Why Hyperliquid ($HYPE) is so cheap? – “The Token Risk Premium”

$HYPE trades at ~9x FCF despite $1.3B in annualized revenue, mainly due to token-specific risk, limited access, and market mispricing. With Hyperliquid Strategies expanding distribution and the L1 value still unpriced, a revaluation seems increasingly likely.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment advice.

Discloser: Analyst (Yarl) behind this research owns $HYPE. Full disclaimer and disclosure here.

Key Takeaways

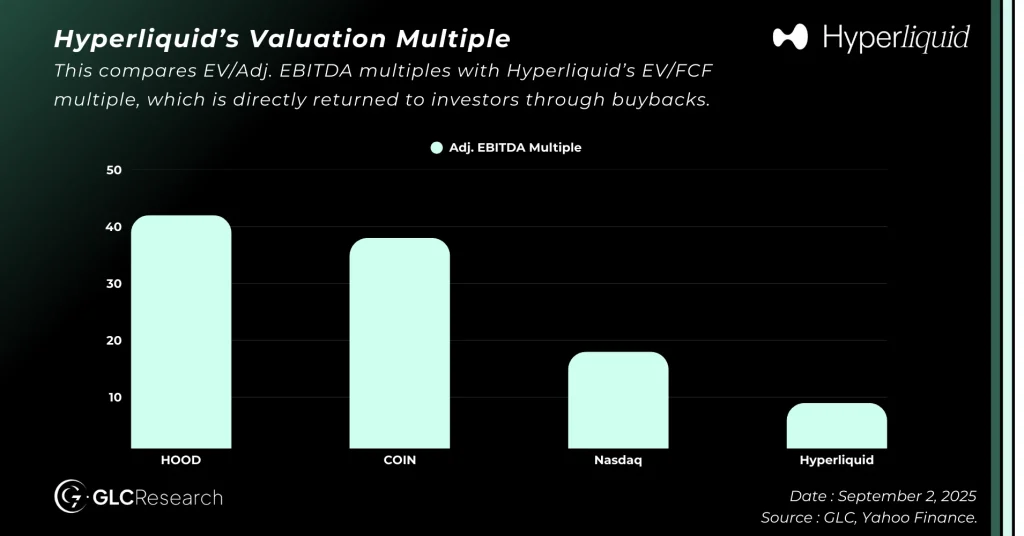

$HYPE trades at ~9x FCF vs 20–40x EBITDA for public comps like Coinbase and Nasdaq.

Structural token risk (governance, transparency, regulation) compresses valuation multiples.

Hyperliquid has mitigated many token-specific risks through full buybacks and aligned incentives.

Key discount factors include information asymmetry and poor token distribution.

Hyperliquid Strategies and the underpriced Layer 1 offer major catalysts for repricing.

The Token Risk Premium: Why Hyperliquid trades below equities

In our latest research on Hyperliquid, we argued that $HYPE remains significantly undervalued compared to listed companies with similar business models, such as Robinhood, Coinbase, and Nasdaq.

To frame the comparison, we benchmarked $HYPE’s free cash flow (FCF) against the adjusted EBITDA of these public peers. While FCF is the most accurate metric for $HYPE given its 97% distribution (buyback) model, we opted to use adjusted EBITDA for equities to introduce a layer of conservatism in the comparison.

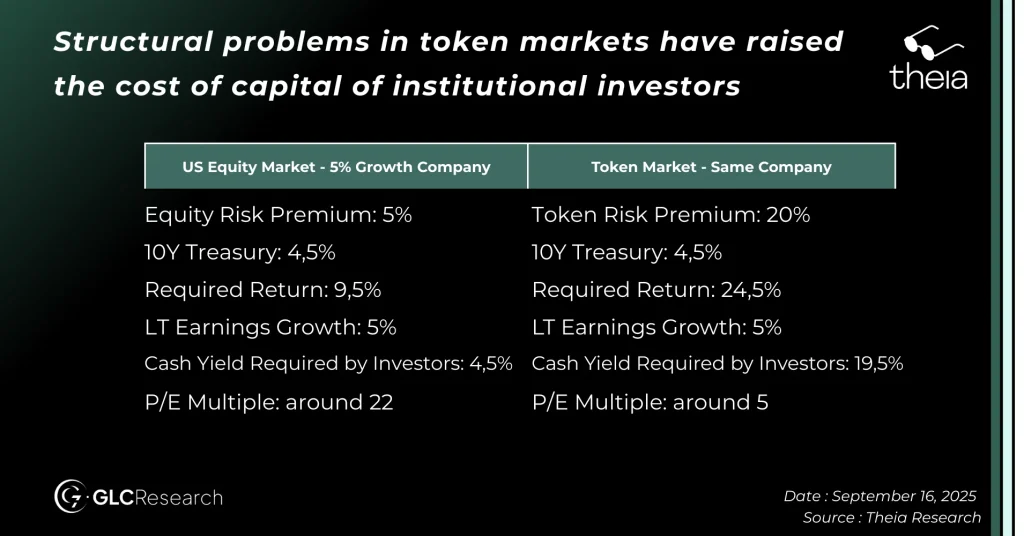

This matters because even under similar growth assumptions, crypto tokens naturally trade at lower valuation multiples than equities. The reason is structural: the risk premium on tokens is significantly higher due to structural risks. Investors require higher returns to compensate for these higher risks, which leads to “compressed” valuations.

That said, we believe $HYPE is not an average token. Its business model is more efficient, the team is long-term aligned, and tokenholders have a direct claim on protocol revenue. The current discount may reflect more than just token risk.

Importantly, the market seems to be catching up. As fundamentals strengthen and adoption deepens, we expect continued repricing of $HYPE to reflect the protocol’s fair value.

Let’s get into it.

Structural Risk & Why Multiples Are Lower for Tokens

What the image below illustrates is that, due to the higher risks associated with the token market, investors demand higher returns which directly impacts valuation multiples. Structural risks specific to tokens include regulatory uncertainty, misalignment with holders, lack of governance rights, poor founder behavior, limited transparency, minimal reporting, and weak communication. These are just a few of the reasons why the token market carries significantly more risk than traditional equity markets, which in turn leads to higher required returns and, ultimately, lower valuation multiples.

That being said, we believe that given the youth of the market, it wouldn’t be accurate to treat Hyperliquid like the average crypto token, as it clearly doesn’t carry the same structural issues. One of the main reasons we argue that the risk premium for $HYPE should be significantly lower is that the team has consistently worked to align its interests with those of holders and the broader community, in a way that is largely unprecedented in crypto.

Every dollar earned is essentially redistributed to investors via buybacks. In our view, that already addresses one of the biggest barriers to investor confidence. When tokenholders receive the majority of protocol revenue, it creates a real sense of economic rights, aligns incentives between the team and the community, and removes the usual concerns about founder behavior, especially given the scale of the airdrop and the ongoing revenue-sharing mechanism.

Overall, even though Hyperliquid has already taken significant steps to reduce perceived investor risk, $HYPE would still likely trade at a premium if it were an equity, based on current market standards. That said, there are several strong arguments in favor of higher valuation multiples for $HYPE.

The first is obvious: the buybacks. A company that distributes 100% of its revenue to investors simply doesn’t exist in traditional markets. This drastically increases the effective earnings power for holders. On top of that, Hyperliquid doesn’t pay taxes, and its infrastructure is unusually scalable. A perfect example, which we’ve highlighted multiple times, is the Phantom integration, which cost the Hyperliquid team literally zero, yet is expected to drive over 5% in annual revenue growth. And that’s just one integration. Dozens of front-ends are likely to follow. Learn more here.

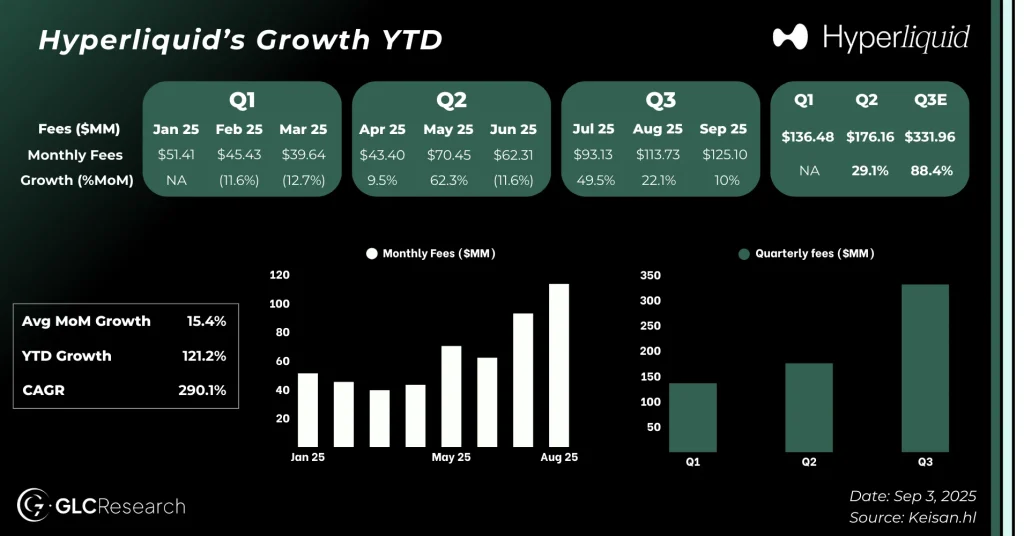

Another overlooked point is how early we still are. People tend to forget this because of the scale Hyperliquid has already achieved. But the fact that we’re comparing its metrics to Coinbase, Robinhood, and Nasdaq, while Hyperliquid is still under three years old, is remarkable. How is a protocol generating $1–1.5B in free cash flow trading at such low multiples while being this young?

In short, most of the structural risks typically associated with tokens have been mitigated by the Hyperliquid team’s behavior and decisions. At the same time, there is a legitimate case for higher multiples. And let’s not forget: this valuation discussion assumes that Hyperliquid is growing at the same pace as its equity peers, which simply isn’t true. $HYPE is growing much faster, and that alone would justify a valuation re-rating.

What Makes Hyperliquid so cheap then ?

We believe there are mainly two reasons why $HYPE continues to trade at such low valuation multiples:

Information asymmetry

Poor distribution, with no major CEX listings and no access in the U.S.

1. Information Asymmetry

To address the first point, very few people actually understand Hyperliquid, especially how to properly value the token. In fact, we believe GLC is one of the most knowledgeable entities when it comes to $HYPE valuation. That being said, it still amazes us how few people, even those working in the industry, truly understand Hyperliquid.

One of the biggest misconceptions, for example, is the use of FDV to compute valuation multiples, when it clearly doesn’t make sense. We’ve addressed that issue in more detail elsewhere. Still, many assume Hyperliquid will behave like other projects that dump on their communities, while their track record speaks for itself.

Most people don’t understand Builder Codes, HIP-3, or the liquidity flywheel that’s already forming. Take the Phantom integration, for instance. A few lines of code added to the infrastructure generated billions in trading volume and is likely to contribute more than 5% annual revenue growth, while costing Hyperliquid absolutely nothing. And this is just one integration. Dozens of others will follow.

Most people also don’t understand what kind of market HIP-3 can create, or the types of innovation that could emerge from this upgrade. The same goes for USDH, which we believe could eventually generate hundreds of millions, or even billions, in additional revenue for Hyperliquid.

And all of this is happening without the need to ramp up CapEx or OpEx. Anyone can plug directly into Hyperliquid infrastructure and focus solely on front-end development and user acquisition. You simply don’t see that level of scalability often.

2. Poor Distribution

We also believe distribution is one of the biggest factors behind the current low multiples. $HYPE is not listed on any major exchanges and is currently inaccessible to U.S. investors. This is clearly one of the biggest pain points.

Retail users can’t access $HYPE through their usual platforms, so they never hear about it. Most funds, institutional players, and sophisticated investors can’t buy it either — and most importantly, we believe they don’t even know it exists yet.

But this is about to change.

Hyperliquid Strategies, led by Bob Diamond and David Schamis, is actively building a bridge between Wall Street and $HYPE. With backgrounds at Morgan Stanley and Barclays, they quickly understood that the real problem wasn’t demand, it was access. Their new investment vehicle is a U.S.-compliant structure that allows traditional equity investors to gain exposure to $HYPE indirectly. Lean more about Hyperliquid Strategies here.

They’ve already raised nearly $900 million, split between $HYPE and over $300 million still to be deployed.

Importantly, they’re not just setting up a fund. Bob and David actually understand Hyperliquid very well, and they’ve been actively educating the broader market on platforms like CNBC, Bloomberg, and more.

We believe $HYPE is one of the best investment pitches in web3. It’s a token that institutional investors can actually model using a DCF or valuation multiples. Once they take a proper look at the numbers, we’re confident they’ll see just how undervalued it is.

We also believe that the $HYPE DAT will be a huge success. Access to $HYPE is limited, so it’s likely the trust will trade at a premium to NAV, which could give the fund even more flexibility to accumulate $HYPE.

And this isn’t the end. Next, let’s look at the L1 premium.

Hypelriquid’s L1 Premium not priced in ?

Another important aspect of Hyperliquid’s valuation is that we continue to believe the most accurate way to value $HYPE is through a sum-of-the-parts approach, breaking it down into Perps, Spot, and the L1.

Back in March, we shared our initial valuation thesis with target prices between $40 and $60, based on a projection through the end of 2025. At the time, $HYPE was trading around $14. While we’ll revisit this valuation soon, it’s clear in hindsight that the model held up well, which further supports the relevance of a sum-of-the-parts methodology for valuing Hyperliquid.

This brings us to the L1 component, which we still feel is being valued at zero by the market, despite the success of HyperEVM and the many high-quality teams building on it. While most current protocol fees are generated from perps, with Spot (via Unit) also starting to contribute meaningfully, we see valuation multiples that already appear low relative to current cash flows. That alone suggests meaningful repricing potential, especially when combined with the structural points outlined above.

Right now, the market is not assigning any value to the L1. This does not make sense. The Layer 1 brings powerful network effects that enhance the overall utility and composability of $HYPE. These effects support ecosystem growth, drive long-term stickiness, and expand the utility of $HYPE. Yet today, none of that is priced in, even though HyperEVM is growing rapidly, with a TVL already higher than several Layer 1s valued in the multi-billion-dollar range.

We’ll revisit the L1’s standalone valuation in a future report. For now, this point reinforces our view: $HYPE should not be trading at a discount to peers, it should likely be trading at a premium.

Final Thoughts: Toward a Fair Valuation

Despite strong fundamentals and over $1B in annualized free cash flow, we believe $HYPE continues to trade at a discount largely due to information asymmetry and poor distribution.

Many investors still don’t fully understand Hyperliquid’s model, token mechanics, or revenue structure. Key features like Builder Codes, HIP-3, and USDH remain underappreciated, while misconceptions such as using FDV to compute valuation persist.

On the distribution side, $HYPE remains inaccessible to U.S. investors and unlisted on major centralized exchanges. This lack of access limits both awareness and institutional participation.

That said, this is starting to change. Hyperliquid Strategies is now building a compliant bridge to traditional capital, with nearly $900 million raised and a clear focus on market education.

Meanwhile, HyperEVM’s growth and traction remain unpriced, even though it adds meaningful utility, network effects, and long-term value to the protocol.

In our view, these two factors, better access and proper recognition of the L1, could drive a repricing of $HYPE. Not only toward fair value, but potentially even toward a valuation premium.