Hyperliquid vs. CEXs: “Trade War 2.0 – The JELLY Incident”

A $JELLY exploit pushed Hyperliquid to the edge. CEX listings escalated the attack. Centralized intervention worked but it raised some questions.

Key Takeaways

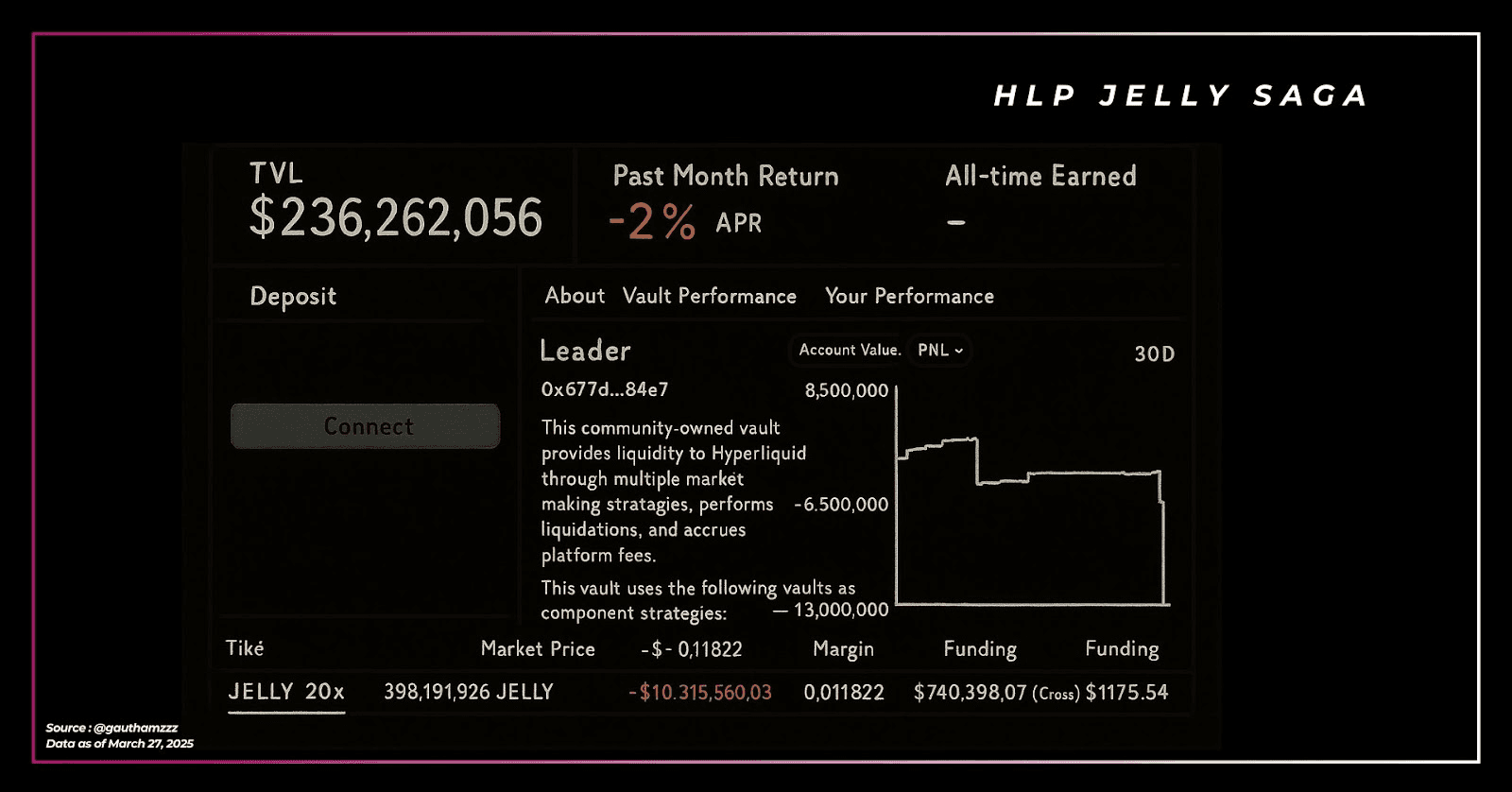

A coordinated exploit attempt using the $JELLY perp market on Hyperliquid exposed key vulnerabilities in the protocol’s liquidation design.

Binance and OKX listed $JELLY perps mid-incident, increasing pressure and pushing Hyperliquid toward forced liquidation.

Manual validator intervention ultimately preserved solvency, but highlighted tensions between decentralization and emergency response.

The incident raises urgent questions around risk management, centralization, and protocol-level crisis handling.

Are CEXs starting to see Hyperliquid as a threat ?

Introduction to the JELLY Incident

Hyperliquid ($HYPE) just faced its biggest stress test yet — and came dangerously close to disaster.

A single, well-timed trade on an illiquid perp ($JELLY) was enough to expose serious vulnerabilities in the protocol’s risk architecture. No automated security mechanism triggered. The protocol’s solvency was on the line. In the end, it took a manual validator intervention to prevent a full-scale meltdown.

This wasn’t just a technical failure. It was a moment that laid bare the risks of Hyperliquid’s current design and revealed how willing CEXs are to go after a rising threat.

In this article, we’ll break down:

What actually happened during the JELLY attack

Why Binance and OKX got involved

How Hyperliquid responded

What this means for Hyperliquid and CEXs

Quick Incident Overview

Trader goes max short $JELLY perps (low. liquidity)

Trader buys spot, pumps $JELLY & self-liquidates

HLP inherits the toxic short position

Trader keeps buying spot & $JELLY pumps 400%

HLP eventually faces liquidation if $JELLY keeps pumping

Let the War Begin

Binance and OKX saw an opening — and they went for it. The $JELLY perp listings went live almost immediately after the exploit attempt began, creating the perfect conditions to push Hyperliquid toward forced liquidation.

Let’s be clear: without this coordinated CEX pressure, the situation wouldn’t have escalated the way it did. That said, the real issue isn’t just external — Hyperliquid’s own risk controls left the door wide open (more on that below).

For Hyperliquid:

Vulnerable to liquidation

Centralization exposed under pressure

Gaps in risk management now undeniable

For the CEXs:

They scared of Hyperliquid ?

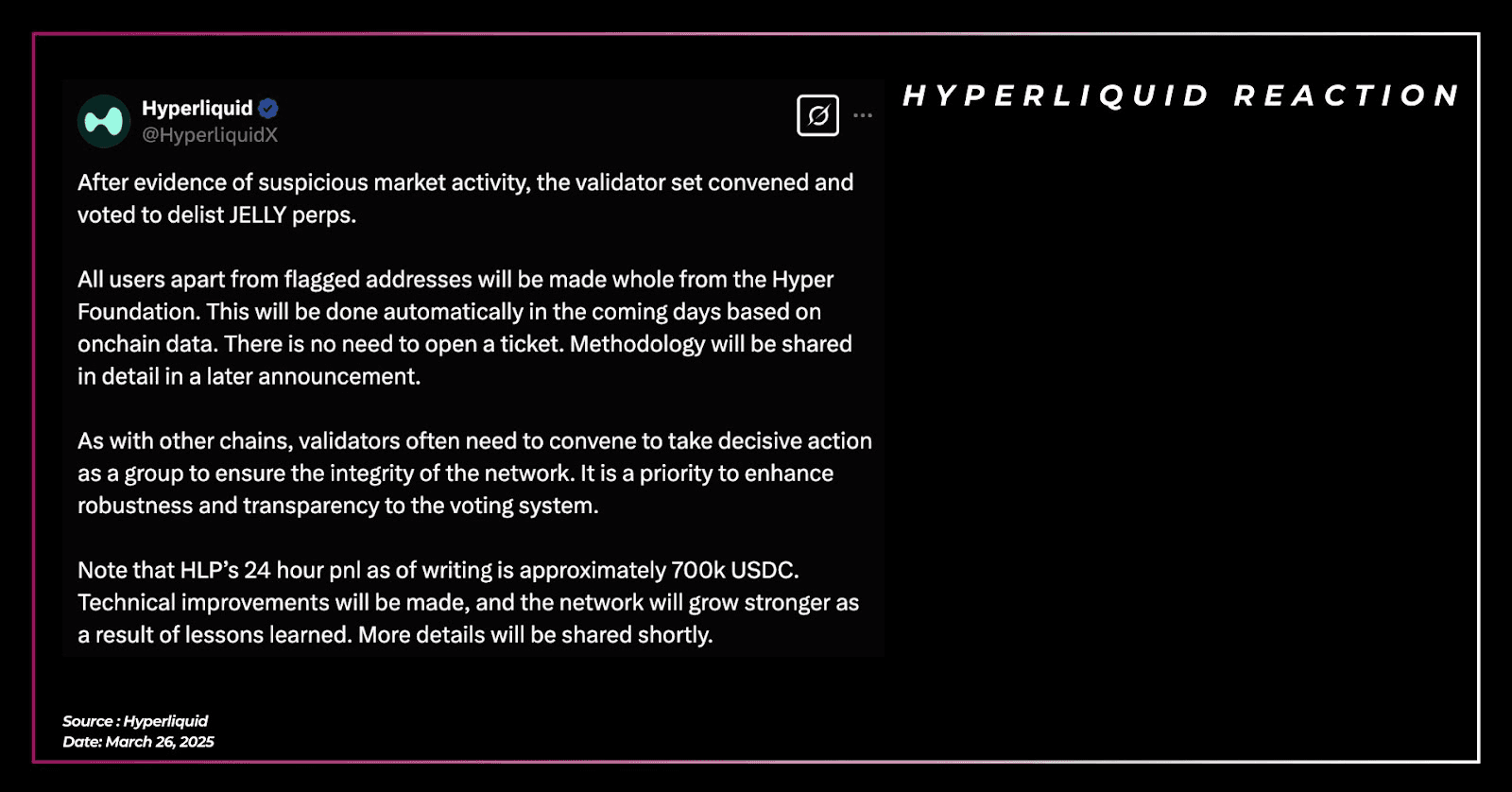

Hyperliquid Reaction

Once the $JELLY listings went live on CEXs, Hyperliquid had a decision to make — and inaction wasn’t an option. Allowing the protocol to collapse in the name of “decentralization” was never on the table.

At the end of the day, a protocol must prioritize the stability of its ecosystem and the interests of its users. And the reality is, most participants in crypto — including those on Hyperliquid — are not ideologically committed to decentralization. They value performance, reliability, and capital preservation. That’s why CEXs still dominate trading volume.

In response to the escalating risk:

Hyperliquid validators voted to close the JELLY position at the price level where the attack began.

A validator’s perspective on the vote can be found here.

As a result, HLP ultimately ended up in profit, and long $JELLY traders will be compensated.

The intent behind the CEX listings was clear: to provoke a panic response and force Hyperliquid into making a rushed decision — one that could frame it as nothing more than an unregulated on-chain CEX.

Instead, Hyperliquid’s measured approach sent a different message.

The fact that no major CEX has listed $HYPE is already telling. They recognize Hyperliquid as a direct competitor — and they don’t want to accelerate its growth. That’s fair play.

But a coordinated effort to destabilize it ? That sets a bad precedent for the broader industry.

Implications for Hyperliquid

There are several lessons to draw from the JELLY incident, but the most urgent is this: risk management must improve.

Hyperliquid is in a strong position — it’s profitable, well-capitalized, and now has definitive proof that centralized exchanges view it as a legitimate threat. That also means it no longer has the luxury of overlooking operational vulnerabilities.

This marks the second time HLP has faced bad debt. For a protocol operating at this scale, that’s a red flag. Trust — from users, holders, and institutional observers — is now on the line.

Hyperliquid has the resources and the talent to ensure this doesn’t happen again. But action is needed.

It’s time to double down on risk management, even if that means dialing back on initiatives like buybacks in the short term.

The protocol’s intervention in this case was justified, but repeated reliance on manual or “centralized” decisions could eventually invite regulatory scrutiny — and erode community trust.

Hyperliquid’s future is still in its own hands. If it can tighten its risk controls and maintain its pace of innovation, it won’t just survive — it will lead.

But that starts with ensuring this kind of event doesn’t happen a third time.

Final Thoughts

Overall, this is a lose-lose situation for both sides.

That said, Hyperliquid now holds all the cards to make things right by tightening up its risk management. It also raises valid questions about how they plan to handle HLP moving forward but we remain confident in the team.

As for CEXs… It was a weak move.

Regarding $HYPE nothing changes for now. Still undervalued based on sum-of-the-parts, with key growth catalysts ahead. We’ll reassess the model once there’s more clarity on the path forward for $HYPE, but we trust the team to navigate it well.

DYOR