Hyperliquid: “The path to $1,000 $HYPE” – By Keisan

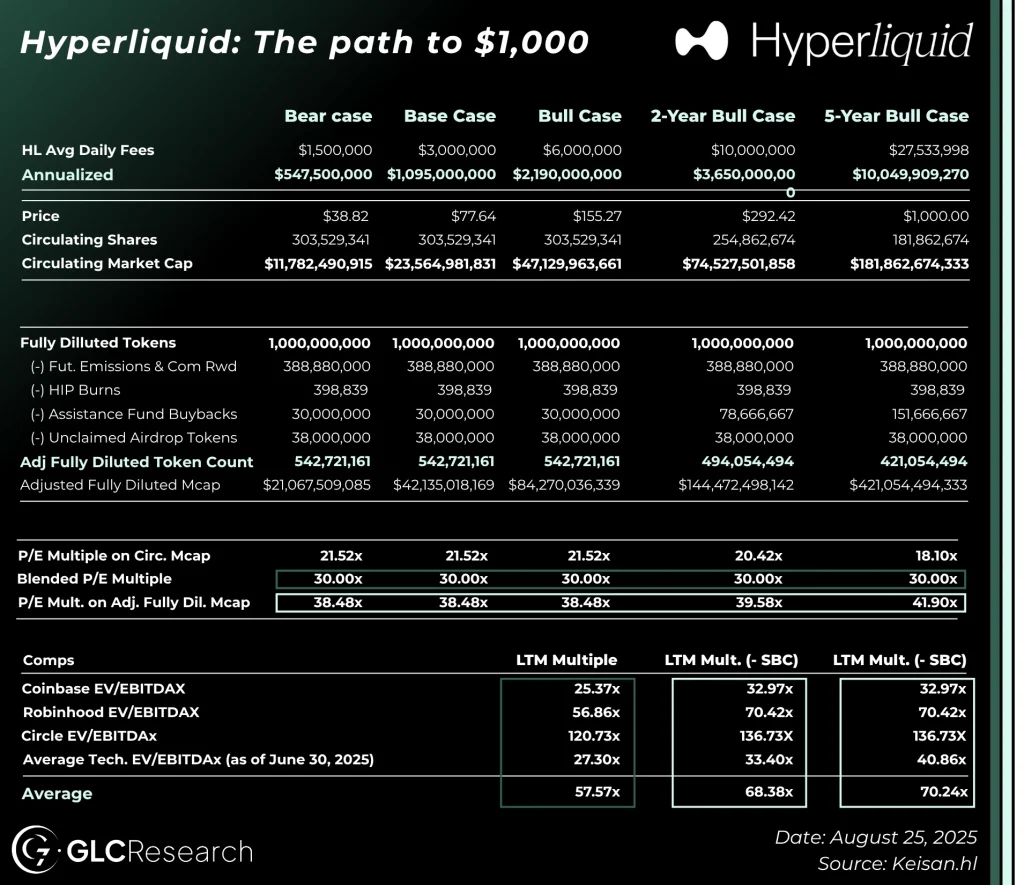

I’ve written a lot about $HYPE’s value today, but what about its value in 5-years ? I’ll try to make this quick & cover what assumptions are required to achieve $1,000 per $HYPE by 2030. Honestly, it doesn’t seem so crazy.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analyst (Keisan) behind this research owns $HYPE. Full disclaimer and disclosure here.

Key Takeaways

Hyperliquid could hit $1,000 by 2030 if it captures ~50% of global perp volume.

Buybacks and emissions offset keep supply in check.

0% taxes, rapid growth, and new fee streams justify premium multiples.

This article was written by Keisan, a former investment banker with experiences in hedge funds and private equity. He is now among the most knowledgeable voices on Hyperliquid and $HYPE valuation framework.

1. Hyperliquid: Revenue Assumptions

Probably the most important assumption here is what will Hyperliquid daily fees look like in 2030. To reach $1,000, the assumption is that Hyperliquid will achieve 50% of global volume (it currently stands at 5.8%), per HypeFlows which is an 8.6x from here

Another way to look at this is volume vs. Binance, which stands at 12.4%. To reach parity with Binance, this would be an 8.1x

So, I took 30d avg fees ($3.2M) and applied an 8.6x multiple to get to $27.5M fees per day

A few caveats as to why this actually feels somewhat conservative:

August is historically the lowest volume month of the entire year. So, $3.2m/day, as well as global volumes, are likely light here by at least 20%.

This assumes ZERO growth in global perps volume over the next 5 years. This is probably the most conservative part. Global perps volume likely 2x’s over the next 5 years, meaning Hyperliquid could achieve a 25% global market share instead (or 50% of Binance share) and achieve the same fees per day.

I am assuming a catch up to Binance only in perps. There is still huge white space in spot market growth via Hyperunit which would boost fees significantly. Additionally, HIP-3 and HyperEVM fees are not accounted for in the current comparisons, which are purely additive fee streams and have huge potential.

Hyperliquid is extremely scalable. It has taken the market by storm and is growing at a rapid rate. We don’t have pre-TGE fees, but my guess is we are looking at close to 1,000% (10x) YoY growth when compared to last August. Market share can be gained quickly in this business, and liquidity flywheels are very real.

2. Hyperliquid’s Future Token Supply

Since we are looking at a 5-year price target, we need to account for what the token supply will look like then. 5-years of assistance fund buybacks can do wonders.

My assumption: the assistance fund continues to buy back $HYPE at $3.2M per day (30d run rate) for the next 5-years (in the 5-year case). This is effectively saying that $HYPE trades at its current multiple for the next 5-years. Similar to my other valuation threads, I have stripped out tokens that I deem as non-dilutive.

Regarding emissions: it is true that in 5-years, we will have 5 years of emissions hit the market. So, the $1,000 price target may be adjusted slightly below as new tokens roll into the market. But in order to do this, you must assume that you have received 5 years of emissions, and thus, these cancel out.

For purposes of this exercise, it is mathematically the same and cleaner to just view it as null (in fact, staking rewards are actually accretive, since not 100% of tokens are staked).

3. Multiple Assumptions

For purposes of this exercise I am using a 30.00x multiple. This is around the average of what the MAG7 trades at today and is generally in line with high margin tech companies that are asset light and growing. For reference, Nasdaq exchange trades at ~36x P/Ex or ~30x adj. P/Ex.

That said, I have talked a lot in prior threads about how trad-fi multiples are not the best to comp to for a few reasons and how $HYPE should trade at a premium multiple: not for growth reasons (that too), but for accounting / mathematical reasons. One of which is stock based compensation in trad-fi, which allows companies to infinitely mint shares to pay execs.

There is one more reason that I have not spoken of before: taxes! Yes, dreaded taxes.

Businesses in trad-fi pay 21% corporate tax rate on earnings. I had previously used EV/EBITDAx comps to look at $HOOD, $COIN, $CRCL. EV/EBITDAx is generally industry standard as it often gives a better proxy for cashflow. However, it removes the burden of taxes, which in Hyperliquid’s case, are 0. Trad-fi exchanges and businesses pay 21% of their cashflow in taxes, while Hyperliquid pays 0 as it is a token and using ~100% of cash flow for buybacks.

4. Hyperliquid’s Future

Today, Hyperliquid trades at ~16.00x multiple on 30d run-rate cash flow, while growing at a staggering rate. That is unheard of in the trad-fi world, as growth businesses should be trading at much higher multiples.

There are a significant number of tailwinds coming to Hyperliquid in the near-term. Some that come to mind:

HIP-3 markets

Further roll out of builder codes

Spot market growth and listings

Cross-collateral perps margin (I hope)

Native USDC

HyperEVM growth

FIAT onramps

Hyperliquid Strategies launch, bringing eyes from trad-fi to Hyperliquid

Volume ramp in the fall. I think we will see multiple $10M fee days in 2025.

5 years is a long time in crypto, but in the normal world of underwriting investments, it’s not that long at all.

“It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight!” : Jesse Livermore

Hyperliquid