Arete Capital Hyperliquid 2026 Thesis: Housing The Entirety Of Finance

Introduction

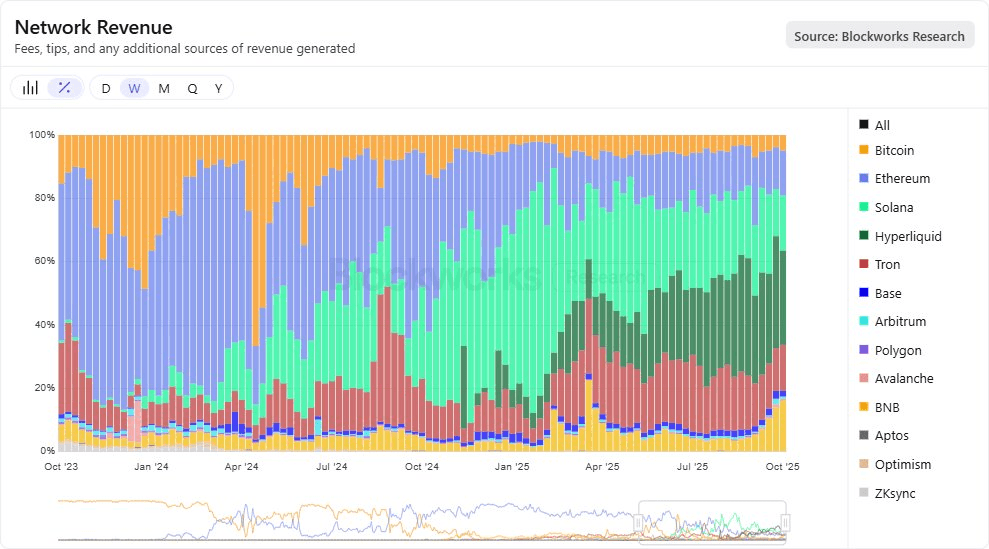

Hyperliquid has taken the digital asset space by storm in 2024/25, finally validating the long-awaited seismic move away from centralised incumbents towards a fully permissionless, transparent and global perpetual futures market. In a short period, Hyperliquid has become the No. 1 revenue-generating blockchain, dominating other generalised networks, all built and capitalised by an 11-person team. This technical feat is nothing short of astonishing and demonstrates the intellectual power of the Hyperliquid core contributors team. We believe Hyperliquid remains the most significant growth story in the digital asset space, outside of the massive growth trend we see in stablecoins following regulatory clarity via the GENIUS Act for stablecoin issuers.

Despite Hyperliquid’s success, we believe it’s prudent to take a step back and reevaluate the thesis from the ground up, along with a concrete valuation framework. In revising our thesis, we will reflect on Hyperliquid’s rise to prominence, where it has substantially eaten into the perpetual trading market share versus its centralised competitors, and then outline a much grander vision for the years to come, which is to house the entirety of finance.

The Hyperliquid Growth Story

Perpetual Trading

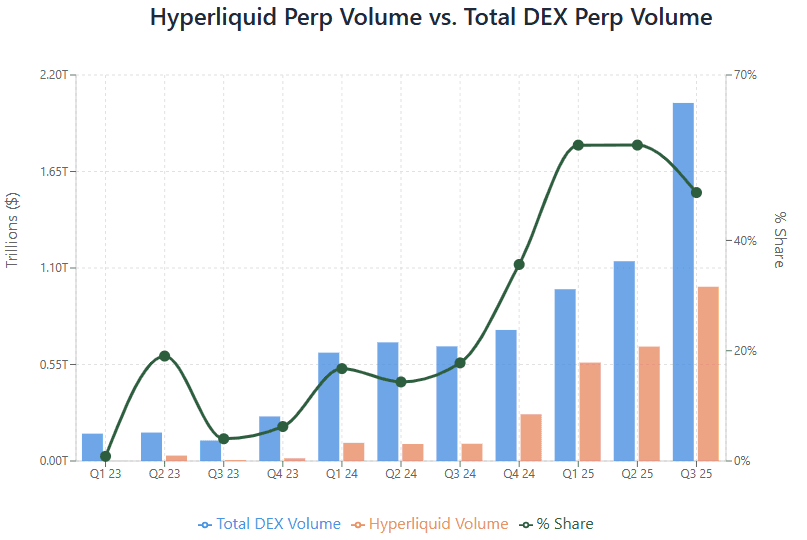

Hyperliquid Volume vs Total DEX Volume

Hyperliquid's rise to prominence was driven by its fine-tuned protocol architecture for trading perpetual futures. HyperCore, the underlying trading and settlement engine of the Hyperliquid protocol, finally offered an off-chain experience that felt like a CEX trading experience, with sub-second trade execution and seamless trading due to the implementation of session keys allowing traders to execute orders without transaction confirmations. Let's take a brief recap of all relevant perpetual futures trading statistics since inception:

In aggregate, Hyperliquid has executed $2.77 trillion in trading volume since the platform's inception, via 165 billion trades executed by users.

In terms of 2025 QoQ growth for perpetual volume, Hyperliquid grew +110.72% in Q1 25, +16.27% in Q2 25 and +52.25% in Q3 25.

Hyperliquid in August 2025 executed it’s highest trading volume to date with $398Bn cleared in perpetual trading volume.

Hyperliquid QoQ Perpetual Volume Growth

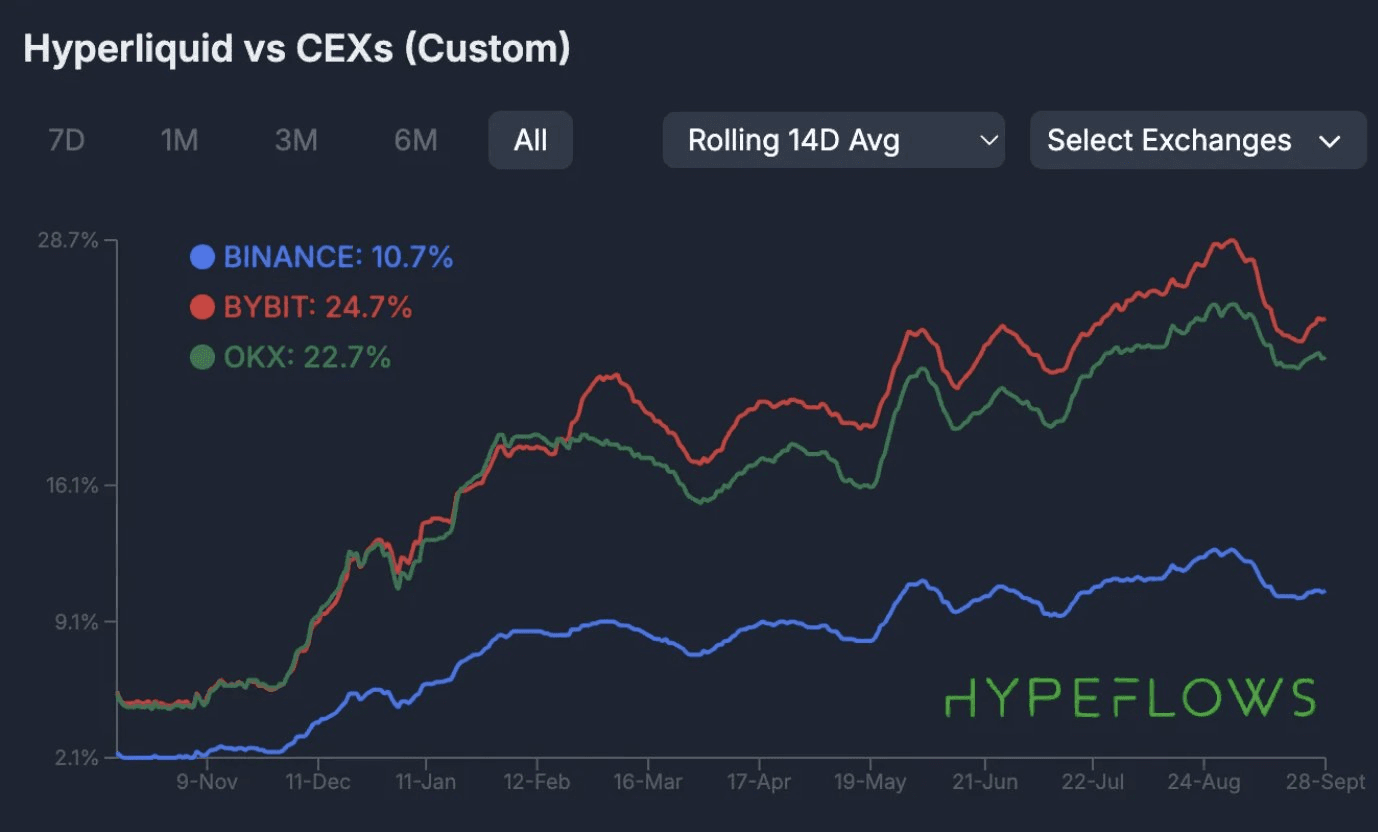

Hyperliquid vs CEX Competitors

Hyperliquid volume vs CEX 14D rolling avg (Hypeflows.com)

In terms of perpetual market share against centralised competitors, Hyperliquid is currently executing 10.7% of Binance, 24.7% of ByBit and 22.7% of OKX volumes, respectively, on a 14-day rolling average. In terms of global volume, Hyperliquid accounts for 5.1% of trading volume executed.

An important metric for all exchanges is open interest, which is the total number of outstanding contracts that are currently open. This indicates that traders are sticky and use the venue as their primary exchange due to its performance, liquidity depth, and other factors. Over the course of 2025, Hyperliquid’s open interest has grown from $3.19 billion to $15.3 billion, representing a +479% increase. Hyperliquid now accounts for 5.3% of all open interest across crypto exchanges.

Fee Structure

The Hyperliquid fee structure consists of a 0.45% taker fee and a 0.015% maker fee that scales with a 14-day weighted volume threshold across fee tiers. Taker fees can scale down to 0.024%, while maker fees can scale to 0%, incentivising market makers to provide deep liquidity to HyperCore orderbooks.

Hyperliquid also aligns the fee structure for traders with staked HYPE via staking tiers that provide fee discounts ranging from 5-40% across a 10-500k staked HYPE balance.

On average, Hyperliquid's revenues represent a consistent 0.0258% of trading volumes.

Hyperliquid fee structure for taker and maker fees

Hyperliquid Assistance Fund (AF)

The Hyperliquid Assistance Fund (AF) acts as a programmatic execution engine that executes a secondary market buyback of HYPE directing 99% of the revenue generated by the Hyperliquid protocol. The fees generated from taker fees, maker fees, spot trading fees, liquidations and HIP-1 token listings are essentially all re-directed to the AF.

To date the AF has purchased 32.2M HYPE tokens via the secondary market buyback deploying $692M since inception now valued at $1.48Bn and a total PnL of $788M marking a +113% unrealised return. The HYPE held by the AF accounts for 9.56% of the circulating supply.

In 2024, Robinhood net revenues were $2.95Bn per it’s Q4 disclosure repurchasing $257M of HOOD shares accounting for 8.7% of it’s annual net revenues. Even if we take the highest repurchase percentage of the MAG7 which is Apple in 2024 they repurchased $95Bn of shares accounting for 24.3% of their 2024 net revenue.

We wanted to outline the above to demonstrate two things. The first being there is zero value bifurcation. The second being even when comparing to traditional equities the buyback structure is unlike anything that exists either in digital assets or traditional equities.

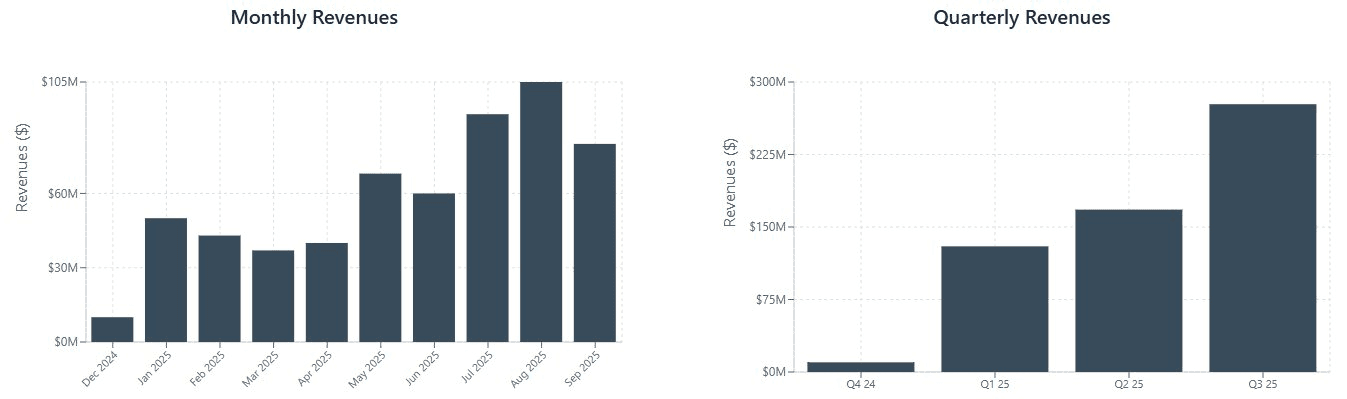

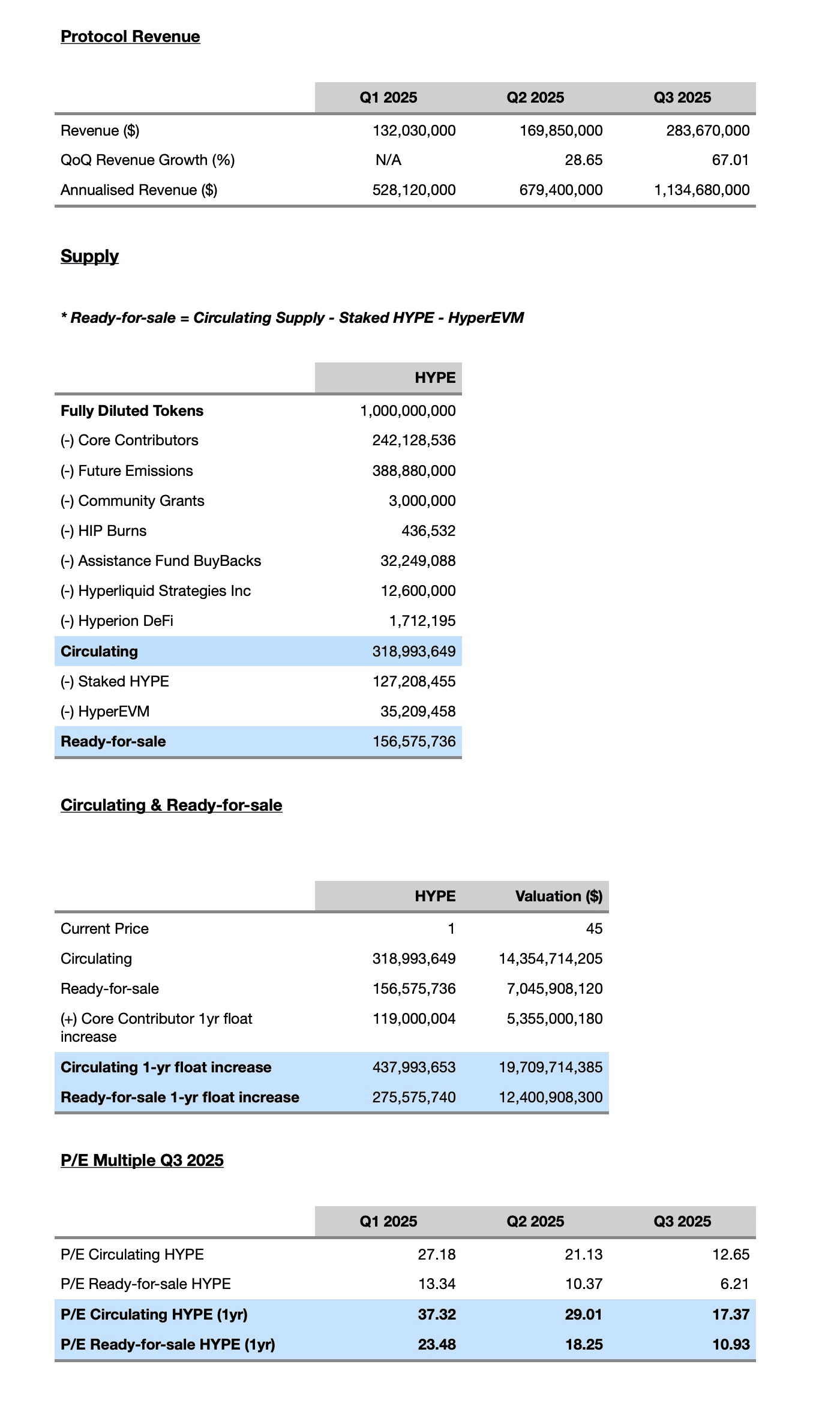

Hyperliquid in a short-period of time has become the number one revenue generating layer-1 protocol driven by demand for an exceptional decentralised exchange product. Below we can see the unrelenting QoQ growth in revenue generated by the Hyperliquid protocol.

Hyperliquid monthly and quarterly revenues

Not only has Hyperliquid become the largest revenue generating protocol in the digital asset space but directs essentially all of the protocols revenue to the accumulation of it’s own token on HyperCore.

Network revenue for all major public blockchains (blockworks.com)

HyperUnit Spot Markets

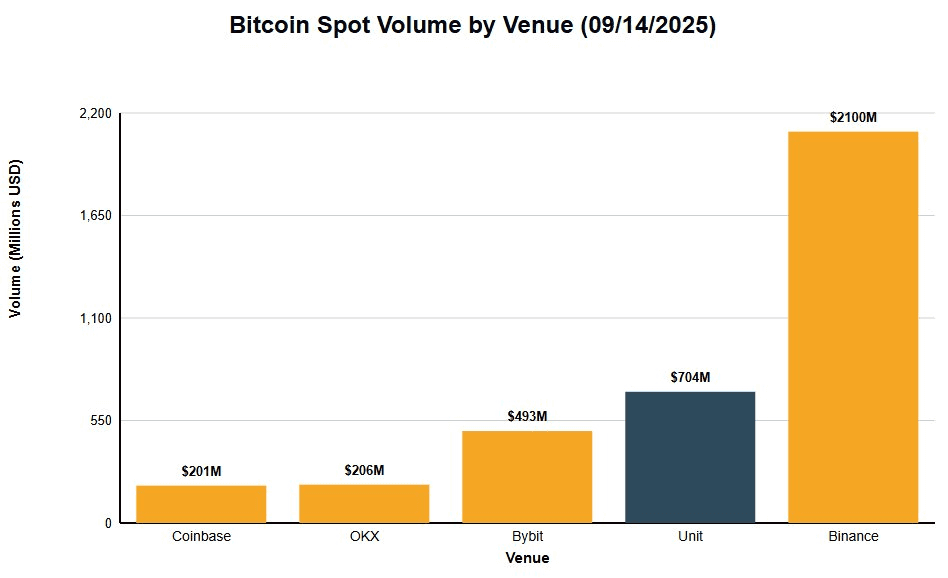

Bitcoin spot volume across major CEXs w/ HyperCore ranking 2nd (09/14/2025)

HyperUnit is an asset tokenisation and bridging layer that enables the seamless spot trading of native assets, such as BTC, ETH, and SOL on HyperCore order books. Assets bridged via HyperUnit become u-assets, which can be traded on HyperCore orderbooks or used within the emerging HyperEVM ecosystem, such as money market protocols like Felix.

Assets are sent to a HyperUnit address on the native chain, which are then locked, and 1:1 corresponding mint of u-tokens are issued on Hyperliquid. This brings native spot assets backed 1:1 on HyperCore and HyperEVM.

As a case study to demonstrate how well HyperUnit, alongside HyperCore’s trading engine, works for spot assets, from August 20th to 25th, a BTC whale deposited 22,769 BTC ($2.59Bn) into Hyperliquid via HyperUnit and proceeded to convert UBTC to 472,920 UETH ($2.22Bn). This was one of the most significant public asset conversations we have seen to date and was seamlessly and permissionlessly enabled through HyperCore spot markets.

To date, HyperUnit has seen $718 million in asset deposits across BTC, ETH, SOL and FARTCOIN, offering a fully permissionless way to trade spot assets on a highly performant orderbook. HyperUnit spot markets have also executed $40.5 billion in spot trading volume since inception, with $ 21.4 billion in spot Bitcoin traded on Hyperliquid.

HyperUnit has also successfully offered Day 1 access to prominent TGEs via their spot orderbooks, with a recent example being PUMP and XPL. We expect this trend to continue, with the spot orderbook volume growing as liquidity deepens through asset deposits and access to new high-profile launches on the date of the TGE.

Builder Codes: The Hyperliquid Liquidity and Distribution Flywheel

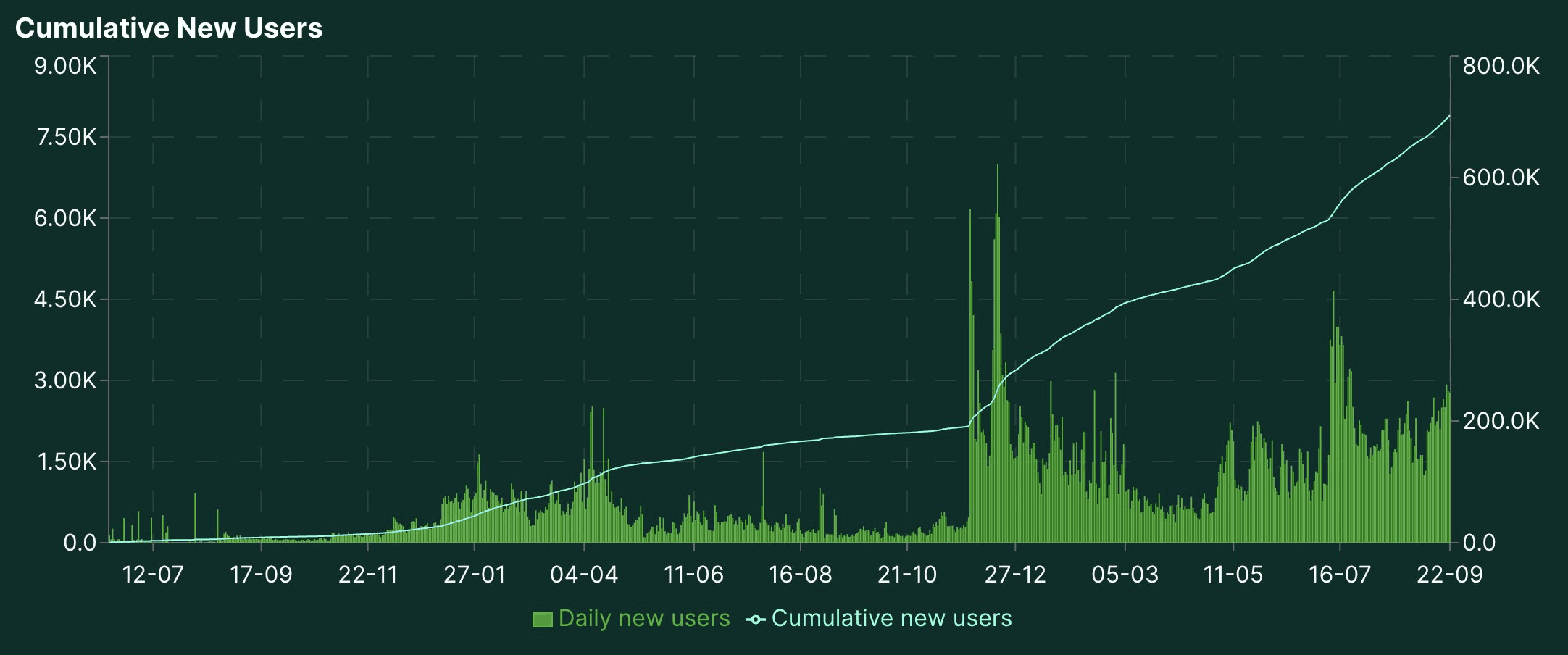

Daily and cumulative new users to HyperCore

Builder Codes are one of the most essential components of the Hyperliquid protocol, which opened up distribution channels to new users, allowing third parties to plug directly into HyperCore’s performant trading engine and liquidity. Third-party apps build out the front-end and leverage HyperCore as the direct back-end to offer perpetual trading to their user base natively. To date, builder codes have generated over $30 million in revenue and onboarded 169,900 new wallets interacting with HyperCore.

Paxos Labs, in their recent USDH proposal, clearly outlined that Hyperliquid is to become the default liquidity infrastructure, providing seamless and cost-efficient spot and perpetual trading. We believe based on the Paxos USDH proposal that the coming growth phase for builder codes would come from direct integrations into fintechs and brokerage platforms. Builder codes have seen material success with integrations of crypto-native wallet providers, such as Phantom, and other crypto-native integrations like Axiom and BasedApp. Given that fintechs or prime brokerages do not offer perpetual trading to their users, this would provide a gateway for these platforms to offer perpetual trading to their massive, well-capitalised user bases without the need to build out back-end infrastructure or bootstrap liquidity.

It’s challenging for businesses with a crypto-native userbase or larger players such as FinTechs to pass up such an easy way to integrate a new revenue generating business line that would benefit their users. Phantom itself generated $18.8 million in revenue in Q3 from this integration alone. We expect several large fintechs and brokerages to directly integrate builder codes into their platforms, potentially attracting millions of new users to Hyperliquid, which will significantly increase trading volume. Given that Interactive Brokers is exploring stablecoin deposits, we believe that their 3.3 million clients may one day have access to perpetual trading via Hyperliquid builder codes. Other strong candidates for builder code integrations include fintechs like Revolut, which boasts 65 million customers.

Builder Codes 2026 Growth Analysis

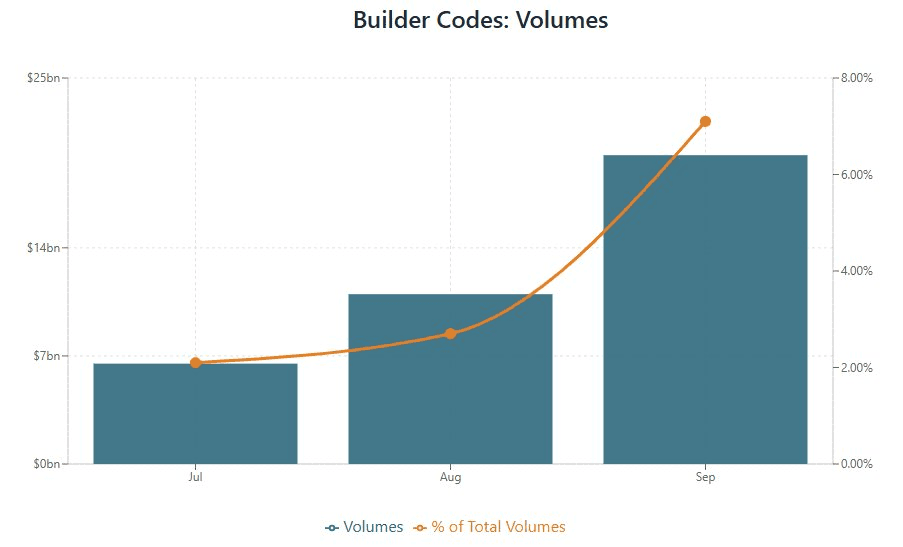

Assuming a 0.05% builder fee, builder codes brought in $20 billion in volume to Hyperliquid in the month of September. It is quickly growing to become a significant source of volume for the Hyperliquid protocol, accounting for 7.1% of total perp volume in September:

Builder codes monthly volume & percentage of total perpetual volume

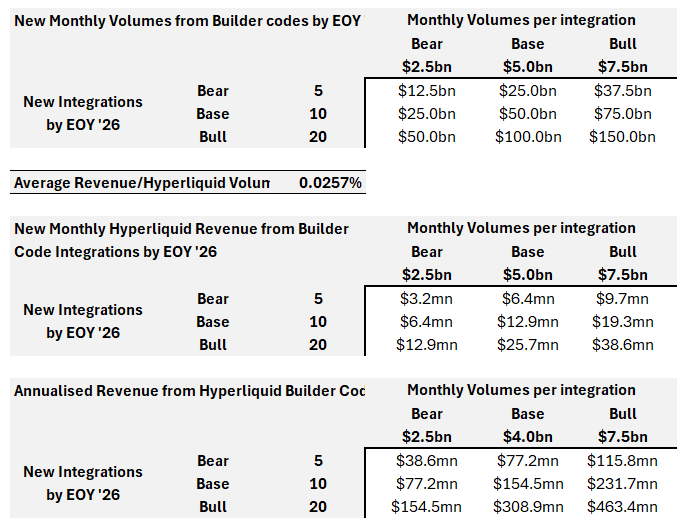

We have carried out some scenario analysis on the impact of builder codes on Hyperliquid revenues. Assuming an average revenue of 0.026% per unit of volumes, and a base case that we see 10 large builder code integrations by the end of 2026 with an average monthly volume of $5 billion, we expect these integrations will generate an annualised $154m in revenue for Hyperliquid by EOY 26:

Builder code modelling for 2026

This would represent a 15.6% increase in revenues for Hyperliquid - excluding any organic growth of the Hyperliquid perp exchange and general perp market.

Hyperliquids Entrance into The Stablecoin Mania

USDH: The Hyperliquid Native Stablecoin

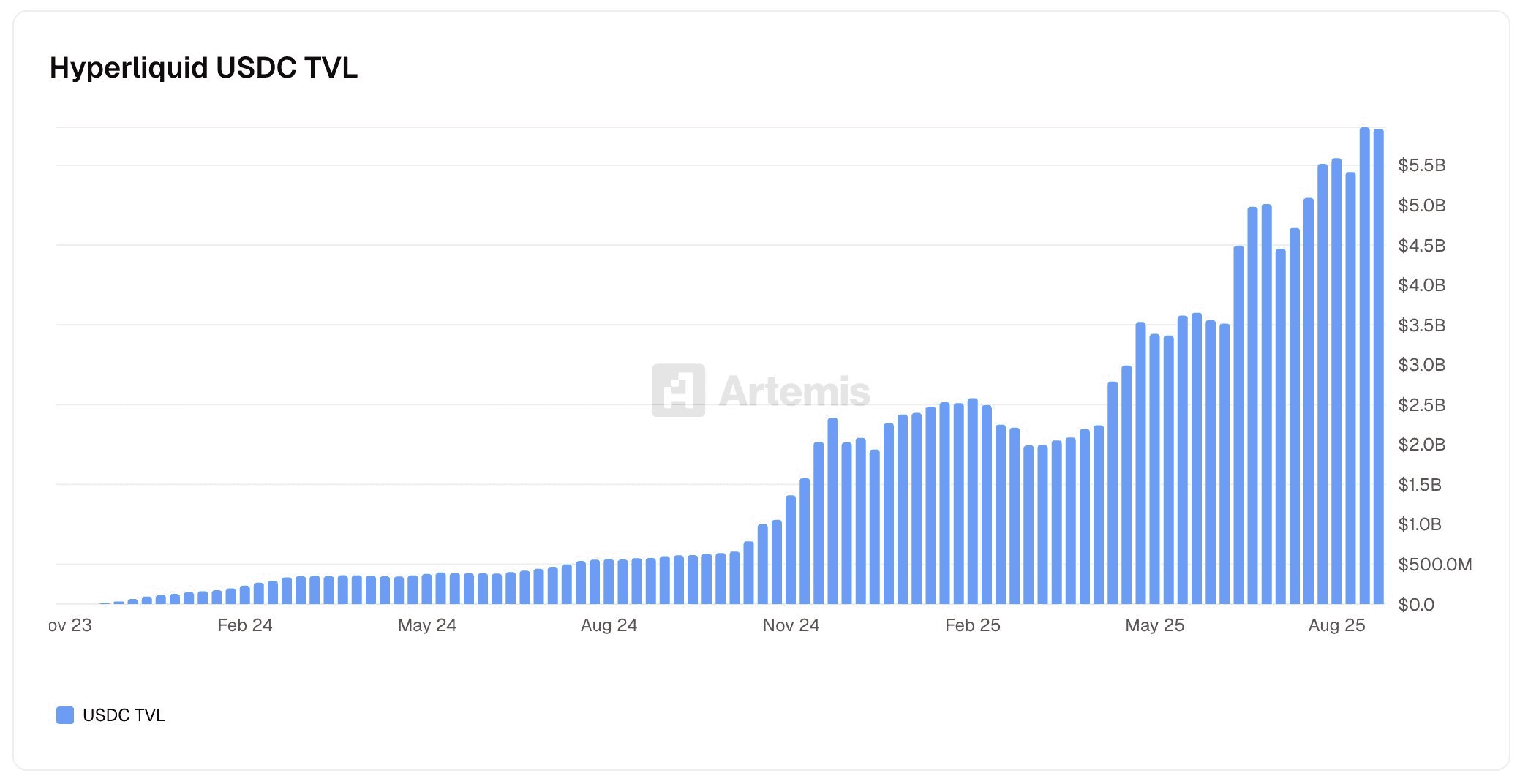

Total USDC bridged to HyperCore

Hyperliquid recently entered the upcoming stablecoin mania with USDH, a fiat-backed native stablecoin used as a quote and collateral asset on HyperCore.

Prominent stablecoin issuers such as Circle and Tether to date have been the key beneficiaries of the yield generated by treasury bills backing USDC/USDT. USDH seeks to change this by directing 50% of the yield generated by USDH back to the assistance fund to purchase HYPE on the secondary market.

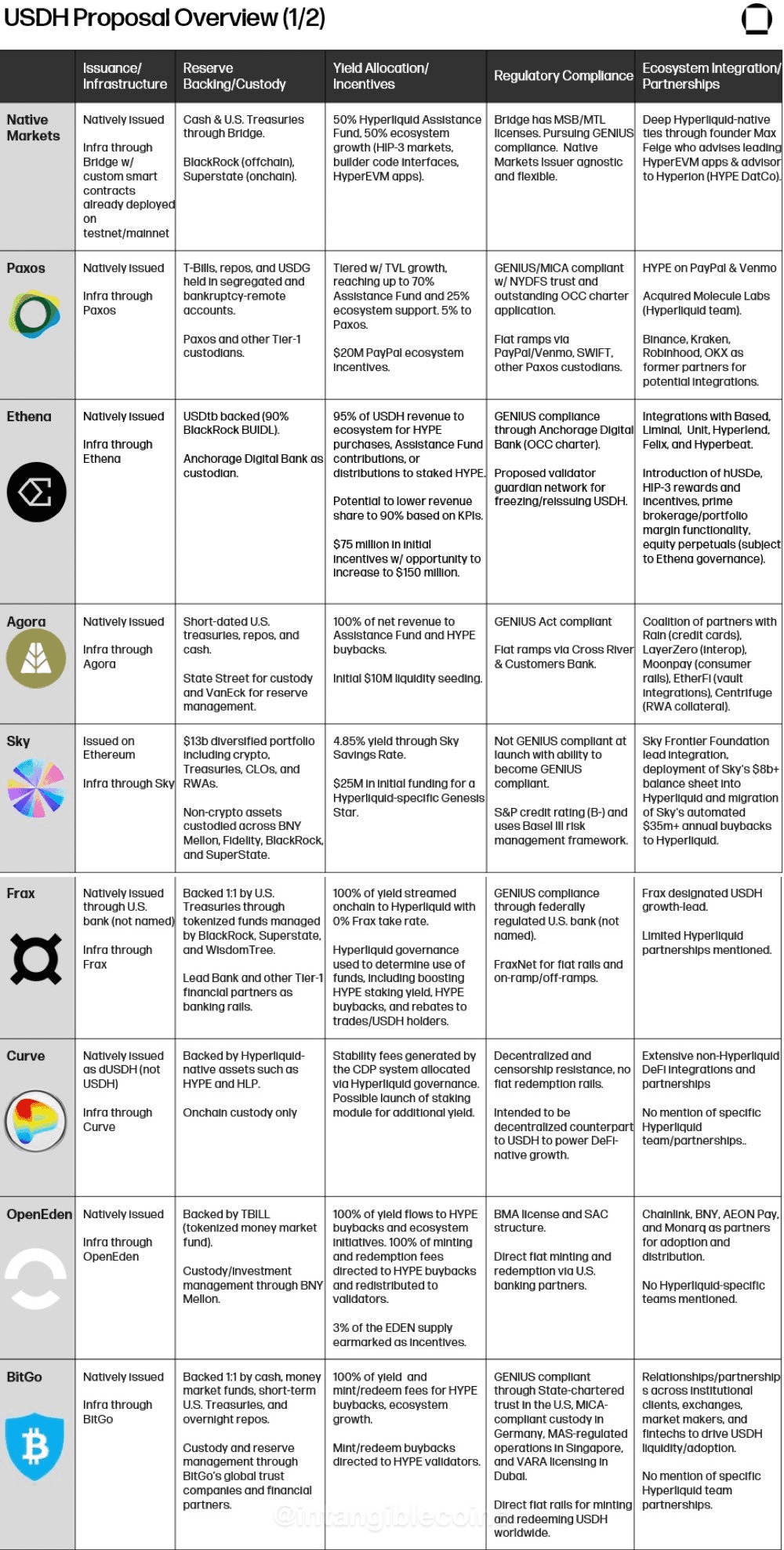

USDH had several proposals from prominent Institutional players, including Paxos/PayPal, Agora, Ethena, BitGo, and Native Markets. These proposals outlined their respective custodians, T-Bill yield allocation, regulatory compliance with the newly passed GENIUS Act, and proposed partnerships. The Native Markets proposal was passed by Hyperliquid governance.

To date, Hyperliquid has around $5.6Bn in Circle’s USDC deposited into HyperCore, primarily benefiting Circle and Coinbase rather than the Hyperliquid ecosystem. In terms of deposited USDC and the forward guidance provided by the recent FED dotplot, which outlines a 75 bps cut by the end of 2025, assuming 100% conversion into USDH, this would net the protocol $98M in annual revenue directed towards the buyback of HYPE.

In response to USDH, Circle recently launched native USDC and CCTP V2 on the HyperEVM, began purchasing HYPE on the secondary market, and is now seeking to become a validator. This is incredibly important as it demonstrates complete alignment with Circle and Hyperliquid, facilitating full Institutional on/off ramps via Circle Mint and bootstrapping the HyperEVM DeFi protocols, particularly emerging money market protocols. Plans aim to include seamless deposits and withdrawals between HyperEVM and HyperCore from 14 other blockchains via CCTP V2.

Despite several prominent proposals failing to secure the USDH ticker, many will still move forward with their proposals, deploying stablecoins under a different ticker. This ultimately means that Hyperliquid will host multiple fiat-backed and several aligned stablecoins with established on/off ramps and enterprise rails. We expect major payment providers like PayPal and Venmo to advance in the emerging Hyperliquid stablecoin ecosystem by integrating direct on/off-ramps, potentially opening the door to 400 million PayPal users and 35 million merchants.

USDH Proposals (Galaxy Research)

Hyperliquid Aligned Stablecoins

A new stablecoin-focused proposal was announced by the Hyperliquid Foundation to offer a permissionless primitive for stablecoin issuers.

The primitive offers stablecoin issuers 20% lower taker fees, 50% better maker fees and 20% higher volume contribution toward fee tiers when used as a quote asset for a spot pair or the collateral asset for HIP-3 deployed markets on HyperCore.

The above ultimately further accelerates the Hyperliquid liquidity flywheel, incentivising liquidity provision and trading volume for aligned stablecoins plus the conversion of USDC into USDH further driving revenue from aligned stablecoins.

To become an aligned stablecoin on Hyperliquid, issuers must be enabled as a permissionless quote asset, 800k HYPE staked by the deployer and 200k staked HYPE for the quote token deployment. In total, the issuer must have staked 1M HYPE to receive the above benefits. Additionally, 50% of the off-chain yield must be shared with the protocol, which will go directly to the Assistance Fund for HYPE secondary market buybacks.

The aligned stablecoins proposal aims to lay the groundwork for Hyperliquid to become the settlement layer for the next generation of payments and personnel finance technologies. Housing all of finance means entering the coming stablecoin race in full force. As quoted in the Hyperliquid Announcement ‘The blockchain that houses the future of finance should also be the premier stablecoin chain’.

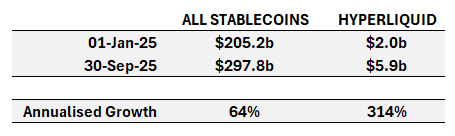

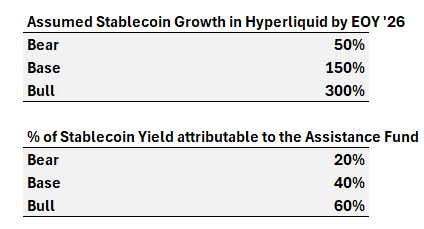

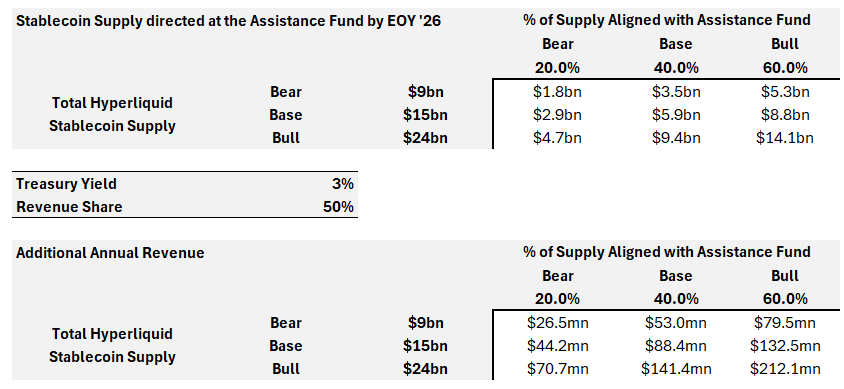

Similarly to Builder Codes, we have carried out some scenario analysis to extrapolate what the stablecoin market in Hyperliquid may look like by the end of 2026. Hyperliquid has had a significant expansion in the stablecoins deposited to its chain - a 314% annualised growth from $2bn at the start of the year to $5.9bn by the end of Q3, compared to a 64% annual growth rate for the overall stablecoin market:

Hyperliquid 2025 USDC Growth Rate (Jan 25 - Sept 25)

As a base case we expect more slowed growth in 2026, given the scale Hyperliquid has reached this year. As a base case, we assume a 150% growth rate by EOY ‘26.

Hyperliquid USDC growth rate EOY 2026

Crucially - we expect a significant migration from USDC dominance to Hyperliquid-aligned stablecoins, given the USDH proposal as highlighted above. Assuming treasury yields fall to 3% as per the latest FedWatch probability, and 50% of treasury yield from stablecoin backing is directed to the assistance fund, as per the USDH proposal, we expect $110m in additional annual revenue for the protocol by EOY ‘26:

Aligned Stablecoin Modelling 2026

HIP-3: Builder-Deployed Perpetuals

HIP-3 is a new hyperliquid improvement proposal that aims to transform exchange perpetual listings into an on-chain primitive, moving away from the validator-approved listing process. This change allows anyone to create their own native perpetual markets on Hypercore permissionlessly.

Deployments of new markets on HyperCore, each with its own orderbook, occur via a Dutch auction process that runs every 31 hours, resulting in 282 new markets being deployed annually via HIP-3. To deploy an orderbook to Hypercore via the Dutch auction, each entity must have 500k HYPE staked.

HIP-3 offers deployers maximum flexibility in terms of market customisation, encompassing Oracle integration, specifying collateral assets, fee parameters, and including additional deployer fees on top of the base fee.

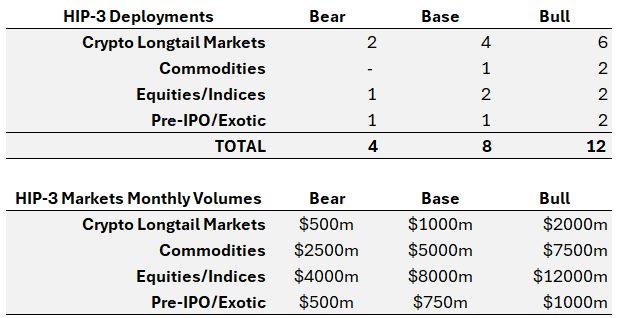

HIP-3 opens up HyperCore to traditional markets such as Indices, equities, forex, commodities, bonds and other exotic markets such as political prediction markets and pre-IPO markets.

We are moving to a digital age where people prefer to hold digital dollars. There exists considerable friction between off-ramping and wiring to a brokerage account. Plus, traders are accustomed to trading perpetuals as it’s the simplest derivative contract for the end user to understand and express a market view. Hyperliquid aims to house all of finance, and people should take that statement literally: any market where an oracle is available will be available to trade on HyperCore.

Given HIP-3 is pre-launch it is difficult to note down assumptions on the potential volumes these markets may achieve. We have already seen multiple exceptional teams announce they will launch perpetual markets via HIP-3, including:

Kinetiq’s Launch: Kinetiq is the leading liquid staking protocol on Hyperliquid and in July announced Launch, a ‘exchange-as-a-service’ infrastructure product enabled by HIP-3, designed to help teams deploy new perp markets.

Ventuals: On October 6th Ventuals announced they will be launching a perp exchange for pre-IPO companies with 10x leverage via HIP-3.

HyperUnit’s trade.xyz: As discussed earlier, Hyperunit is a key component of the Hyperliquid ecosystem facilitating spot trading activity on the HyperEVM. They have shared news on the launch of trade.xyz, which is speculated to be their own perp DEX via HIP-3.

These are three teams that will immediately create new perp market activity contributing to Hyperliquid’s economics. HIP-3 markets have up to 2x the fees - Hyperliquid takes the same fee for volumes on HIP-3, whereas the deployer takes up to 50% of fees. Thus, HIP-3 is a scaling mechanism for Hyperliquid without hurting its unit economics.

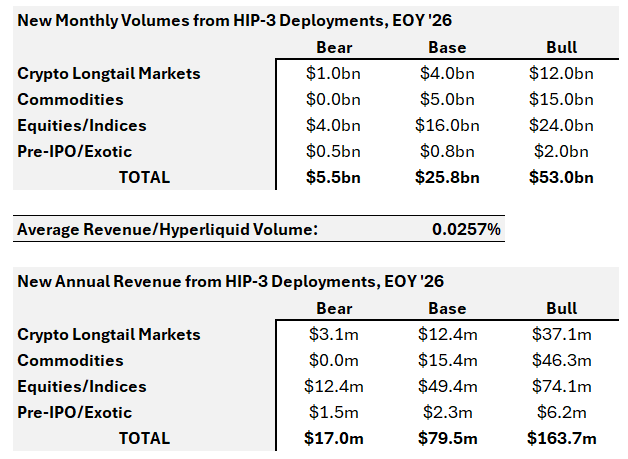

Given HIP-3 supports the creation of new perp markets, we believe it has the potential to be more impactful than builder codes, which simply offer further access to HyperCore’s current perp markets. HIP-3 perp instances will support crypto assets but crucially will likely expand into commodities, equities & indices, and pre-IPO/exotic markets. As a base case, we believe 15 strong HIP-3 perp integrations will launch with a total of >$40bn in Monthly volume generated for the protocol by EOY ‘26:

Given a 0.0225% fee this would generate as a base case an additional $120m in annualised revenue:

HIP-4: Event Markets & Parlays

Weekly Prediction Market Volume (Polymarket & Kalshi)

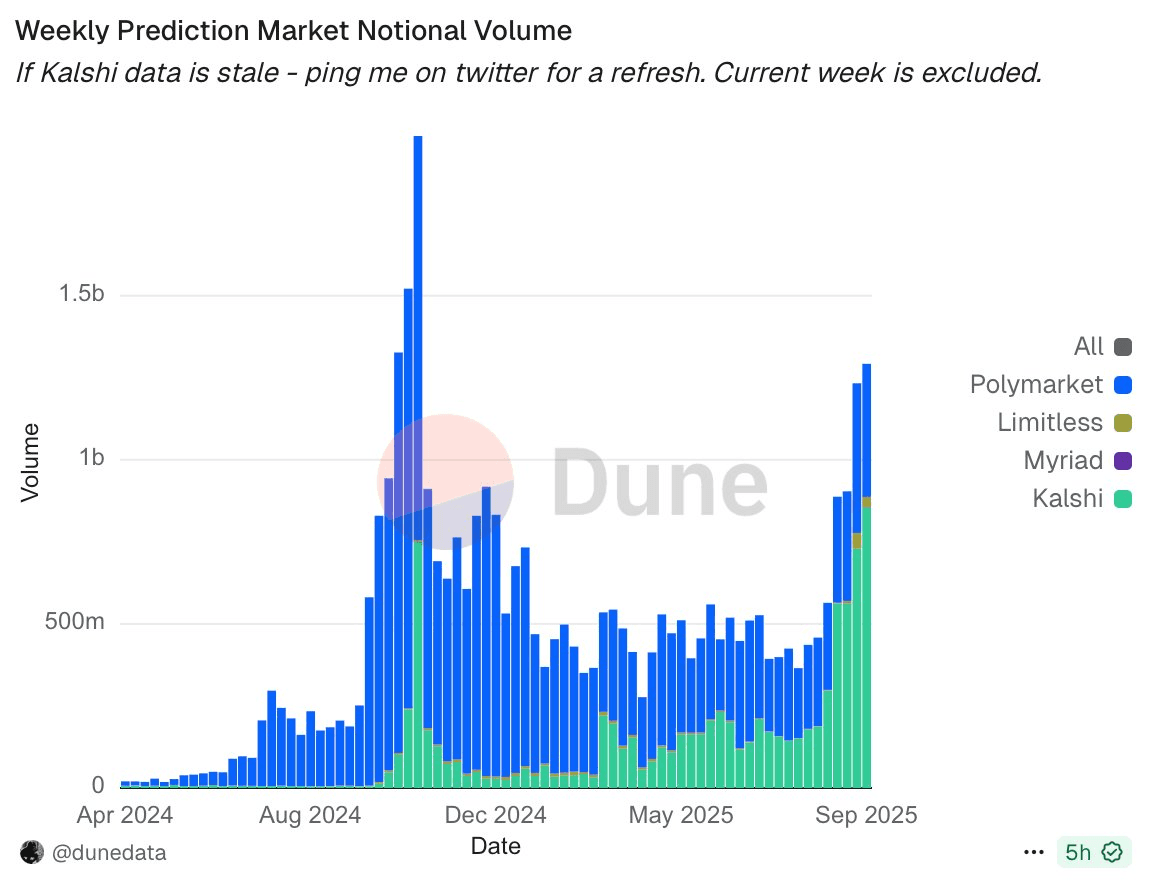

HIP-4 is a novel improvement proposal to the Hyperliquid protocol that would introduce binary markets akin to prediction markets such as Kalshi and Polymarket, which both have seen notable adoption primarily driven through political forecasting.

Prediction markets such as Kalshi and Polymarket have seen notable attraction, with notional volumes exceeding $11 billion every week and cumulative volumes of $8.2 billion and $27.9 billion, respectively.

HIP-3, which introduced builder-deployed perpetual order books, does not support prediction markets in their current form, given that the mark price can only change <1% per tick, which does not support binary payoffs.

Regarding the Hyperliquid team's response, Jeff has been quoted on event perpetuals, stating that they are more suitable for being treated as permissionless spot deployments with full collateralization, no liquidations, or continuous funding.

HIP-4 also opens up the possibility of Parlays, which are multiple independent single bets often used in sports betting that provide convexity without leverage.

In summary, HIP-4 aims to redefine how markets can be deployed on Hyperliquid and provides the path for Hyperliquid to enter the emerging prediction market trend, potentially competing with the likes of Polymarket and Kalshi.

Hyperliquid Digital Asset Treasuries

Hyperliquid, like many other prominent protocols, is well-positioned to capture the emerging digital asset treasury wave, which seeks to acquire the underlying asset to hold on its balance sheet. The equity listed on the NASDAQ will provide accredited investors a path to attain HYPE exposure without the custody requirements of holding the asset themselves. HYPE, as we know, has poor distribution via CEX, which currently limits its accessibility, especially for those based in the United States. DATs such as Hyperliquid Strategies Inc. are set to solve this accessibility issue by the end of 2025.

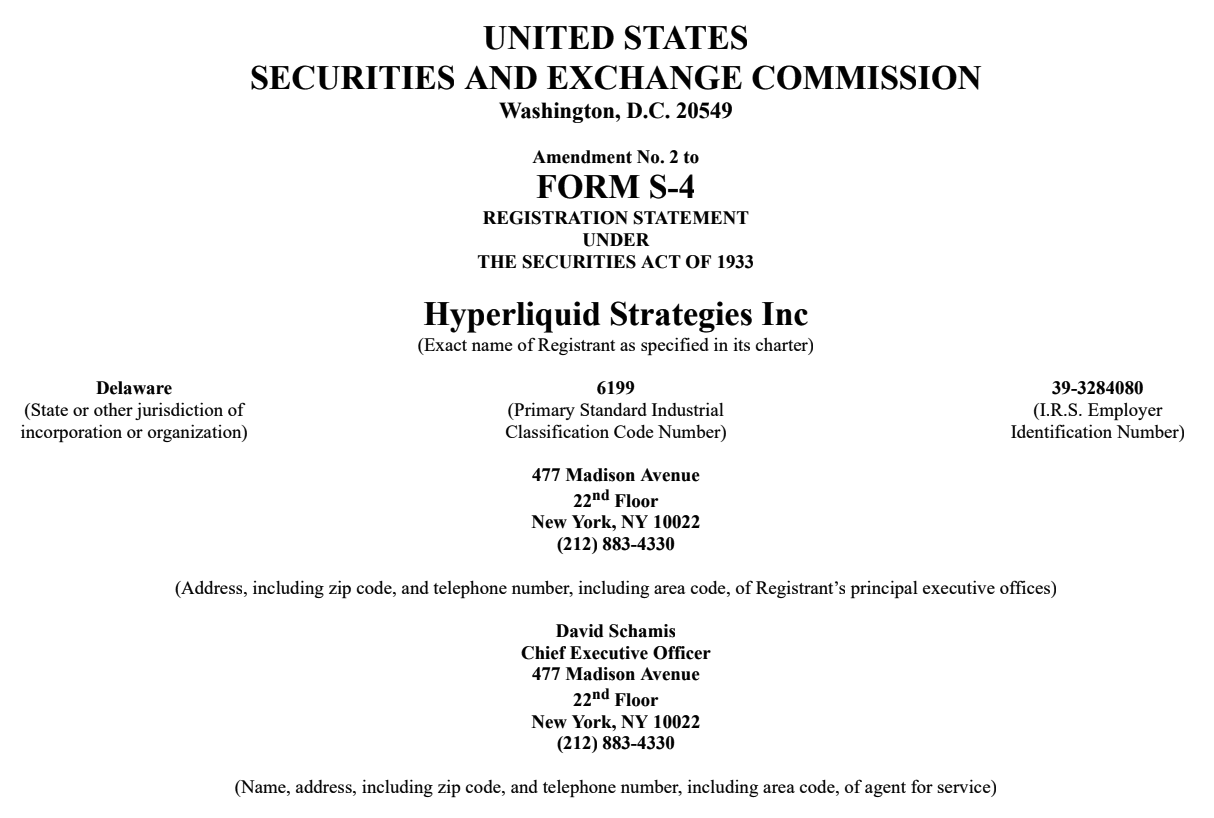

Hyperliquid Strategies Inc (NASDAQ: PURR)

Hyperliquid Strategies Inc is a newly formed treasury company primarily focused on the acquisition of HYPE which was formed from the business combination of Sonnet BioTherapeutics and Rorscach I LLC. The new ticker HSI is to be listed on the NASDAQ.

HSI is lead by Bob Diamond founding partner of Atlas Merchant Capital who was previously CEO of Barclays and held senior executive roles at Credit Suisse and Morgan Stanley as well as David Schamis CIO of Atlas Merchant Capital previously J.C. Flowers serving as the Managing Director.

At closing, Hyperliquid Strategies Inc is set to hold approximately 12.6M HYPE tokens ($578M) and gross cash invested of at least $305M. HSI is expected to close some time in Q4 2025.

Participation included the likes of Paradigm, Galaxy Digital, Pantera, D1 Capital and others.

HSI just filed an S-4 with the SEC on September 4th 2025 meaning the merger is now being formalised for shareholders.

Hyperliquid Strategies Inc S4 Submission

Hyperion DeFi (NASDAQ:HYPD)

Hyperion DeFi is the rebranded entity of Eyenovia Inc who’s central focus is on the acquisition of HYPE and yield generation strategies when it comes to staking and generating yield via the HyperEVM.

Based on the September 25 news letter, Hyperion DeFi holds 1.71M HYPE with an average purchase price of $38.25.

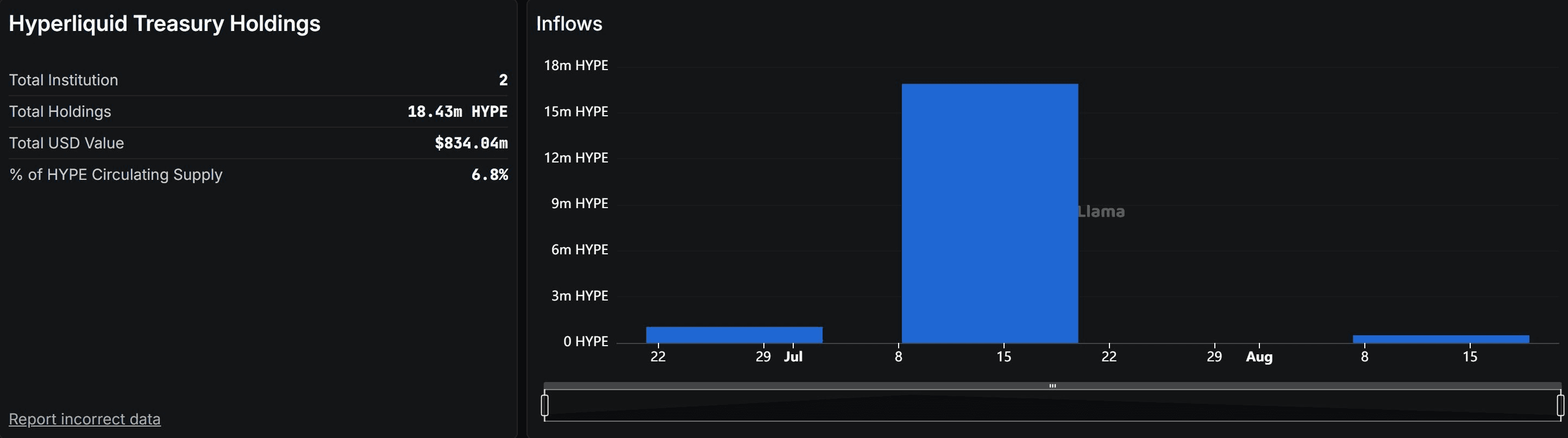

Sonnet and Hyperion DeFi now hold collectively 18.43M HYPE valued at $834M permanently taken away from circulating supply.

Hyperliquid Strategies Inc & Hyperion DeFi HYPE holdings

Core Contributor Unlocks

Hyperliquid core-contributors account for 238M HYPE tokens accounting for 23.8% of the total supply. These portion of the tokens are set to begin unlocking on a monthly basis post November 29th 2025.

We think it’s unreasonable to assume 23.8% of the token supply will be fully distributed to 11 team members. Tokens assigned to core contributors will be locked for one year after the genesis event, with vesting schedules completing between 2027 and 2028. In some cases, vesting will extend beyond 2028. We believe the above statement indicates that the beyond 2028 supply will be allocated to future core contributors and may represent 3-6% of the core contributor supply.

The Hyperliquid core contributors have every right to sell. However, assuming they are going to nuke the spot orderbook from an execution perspective is also unreasonable. There are many avenues to transfer core contributor supply to larger entities seeking additional HYPE exposure which will be a simple transfer of hands without directly hitting the spot orderbook.

We are not saying core contributors are not going to sell directly on the spot orderbook but outlining there are many other ways for supply to transfer hands without resulting in direct sell pressure. We have seen some people extrapolating sell pressure from the monthly unlocks and think this fear is overstated. The Hyperliquid team have proven full alignment from Day 1 and have yet to deviate from this in any regard.

Vlad Tenev founder of Robinhood has sold 3.8M class A shares of Robinhood and has 50.2M in class B shares yet to be converted and Robinhood trades at a $111.2B market capitalisation. We draw these parallels because we believe Hyperliquid is on par with a Robinhood given it’s future growth prospects.

We expect the same alignment from Jeff and other core contributors given how grand the long-term vision Hyperliquid is coupled with how much work is to be done. Sales will be easily telegraphed from unstaking HYPE and if sold drectly on the spot orderbook will be executed in tranches.

Valuation Framework

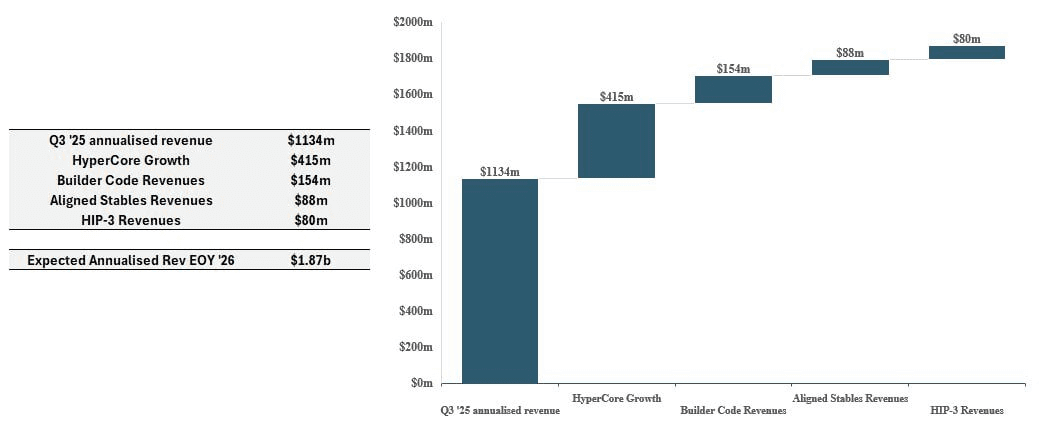

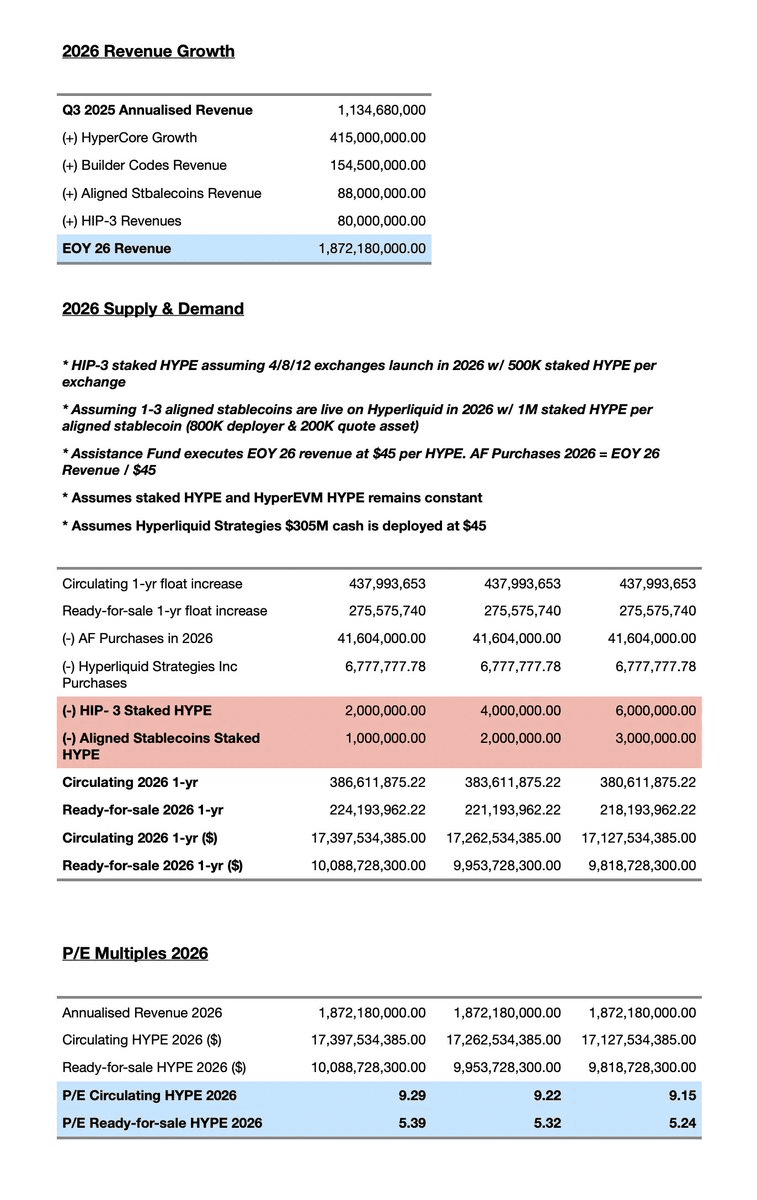

Above in this report we have included multiple scenario analysis that extrapolate the revenue potential for the three main catalysts we see for Hyperliquid:

Continued expansion of Builder Codes.

The launch of Hyperliquid aligned stablecoins with revenue share to the assistance fund.

The launch of HIP-3 markets with the potential to generate >$40b in monthly volume by the end of 2026.

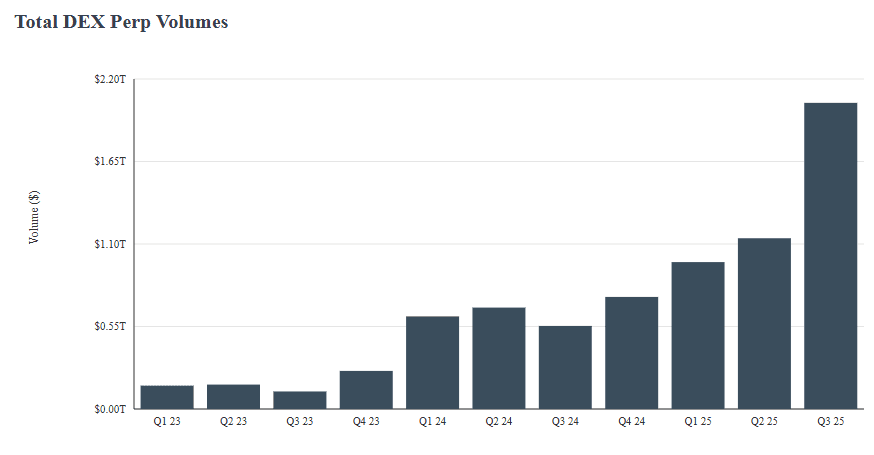

Outside of this, we believe Hyperliquid’s core perp exchange will continue to see organic growth. There is a clear trend where decentralised perp exchanges are gaining significant market share from CEXs, with DEX perp volume in the first three quarters of 2025 growing 125% vs. the first three quarters of 2025:

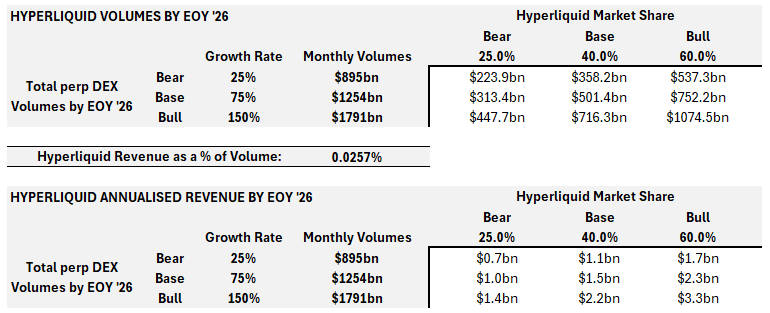

We expect this trend to continue and, despite a number of competitors coming into prominence over the last few weeks, we believe Hyperliquid will sustain a 40% market share over perp activity. Below includes a scenario analysis for the growth of total perp DEX volumes by the end of 2026, and what we expect Hyperliquid’s market share to be. We assume this to be organic growth of the current platform and excludes HIP-3 and Builder Code Volumes:

Combining all these factors, we believe as a base case that Hyperliquid will be annualising $1.9bn in revenue by EOY ‘26, which would represent a 70% increase from Q3 annualised revenue.

Hyperliquid Q3 2025 Annualised & 1-yr Core Contributor Float Increase

Hyperliquid 2026 Revenue Projections & 1-yr Core Contributor Float Increase

Predictions For 2026

[1] Hyperliquid will continue to eat into CEX marketshare for perpetual trading driven by the liquidity flywheel and accelerated through builder codes enhancing flows. By the end of 2026 we predict that Hyperliquid will have between 15-25% of Binance’s perpetual marketshare and account for 7.5-15% marketshare in global perpetual volume.

[2] Prominent FinTech’s and brokerages will begin to offer perpetual trading to their users through the direct integration of builder codes. Builder code integrations will begin to increase protocol revenue materially.

[3] Hyperliquid will host multiple fiat-backed aligned stablecoins driving 50% of the T-Bill yield back to the Assistance Fund. Additionally, we expect many of those who participated in the USDH proposal to move forward with their plans of launching a fiat-backed stablecoin on Hyperliquid. By the end of 2026 we believe USDH will account for >$5Bn in issuance and other Hyperliquid aligned stablecoins accounting for >$2Bn in issuance collectively.

[4] HIP-3 will host multiple vibrant perpetual markets focused on the trading of Indices, equities, forex and commodities. Majority of HIP-3 markets deployed will use USDH as the quote asset further entrenching USDH incentivising USDC to USDH migration on HyperCore.

[5] Hyperliquid will expand into the Real World Asset vertical allowing 1:1 backed tokenised equities to be traded on spot orderbooks. This is outside of trading traditional markets on HIP-3 via perpetuals. It will become the venue with the deepest liquidity for accessing traditional markets on-chain.

[6] Hyperliquid focused DATs to perform incredibly well and acting as a natural beta to HYPE appreciation. We also expect numerous other DATs in 2026 to be announced and launched with differentiating strategies especially with a key focus on HIP-3 and the HyperEVM.

[7] In 2026 it's possible we see numerous filings for Hyperliquid spot ETFs improving accessibility for accredited investors. Given Hyperliquid is the highest revenue generating protocol in the digital asset space we expect to see significant Institutional interest in Hyperliquid given at this point in time Hyperliquid could be generating >$2Bn annually.

Summary

We believe as the digital asset class matures through Institutional adoption that the public market is primed for growth investing. Previous cycles have left a damaging psychological impact on market participants as we slowly approach the inflection point where several key critical businesses begin to scale dramatically producing material cashflows, attracting top talent and expanding products offered to consumers. The premise here is to allocate to elite teams who have demonstrated exceptional execution ability and ride the tailwinds of their growth story for the years to come.

Arete Capital’s liquid investment methodology is not the active trading of public markets but to find those few exceptional bets that are deep value and express a long-term time horizon for investment realisation. Hyperliquid remains our core liquid bet that fully encapsulates our growth investment methodology as outlined in the thesis above. As HIP-3 approaches bringing traditional markets on-chain accessible through perpetuals and it’s entrance into the stablecoin growth story with USDH it’s clear to see important parts of the financial stack are being brought to HyperCore and the HyperEVM. It’s never been more clear to see the grander vision for the entirety of finance to be housed on Hyperliquid.

Disclaimer

This thesis is provided by Arete Capital for informational purposes only and does not constitute investment advice or an offer to buy or sell any security or asset. The views expressed reflect current opinions as of the publication date and may change without notice. While believed to be reliable, no representation is made as to the accuracy or completeness of the information. Past performance is not indicative of future results.

Authors: @Crypto_McKenna & @Daveeemor