which would put Q3 at a staggering $332M in fees, a 88.4% QoQ growth from Q2.

Using August-annualized cash flows, I have $HYPE trading at ~14x P/E, while it just grew 88.4% QoQ and 121% in 7 months since January. If $HYPE traded in public markets, I’d venture to say it would be trading at a P/E of ~5x what it is currently trading at.

Many continue to try to price Hyperliquid at its current fee rate, instead of paying attention to what is one of the most incredible growth stories in financial history. The data is right in front of you, have a look

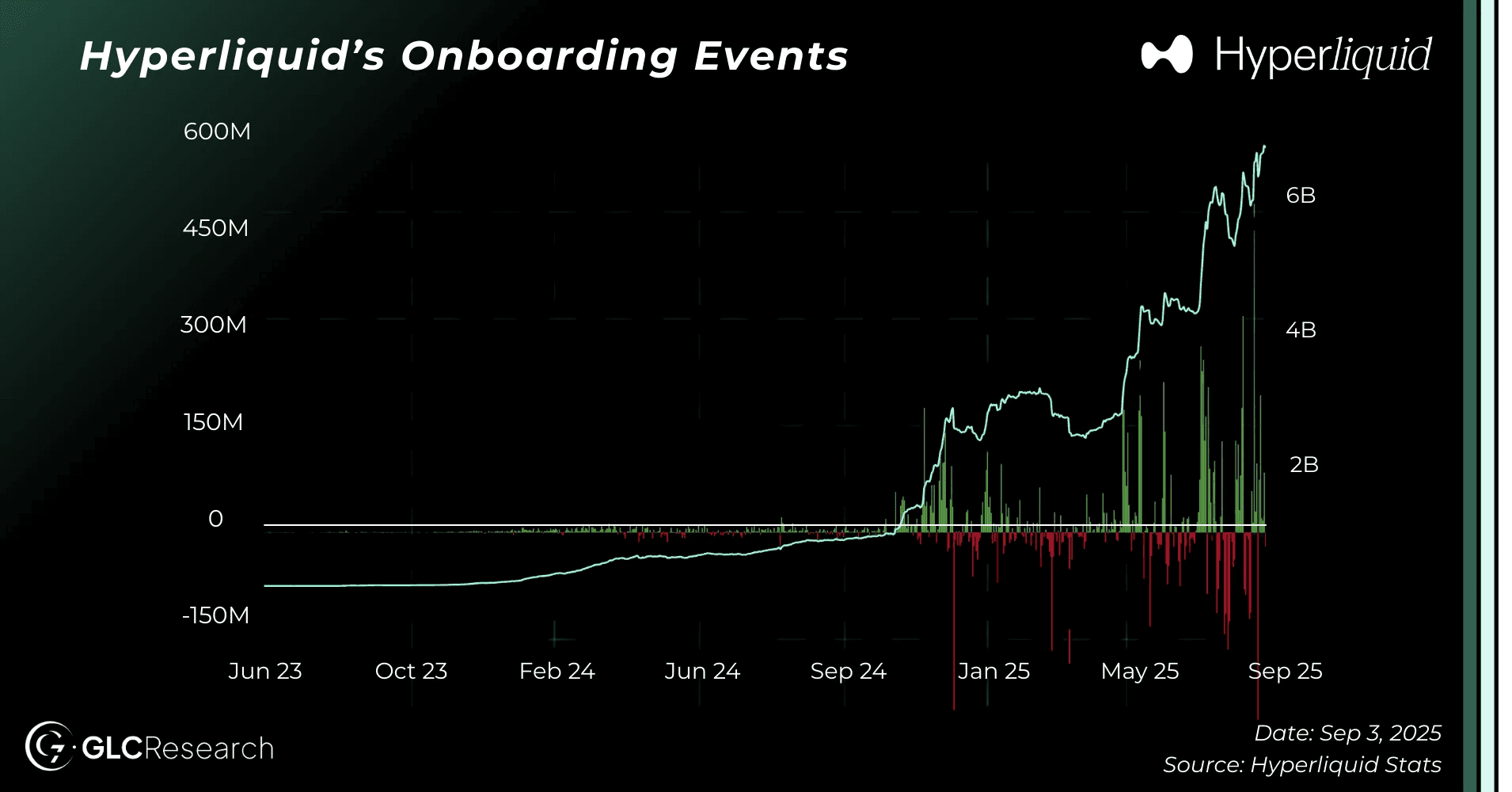

Hyperliquid’s Onboarding Events

Over the course of the year, we have seen numerous onboarding events for Hyperliquid. Some that come to mind:

Hyperliquid was the first to list $TRUMP and $MELANIA perps.

ByBit $ETH hack was scary for many users r.e. the solvency of the exchange.

$PUMP launch – pre-market and spot listings were a tremendous success and flawless execution by both @hyperunit and @HyperliquidX.

$PUMP launch – many CEX’s had major issues during the raise. On-chain was much more successful

HyperEVM has grown significantly and TVL / users continue to rise. I.e. DeFi community discovering Hyperliquid, particularly as yields and points are unparalleled vs. elsewhere right now

James Wynn saga, the excitement of publicly running an account to near ~$100M

Ancient $BTC whale using @hyperunit spot markets on Hyperliquid to swap multi-billions from $BTC to $ETH

Spot markets have gotten significantly more liquid, as evidenced by the OG whale. This has brought in more users as well

Phantom perps launch, bringing in 10s of thousands of new users and millions in fees in just <2 months since launch

I am probably missing a bunch, but these were some that came to mind Inflows tend to spike around these events, and have been up-only this year, currently sitting at ATHs near $6 billion — a 3x since January.

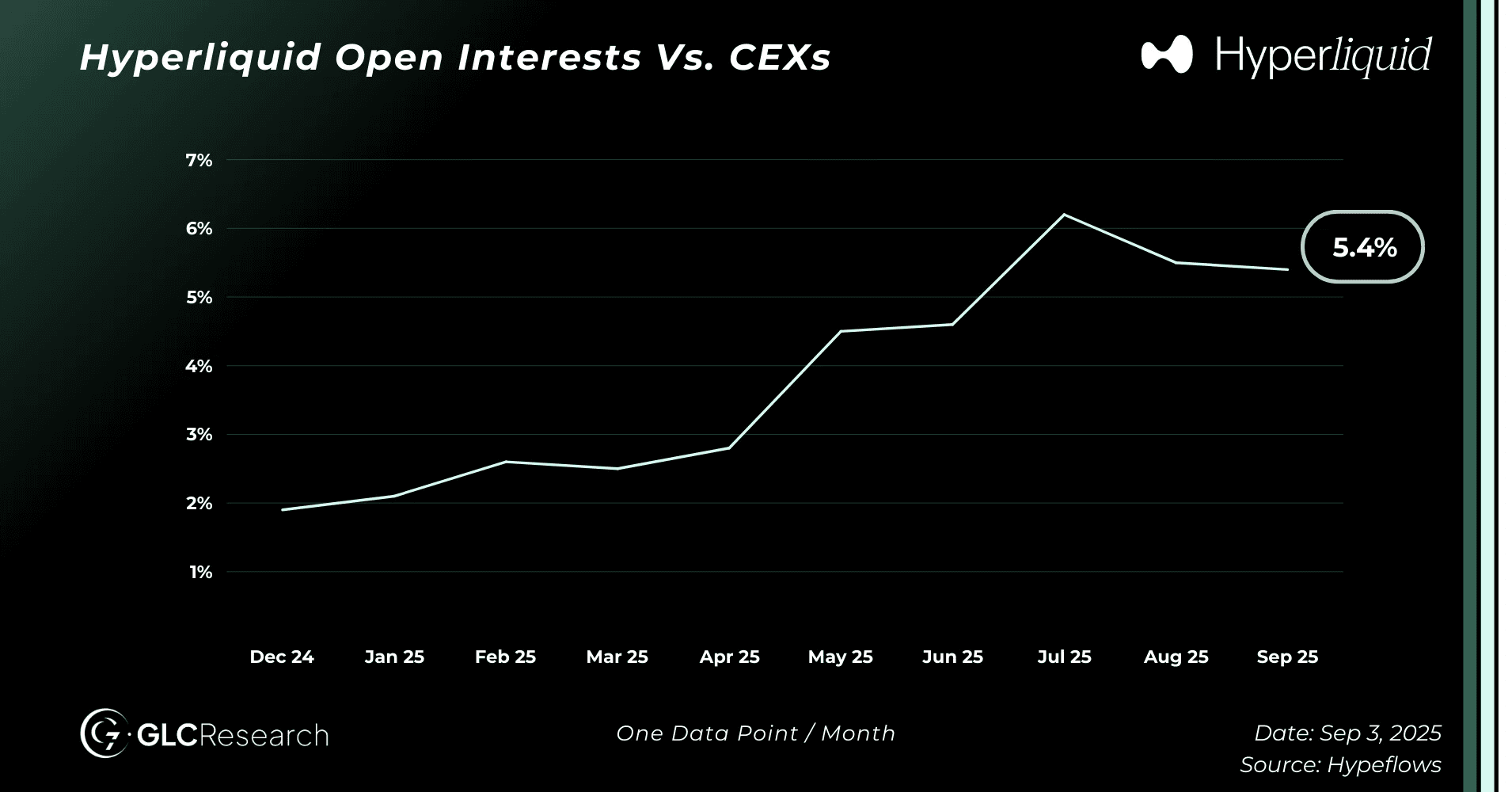

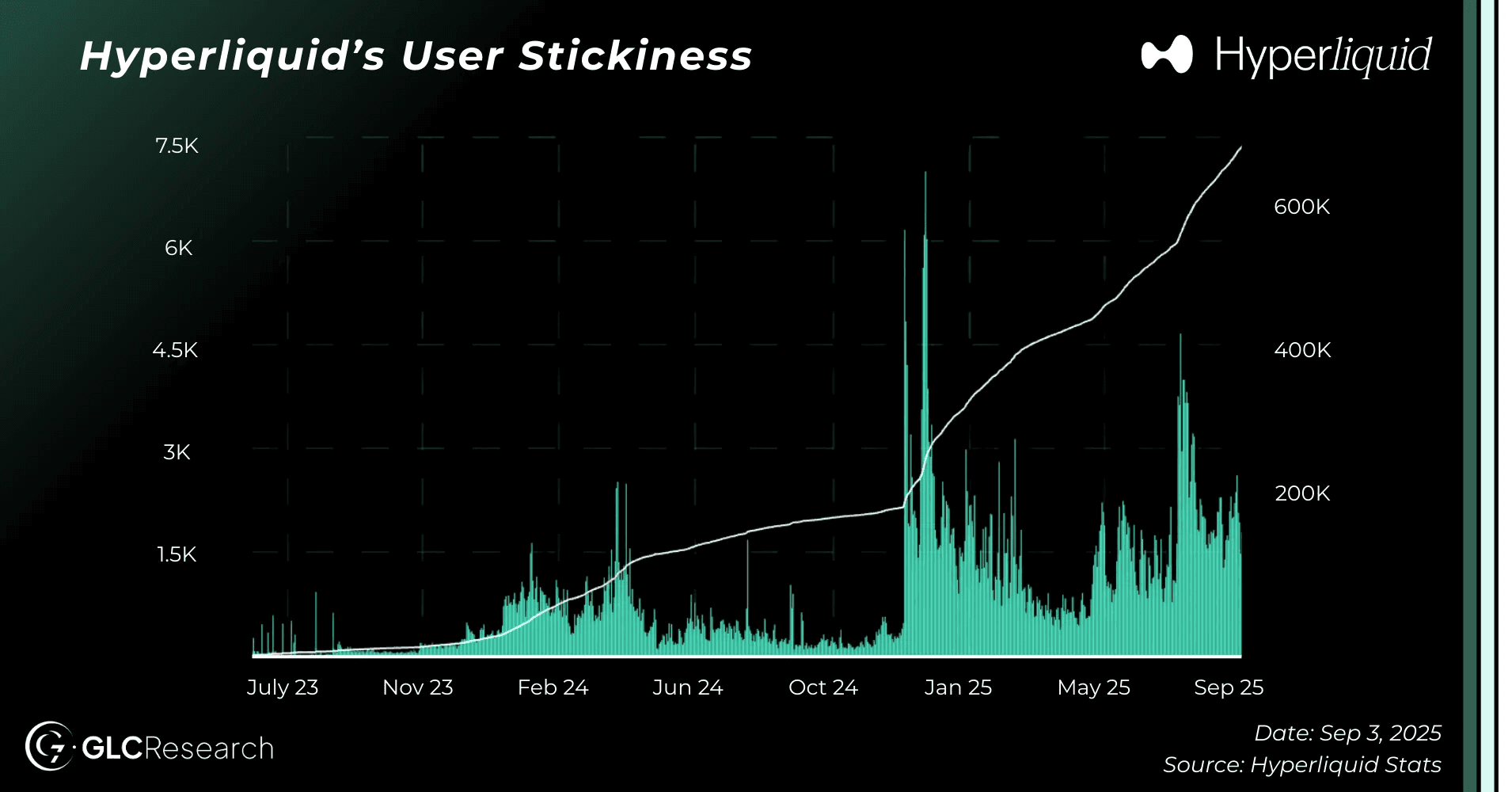

Hyperliquid’s User Stickiness

The more important thing to pay attention to isn’t user onboarding, rather, do these users continue to use Hyperliquid post-onboarding? To me, it seems like a resounding yes.

Open interest, likely the best measure for exchange usage, has grown tremendously since the start of the year.

Volume and OI when compared to CEX’s has also grown substantially, a near ~3x on both market share metrics since January.

Hyperliquid sits at around 6% market share vs. CEXs. I see no reason why this won’t continue to increase substantially.

Hyperliquid’s Continued Growth

Every single day, around 2,000 new users log into Hyperliquid for the first time. This level of continued user growth is the highest we’ve seen since TGE — and it appears users are staying once they try it

As we have witnessed from onboarding events, inflows, market share, and more, it is clear that users who log into Hyperliquid fall in love with what I believe is the best product in all of crypto.

All of this has been done without a single dollar or ounce of time spent on marketing. Just pure word of mouth and a team that constantly ships.

I won’t even go into all the future catalysts b/c I feel like a broken record, you can see my other posts for those.

What I will say is that if we put in a $114M day during August, most are not ready for what kind of fees Hyperliquid will start to generate in October / November this year.

Hyperliquid.