Introducing Pendle Citadel:“HyperEVM integration”

Introduction

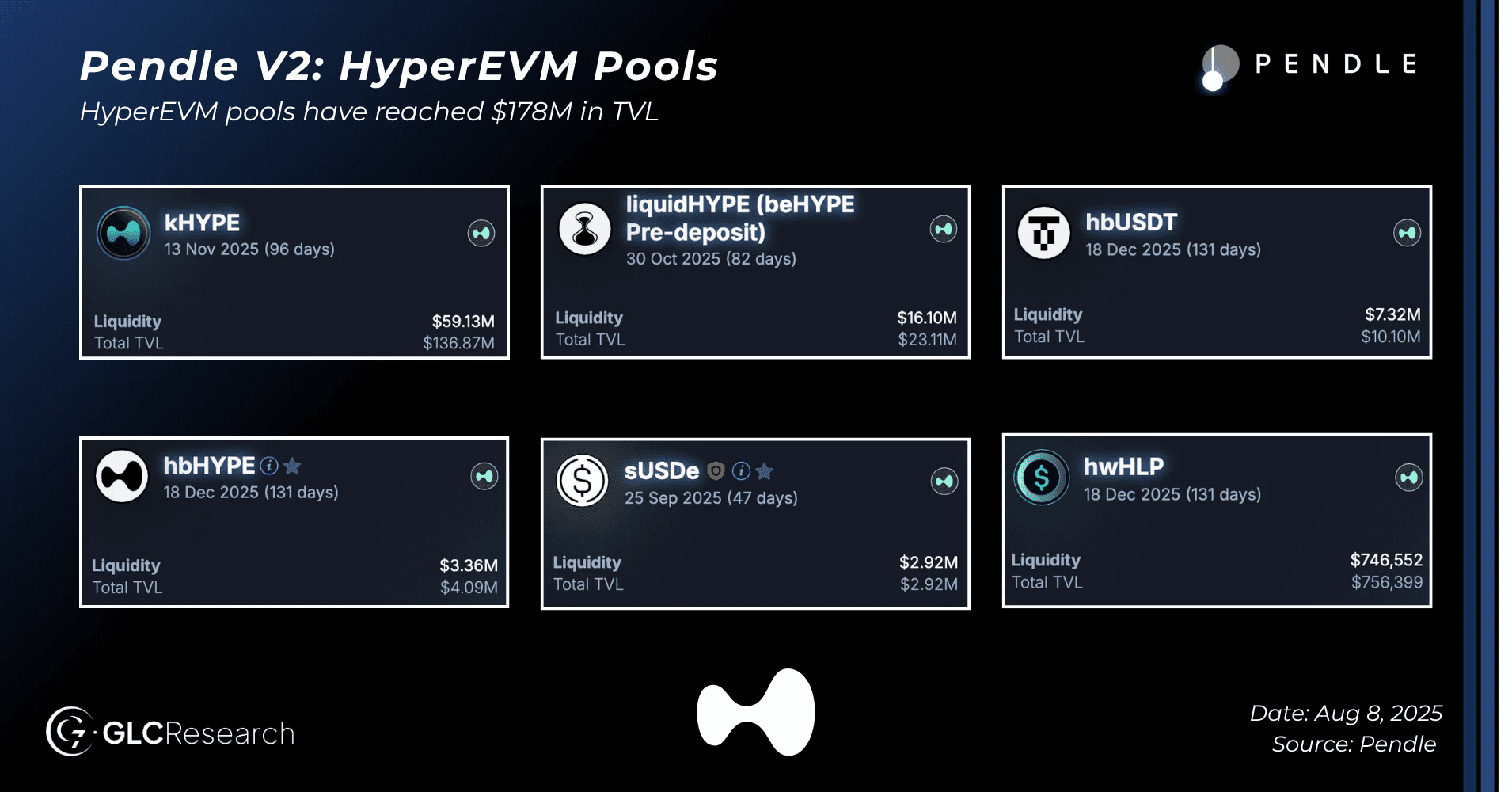

Last week, the first phase of Pendle Citadel officially kicked off with Pendle’s launch on HyperEVM.

This is a major milestone: one of the most innovative DeFi protocols has just expanded to one of the most active chains of the year. HyperEVM recently entered the top 10 chains by TVL, marking its growing relevance in the ecosystem.

For those unfamiliar with Pendle, it’s a protocol that enables users to separate yield (YT) from principal (PT) on yield-bearing assets, unlocking a new class of advanced yield trading strategies.

As more yield-bearing assets emerge on HyperEVM, this integration gives users powerful tools to speculate on, hedge, or enhance their yield, a major step toward a more composable and sophisticated DeFi landscape on Hyperliquid.

This is also a strong win for Pendle, which is now deploying on the chain with the deepest on-chain liquidity. It’s one of the partnerships we were most looking forward to at GLC, as both HYPE and Pendle are high-conviction assets we’ve been tracking closely for months.

Key Takeways

Pendle TVL Growth: Now nearing $8B total value locked.

Revenue Impact: Pendle revenue approaching $40M annualized.

Kinetiq Milestone: First protocol to hit $1B TVL on HyperEVM.

kHYPE Pool Opportunity: ~12% APY on PT side for long-term HYPE holders.

Airdrop Potential: YT side offers boosted points for those speculating on Kinetiq airdrop

Next Expansion: Solana (2nd largest chain by TVL) and TON (Telegram-native retail entry).

Impressive Launch

This integration contributed to Pendle’s growing TVL, which is now approaching $8B, and boosted its revenue, currently nearing $40M annualized.

A large portion of the TVL in HyperEVM pools comes from the kHYPE pool, the LST of @kinetiq_xyz, a protocol that allows users to natively stake their HYPE with Hyperliquid’s top validators while retaining the flexibility to use kHYPE across DeFi.

Kinetiq has officially become the first protocol to reach $1B in TVL on HyperEVM.

From our perspective, the kHYPE Pendle pool is particularly compelling. You can currently lock in around 12% APY via the PT side, a strong opportunity for those planning to hold HYPE long term.

For users looking to gain exposure to a potential Kinetiq airdrop, the YT offers a great way to boost your points and speculate on rewards.

We’ll be publishing a full breakdown of our kHYPE strategy in the coming weeks, stay tuned!

What’s next ?

Following its successful launch on HyperEVM, the next phase of Pendle Citadel is the deployment on Solana and TON.

This expansion is not just technical or geographic, it’s a strategic replication of Pendle’s model across ecosystems with massive growth potential.

Solana: The second-largest chain by TVL, with minimal competition for Pendle’s product.

TON: A gateway to global retail adoption through direct integration with Telegram.

With Citadel and @boros_fi, Pendle is targeting a total addressable market (TAM) worth trillions of dollars, positioning itself as the go-to infrastructure for fixed yield in on-chain finance.

We’ve been tracking Pendle closely for quite some time, and it’s incredibly rewarding to see our thesis playing out in real time.

If you haven’t read the thesis we co-authored with @0xCheeezzyyyy and @kenodnb yet, now’s the time:

Investment Thesis:“The Best Stablecoin Beta?”