HyperUnit Overview:“Bridging CEX Experience Onchain”

Discover how Hyperliquid and Unit merge CEX performance with DEX composability. Metrics, fees, liquidity, and adoption analysis inside.

Key Takeaways

Hyperliquid accounts for 68% of decentralized perps volume and now captures 10% of Binance’s perps activity.

Unit enables native BTC and ETH deposits, powering Hyperliquid’s growing spot market.

Since launch, spot trading has reached $2.6B in volume with over 1,100 BTC deposited.

Hyperliquid is the most liquid venue for onchain BTC spot trading, with low fees (0.07%) and competitive slippage (~0.05%).

Composability, transparency, and permissionless access differentiate it from traditional CEXs.

Growth potential remains significant, with catalysts including fiat ramps, asset expansion, and HyperEVM adoption.

Introduction

Hyperliquid has established itself as the undisputed leader in decentralized perpetuals, capturing 68% of the market share. For the first time in history, a DEX has disrupted the dominance of CEXs, with Hyperliquid now having 10% of Binance’s perps volume.

But, Hyperliquid’s ambition goes beyond perps. To become the “House of Finance”, Spot must also stand out, not only in terms of trading volume, but also by offering a wide range of assets that can be traded and used within dApps built on HyperEVM.

This is where Unit plays a critical role. As the infrastructure layer enabling native deposits and withdrawals, Unit is powering the early growth of HL’s spot market, already supporting BTC and ETH, with SOL on the way.

HL spot market has already seen significant growth thanks to Unit, now ranking as the third-largest DEX for Bitcoin volume. But the opportunity remains massive. Compared to total Bitcoin trading activity, it’s still just a drop in the ocean.

Yet HL holds some competitive advantages over both CEXs and DEXs without the usual trade-offs.

Let’s get into it.

Note: For this analysis, we used BTC as the basis for comparison.

Hyperliquid VS CEXs

Hyperliquid’s vision has always been to build a DEX that replicates the trading experience of a CEX. To achieve this, they have brought the most valued features onto their platform, while also developing competitive advantages that are currently unmatched by any CEX.

What do traders value most on CEXs ?

Seamless user experience

Deep liquidity with price discovery

Cheap fees

Wide selection of assets with native deposit

How does Hyperliquid measure up against these criteria?

Trading Experience on Hyperliquid: UX, Speed & Integration

To replicate a trading experience comparable to that of a CEX, Hyperliquid has developed its own purpose-built Layer 1 blockchain, specifically optimized for trading. The chain delivers ultra-low latency, congestion-free performance, and supports a unified orderbook across both spot and perpetual markets. This shared liquidity model allows for more efficient pricing and tighter spreads, offering a significantly more seamless experience compared to the AMM models typically used by DEXs.

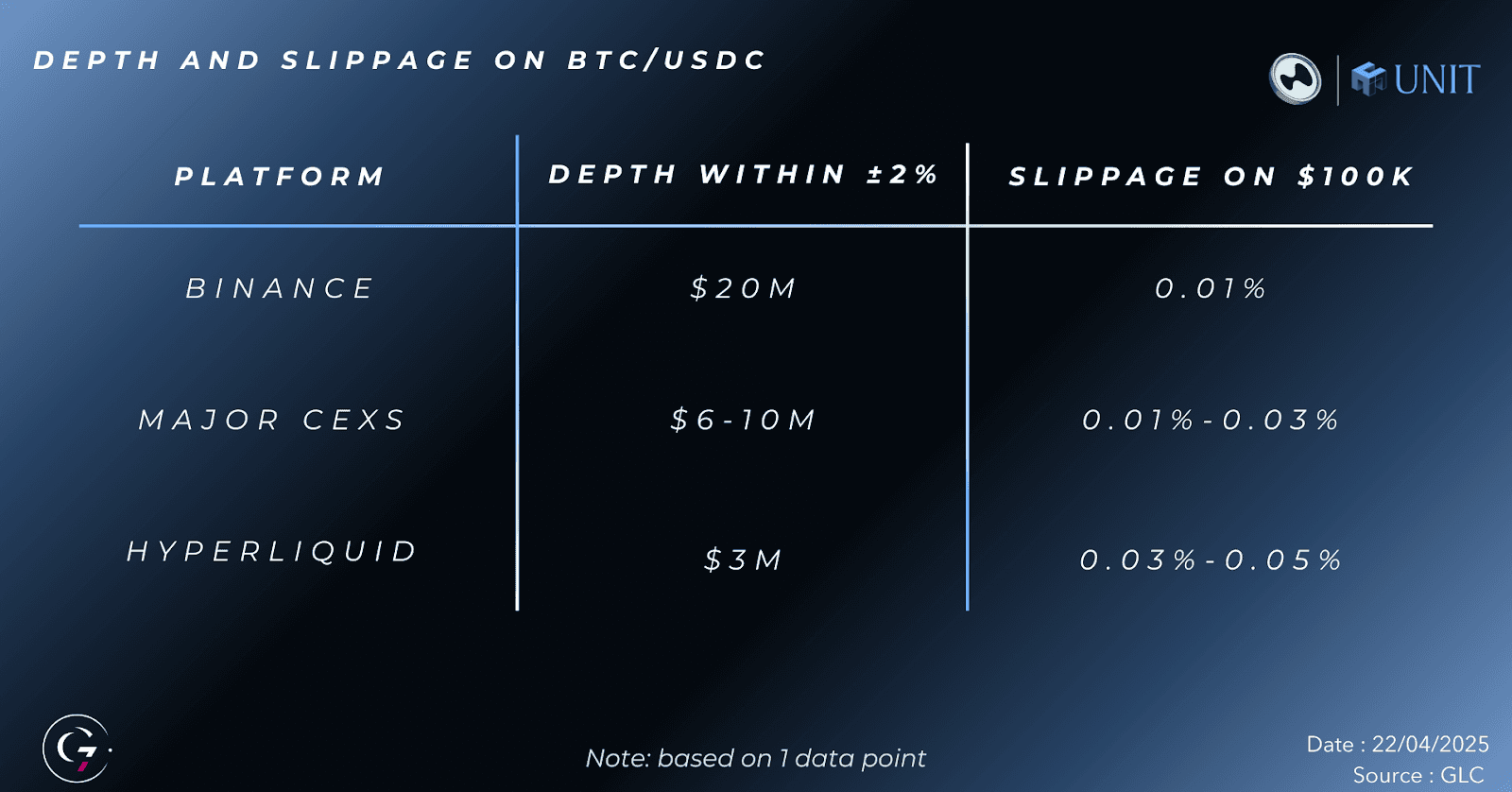

Liquidity: Hyperliquid vs Binance & Other CEXs

One of the common claims about HL is that it offers CEX-level liquidity. Let’s look at key liquidity indicators for the BTC/USDC pair and benchmark them against major CEXs.

We started by analyzing order book depth, which measures the amount of liquidity available within a given price range. Within ±2% of the mid-price, Hyperliquid shows robust depth for a DEX, with approximately $3 million in liquidity. This remains below the average depth observed on average CEXs ($6–10M) and Binance ($20M).

This difference in depth has a direct impact on large orders. To further investigate, we compared slippage caused by executing a $100k market order, across platforms. On Binance, slippage is just 0.01%, increases to about 0.03% on other average CEXs, and reaches up to 0.05% on Hyperliquid.

While Hyperliquid shows impressive depth for a DEX, the relatively lower level of user deposits compared to CEXs likely contributes to the gap in order book depth and slippage at larger order sizes. As Bitcoin deposits continue to grow, so will liquidity.

It’s worth noting that this analysis is based on a single data point, and these metrics fluctuate daily. While competing with CEXs on large-size execution remains challenging due to the sheer volume of user balances held in custody, Hyperliquid’s liquidity is highly competitive and it has several additional advantages we’ll explore below.

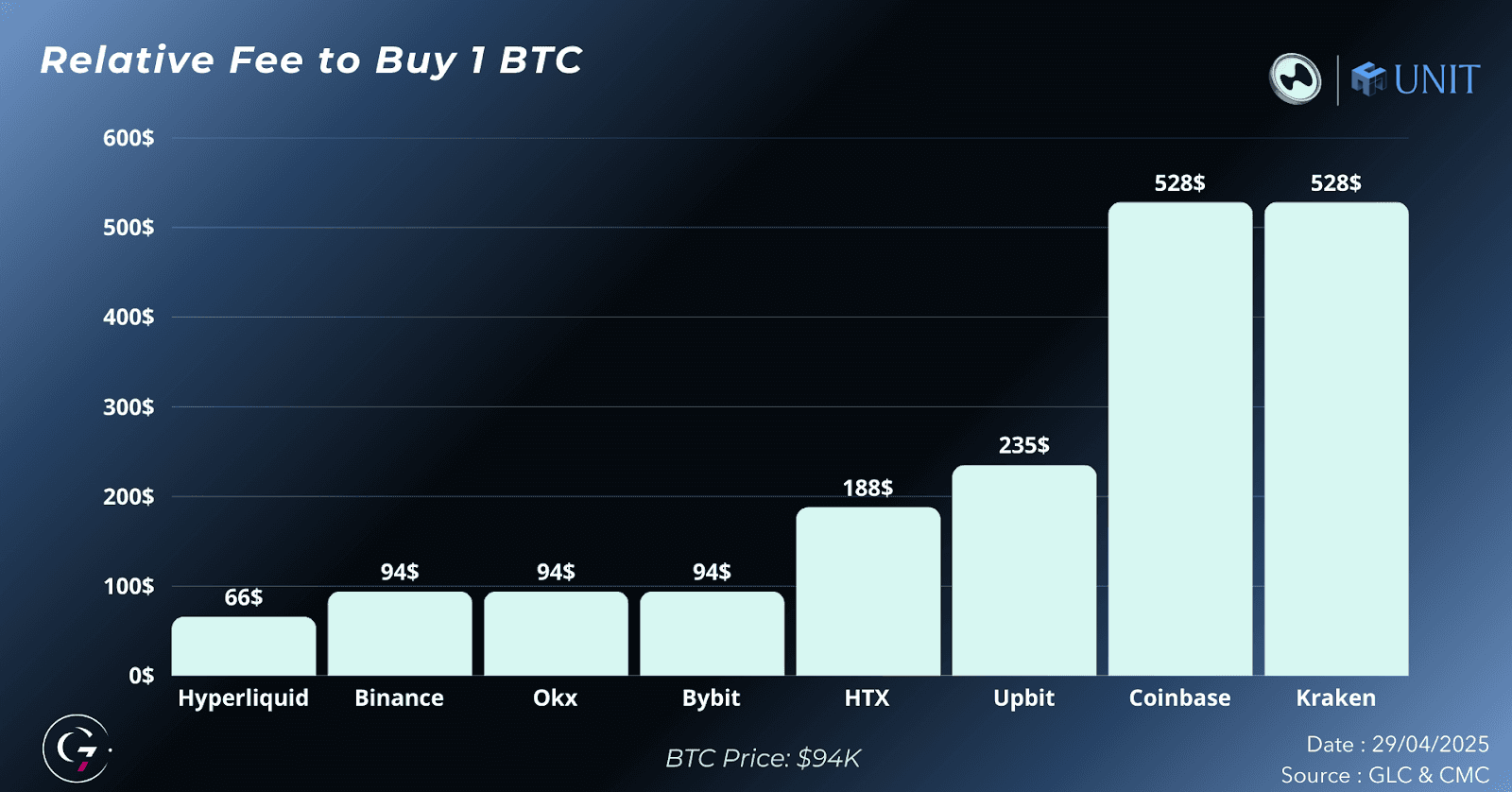

Bitcoin Spot Trading Fee: Cheapest Place to Trade Bitcoin

Cost efficiency remains one of the most important factors when evaluating trading venues.

Since April 30, following the introduction of staking tiers, the base fee for spot trading on Hyperliquid has increased from 0.03% to 0.07%. However, this fee can be reduced based on the amount of HYPE staked and the user’s trading volume.

Despite this adjustment, Hyperliquid remains the most cost-effective platform for spot trading compared to major CEXs. The base fee at the nearest competitor starts at 0.1% and can rise to as much as 0.6% on platforms like Coinbase or Kraken.

This fee increase makes sense — and we had already highlighted it in our Hyperliquid valuation before it was announced. You can double the fee, strengthen alignment with the token, improve network security through staking, and still remain the cheapest venue for trading.

In our view, this is a positive development: it should significantly boost spot market revenues, which will support HYPE buybacks and reinforce long-term value creation.

Why Hyperliquid Has a Structural Edge

Hyperliquid has successfully matched the trading experience offered by centralized exchanges while maintaining its decentralized nature, which brings several key advantages:

Permissionless

Ownership of assets (“your keys, your coins”)

Transparency

Composability

Beating the CLOB performance of centralized exchanges is extremely difficult — and arguably not the ultimate goal. But Hyperliquid is pushing the boundaries of what’s possible onchain, positioning itself as the premier venue for onchain spot trading.

More importantly, permissionless access, full transparency, and composability are powerful competitive advantages that many users prioritize. The tradeoff between choosing a CEX over Hyperliquid is narrowing every day.

Hyperliquid enables native onchain composability. Any asset, position, or trade can be integrated directly into other smart contracts, dApps, or protocols. Hyperliquid’s vision has always been to build the highest-performance infrastructure possible, creating a strong foundation that enables builders to develop innovative applications on top of it.

As the saying goes, “Alone you go faster, but together you go further”.

From this vision, it is now up to builders to step in and create new applications that can redefine the trading experience, as Unit is already demonstrating.

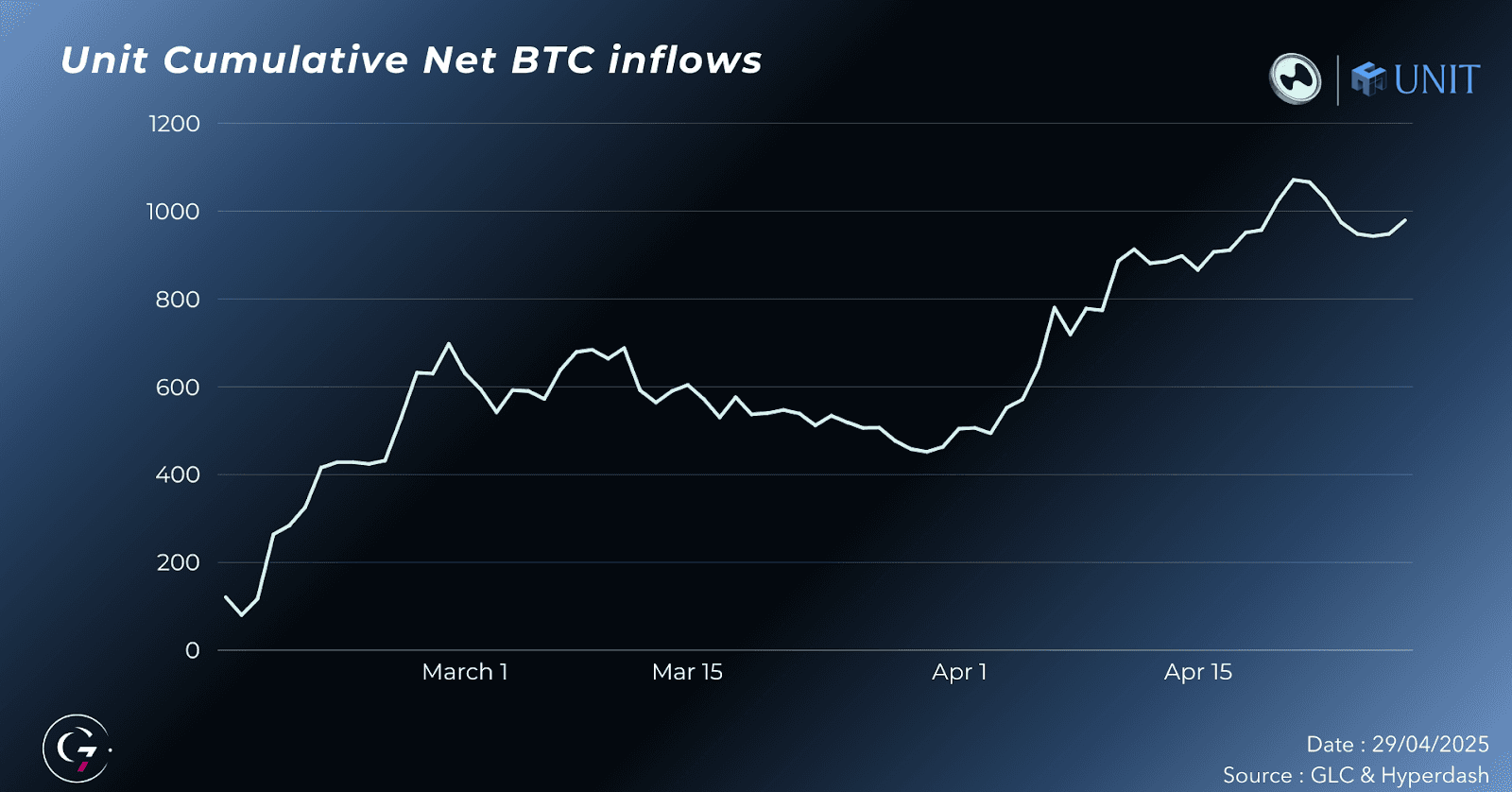

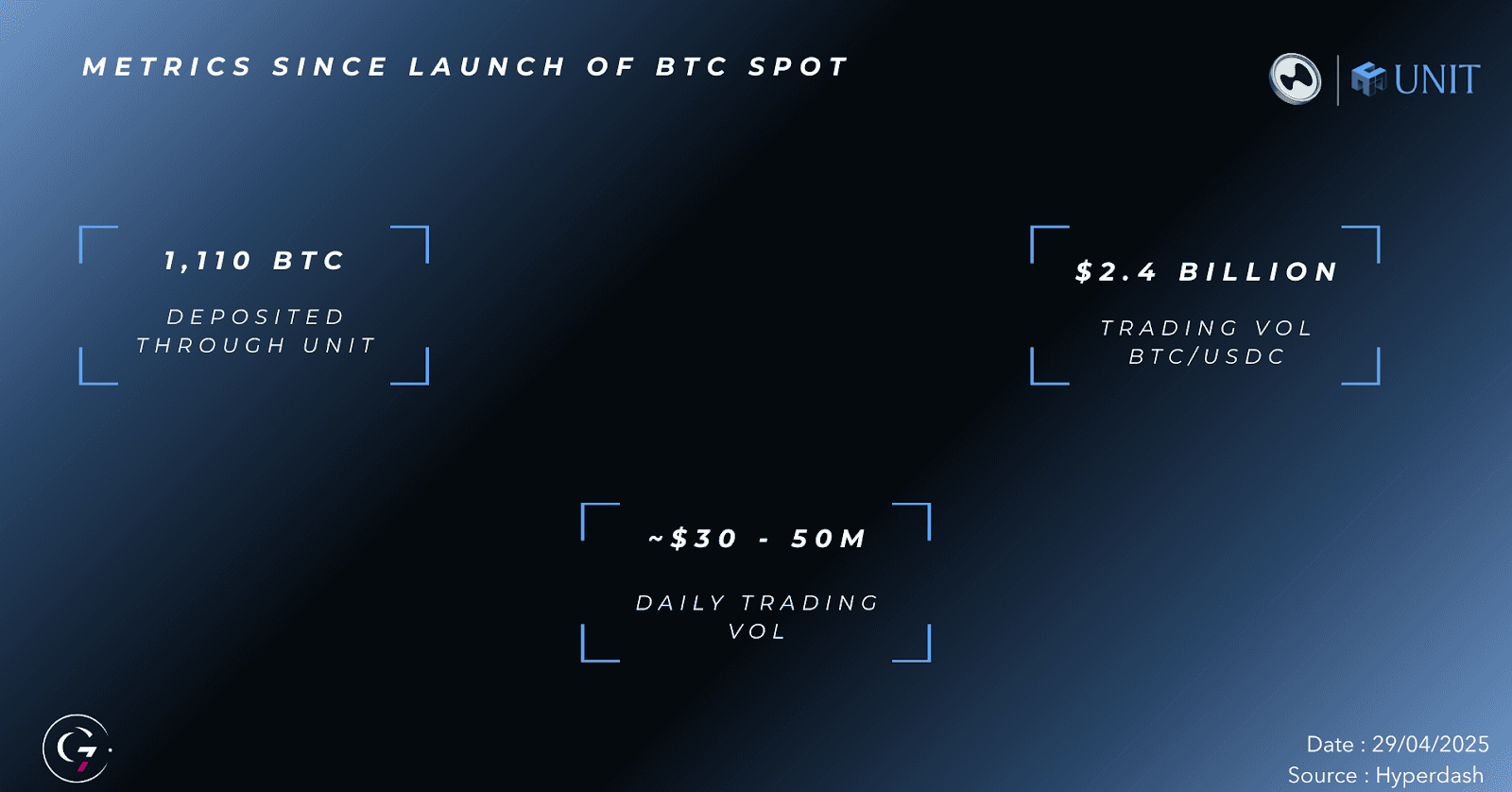

Composability turns Hyperliquid from a trading venue into a base layer for financial infrastructure — something no CEX can replicate which should help HL further capture market share. This approach appears to resonate with users, as since the launch of BTC deposits on February 14, Unit has facilitated the deposit of 1,110 BTC but only a drop in the ocean at the moment.

Hyperliquid vs DEXs

There’s always a tradeoff when choosing a DEX over a CEX — but there are several core benefits that continue to attract users to DEX:

Permissionless

Ownership of assets (“your keys, your coins”)

Transparency

Composability

Hyperliquid preserves the core attributes that traders value in a DEX but holds several key competitive advantages as detailed below.

Better UX, Liquidity & Cost efficiency

Let’s be honest, the trading experience on most DEXs is far from ideal. It is often slow, complex, and not cost-efficient. Simply offering a CEX-like trading experience on a decentralized platform is already a strong differentiator that sets Hyperliquid apart from other DEXs.

However, Hyperliquid is far more than a typical DEX. Its high-performance, highly liquid infrastructure is also by far the cheapest venue for trading Bitcoin or other assets.

HyperUnit Enabling Native Deposits and Withdrawals

As a reminder, Unit is a decentralized asset tokenization layer, Unit’s mission is to tokenize all assets on-chain and enable native deposits/withdrawals, and spot trading directly on Hyperliquid. They started with BTC, followed by ETH, and SOL is now set to launch soon.

Through Unit, Hyperliquid becomes the first DEX to offer native Bitcoin deposits and withdrawals — feature historically reserved for CEXs.

In our view, this represents a major advancement. Users no longer need to manually wrap or bridge their assets in order to trade on a DEX. Instead, they can deposit natively into Unit, and the protocol takes care of the rest.

Of course, just like with CEXs, you need to trust Unit’s security infrastructure.

Growth Metrics

As you can see, Hyperliquid has successfully brought together the best of both worlds. This hybrid approach is already delivering strong results.

The BTC/USDC spot market on Hyperliquid has shown significant early adoption. Key metrics since its launch on February 14, 2025, include:

Total BTC Deposited via Unit: 1,110 BTC

Total Trading Volume: $2.6 billion

Average Daily Volume: $30 – 50M Volume/Day

A drop in the ocean

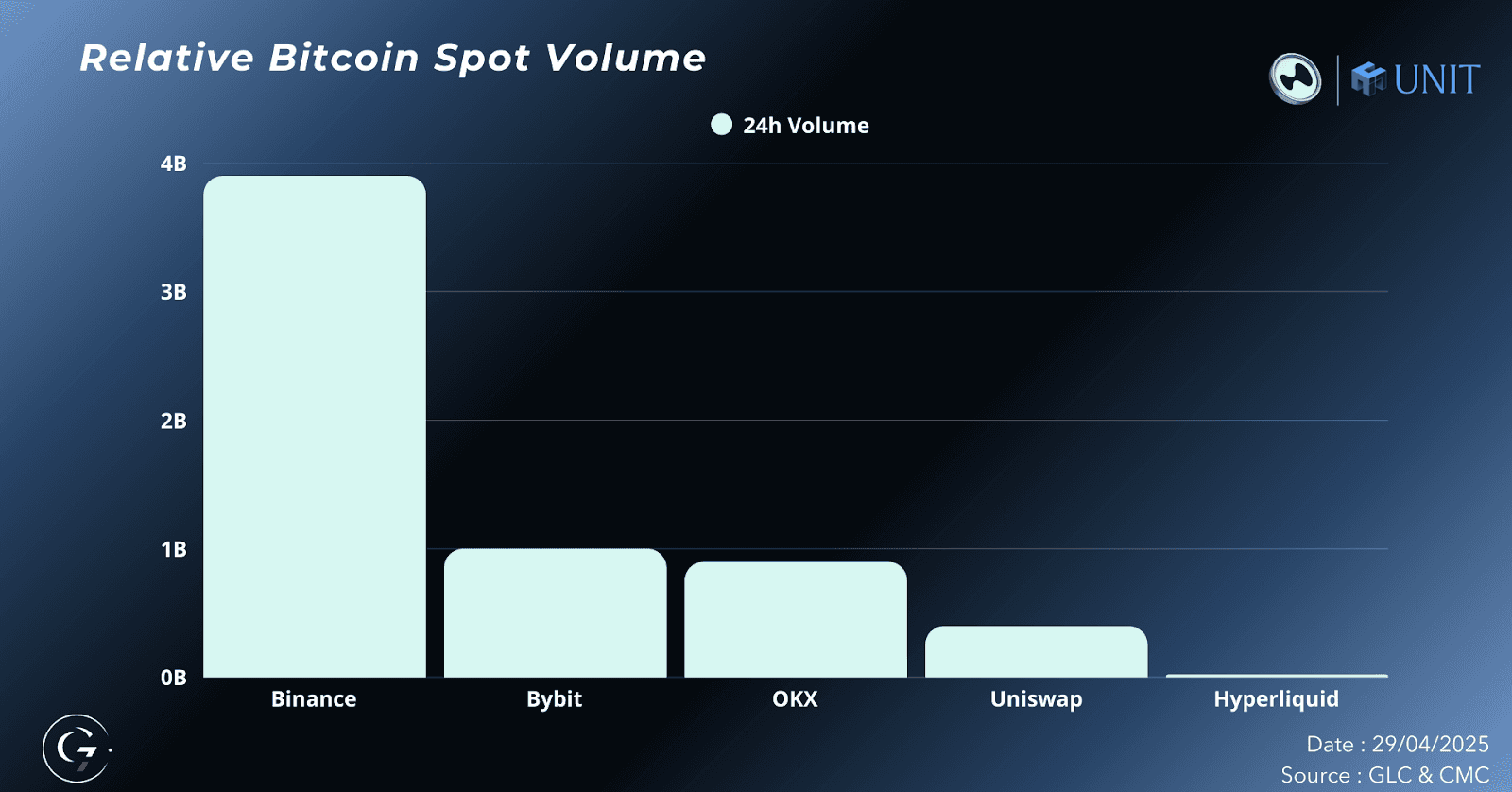

On April 29th, Hyperliquid recorded approximately $25M in Bitcoin spot volume — a strong figure for a protocol barely three months old. However, when placed in context with leading CEXs and DEXs, it remains relatively small. That same day, Binance processed nearly $4B in BTC spot volume, Uniswap & Aerodrome saw around $400M combined.

In our view, this gap reflects significant room for growth for both Unit and Hyperliquid. Today, spot volume on HL represents just 1% of its perpetual volume, compared to a typical 15–30% spot-to-perps ratio on major CEXs.

If current dynamics hold, Hyperliquid is well-positioned to naturally capture market share thanks to its competitive advantages — narrowing the gap between CEXs and DEXs. But to accelerate this trajectory, there are still key catalysts that will drive further adoption and growth.

Growth Catalysts: Fiat, HyperEVM, Asset Listings

In just a few months, Unit has turned Hyperliquid into one of the most compelling venues for Bitcoin spot trading. But several upcoming catalysts could significantly accelerate its growth and cement its position in the market:

1. Fiat on/off-ramps

A native fiat gateway is on the way, allowing users to deposit and withdraw directly from the platform. Today, users need to onboard elsewhere and transfer funds to HL, a process that adds friction. Removing this barrier will make it far easier to onboard new users.

2. Asset listings

Currently, Unit supports uBTC, uETH, and soon uSOL. While starting with high-volume assets makes sense, the broader opportunity lies in expanding listings. The more assets accessible on HL, the more users will be willing to move capital on-chain. Without enough depth in asset coverage, transfer costs and friction may still be a deterrent.

3. Growth of HyperEVM

As more dApps launch and grow on HyperEVM, composability becomes a stronger pull factor. If assets can be traded, staked, or used as collateral within the same ecosystem, users have more reasons to bring capital on-chain and trade directly on HL.

4. New asset classes

If Unit eventually brings commodities, securities, or other real-world assets on-chain, it opens the door for entirely new capital flows. Broader asset diversity will make HL a more complete trading venue — not just for crypto-native users, but for a wider financial audience.

These are just a few of the catalysts that could drive further adoption and make Hyperliquid, powered by Unit, a dominant force in onchain spot trading.

Closing thoughts

Hyperliquid’s spot market is still early, but it already stands out as one of the most compelling venues for onchain Bitcoin trading. With high performance, low fees, and strong composability, HL bridges many of the gaps between CEXs and DEXs.

A key enabler of this progress has been Unit which makes native asset onboarding possible and eliminates the friction that has historically limited DEX adoption for spot markets.

While spot volume remains just a drop in the ocean relative to the broader market, the fundamentals are strong. As adoption builds and the ecosystem matures, the combination of HL’s infrastructure and Unit’s tokenization layer could significantly expand market share and help redefine what onchain spot trading can be.

Looking ahead, a number of upcoming catalysts, including fiat on/off-ramps, broader asset listings, and HyperEVM growth, are likely to accelerate this trend. Together, these elements position HL and Unit as critical infrastructure in the future of onchain spot trading.