Hyperliquid Valuation Thesis: “The House of Finance”

Hyperliquid leads DEX perps with $600M+ in revenue, 97% buybacks, and a custom Layer 1. Explore $HYPE token valuation and risk/reward scenarios.

Key Takeaways

Hyperliquid captures over 70% of the DEX perps market, delivering a fully on-chain alternative to CEXs with unmatched execution speed and liquidity.

Built on a custom Layer 1 and integrated HyperEVM, it supports native perps, spot trading, and DeFi apps.

The protocol generates $600M+ in annualized revenue, with 97% funneled into $HYPE token buybacks via the Assistant Fund.

Valuation model estimates a $32–$49 price range per $HYPE, with downside risk capped around 55% at current price levels.

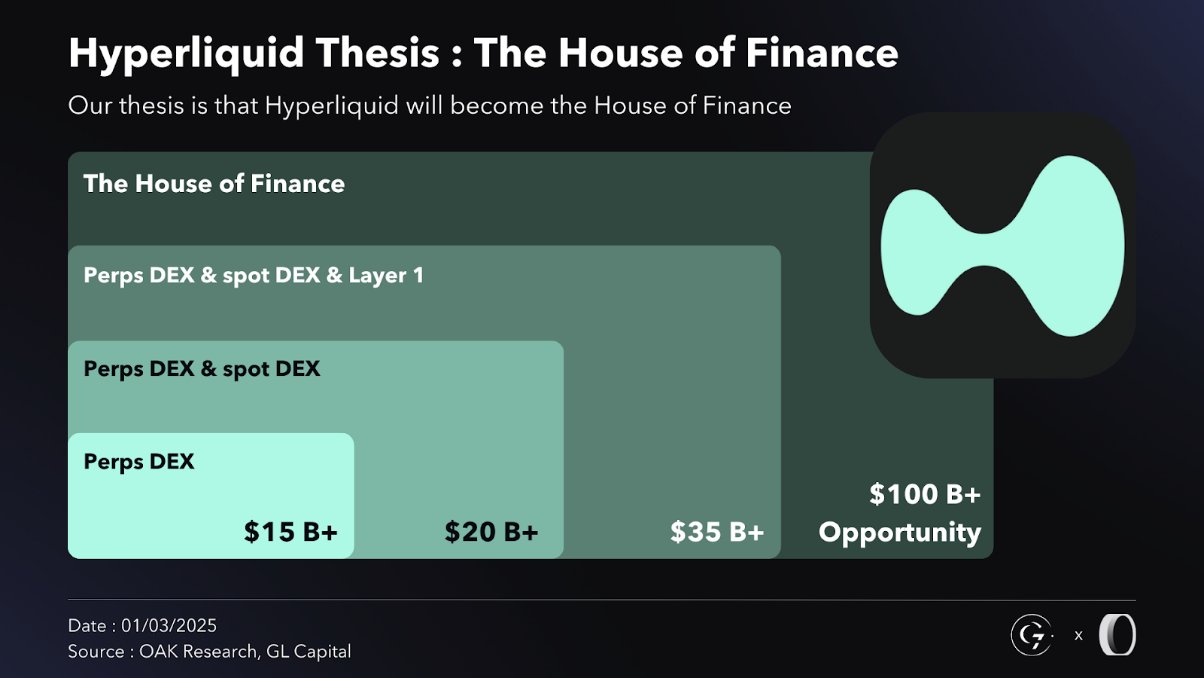

Sum-of-the-parts valuation includes perps, spot, and L1 components, with the Perps segment alone justifying a price between $11–$16.

Hyperliquid has no VC funding, and its growth is entirely bootstrapped.

Execution, continued adoption, and trading volume growth remain key to realizing its potential as the “House of Finance”.

Introduction

The previous bull cycle marked a major milestone in the evolution of cryptocurrencies. In 2020-2021, millions of new investors entered the market, and their first experience was through centralized platforms. Binance, FTX, and Coinbase became the go-to exchanges for crypto trading, thanks to their ease of use.

Then, in November 2022, everything changed. The collapse of FTX shattered an illusion—the belief that centralized actors could serve as trusted intermediaries in the crypto ecosystem. The scandal left a lasting impact on investors, pushing them to seek refuge in decentralized finance.

But a harsh reality quickly emerged. While the promise of DEXs was appealing, none had the infrastructure necessary for high-frequency trading. Insufficient liquidity, high latency, and expensive fees, there were simply too many limitations for them to compete with the seamless experience offered by CEXs.

Hyperliquid was born to fill this gap. The idea was simple: build a DEX that combines the power of centralized platforms with the transparency and sovereignty of decentralized finance. But achieving this required breaking free from existing technological constraints. Since no blockchain met the technical demands of a trading application, the Hyperliquid team took a bold bet—to build it themselves.

Two years later, that bet has more than paid off. Hyperliquid now captures over 70% of the trading volume in the perpetual DEX market and is redefining industry standards. The gap between CEXs and DEXs is closing rapidly, and for the first time, a decentralized alternative appears capable of competing with the giants of the market.

In this article, we outline a valuation framework for Hyperliquid. If you’d like to dive deeper into the full analysis, you can read the complete research report — developed in collaboration with OAK Research — via this link.

Hyperliquid description

Hyperliquid has taken a unique approach to the decentralized trading sector. While most perpetual DEXs are built on existing blockchains, inheriting their limitations in scalability and performance, Hyperliquid made the radical choice to develop its own custom-built infrastructure.

More than just a DEX, Hyperliquid is a complete financial ecosystem, designed to become a “fully on-chain version of Binance,” as Messari aptly described it in a July 2024 analysis. Today, Hyperliquid is built on four key technological pillars that support this vision:

A high-performance perpetual DEX, capable of competing with CEXs in terms of execution speed, liquidity depth, and advanced trading tools.

A rapidly growing spot market, offering a transparent on-chain order book and an innovative infrastructure for token issuance and listing.

A dedicated Layer 1 blockchain (Hyperliquid L1), specifically designed to support high-frequency order book trading and near-instant transaction finality.

HyperEVM, an integrated Ethereum Virtual Machine, expanding the ecosystem to native smart contracts and DeFi applications.

Hyperliquid Valuation

Hyperliquid stands in a league of its own, with no true comparables in the crypto space. As the fastest-growing company in the industry, its token, $HYPE, offers a compelling risk/reward given its strong fundamentals and growth potential, unlike most altcoins driven by speculation rather than real value.

What sets Hyperliquid apart is its intrinsic value. It generates substantial fee revenue, reaching $600M annualized, a figure rarely seen in the space. Unlike many projects reliant on VC or insider funding, Hyperliquid has been fully bootstrapped, creating a more organic and sustainable growth trajectory. Additionally, the Assistant Fund (AF) reinvests 97% of revenue into buying back $HYPE, further reinforcing its value.

Let’s break down this compelling risk/reward through a sum-of-the-parts valuation.

Methodology

To accurately assess Hyperliquid’s valuation, it is essential to distinguish between its Perps, Spot, and L1. A sum-of-the-parts valuation will be employed, valuing each component separately before aggregating them to determine Hyperliquid’s overall valuation.

Asset valuation typically relies on cash-flow-based valuation or market multiples. Given crypto’s unpredictable long-term growth, market multiples provide a more objective approach. With the market’s five-year trajectory uncertain, traditional cash-flow projections are less reliable, making market multiples our default framework.

1. Perps Valuation

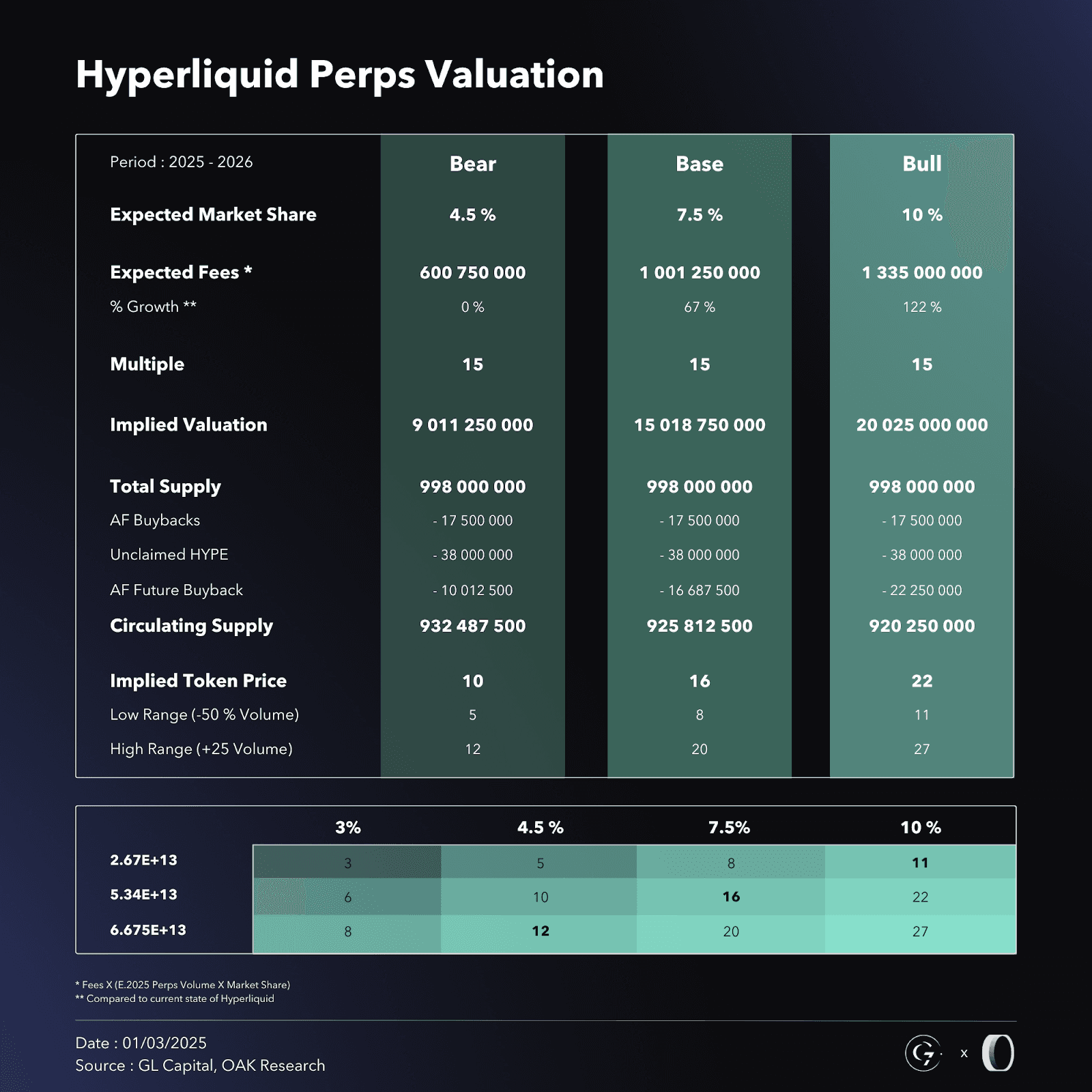

To accurately assess the Perps segment, several key factors must be considered:

LTM Perps trading volume across 4 major CEXs ($53,4T).

Projected Perps trading volume for 2025-2026.

Hyperliquid’s current market share (4.5%) and its projected market share.

Trading fees charged by Hyperliquid (0.025%).

To conduct a proper valuation, we must consider multiple factors. However, given the high level of uncertainty in the market, accurately predicting its trajectory remains a challenge. As a result, we will fix certain variables in the model and apply a sensitivity analysis to account for potential fluctuations.

Ultimately, market direction remains uncertain, and these projections serve as a range of possibilities rather than definitive outcomes.

One of the key variables is the expected Perps trading volume for the next 12 months, which is inherently unpredictable. To address this, we will use the past 12 months of data as a baseline projection for 2025 and adjust the model through sensitivity analysis:

The low-range scenario assumes a 50% decrease in Perps volume, reflecting the potential impact of a bear market with significantly reduced trading activity.

Conversely, the high-range scenario accounts for a 25% increase in overall Perps volume by 2025, factoring in potential market expansion.

Another critical factor is Hyperliquid’s market share, currently at 4.5% (relative to the top 4 CEXs). Given its competitive advantages—notably superior user experience, lower fees and incentives (see full analysis)—we assume Hyperliquid will at least maintain its market share. In fact, based on the base and bull case scenarios, we anticipate further market share growth, which aligns with the current market consensus.

To estimate fee revenue, I will use the 0.025% fee on Perps, which is expected to remain stable, making it a fixed variable in the model (based on last 30d). However, a key consideration is the valuation multiple. Under normal market conditions, DEXs typically trade at a median 10x price-to-sales multiple.

For Hyperliquid, the case for a higher multiple is strong due to the buyback mechanism, which effectively translates revenue into “earnings” for token holders by inducing continuous buying pressure. Given Hyperliquid’s immense growth potential and the fact that it has already reached $600M in annualized revenue in such a short time without external funding, a 15x multiple appears not only reasonable but actually quite conservative. It’s rare—if not unprecedented—to see a company achieve this level of success while bootstrapping the entire process.

The final key variable is the expected circulating supply at least one year from now. To determine this, we start with the total supply and subtract:

$HYPE already bought back by the AF

Unclaimed $HYPE from the airdrop

Future buybacks

For the buyback estimate, we assume 50% of revenue (reflecting the low-range scenario) will be allocated to buybacks, using an average $HYPE price of $30—a conservative projection overall.

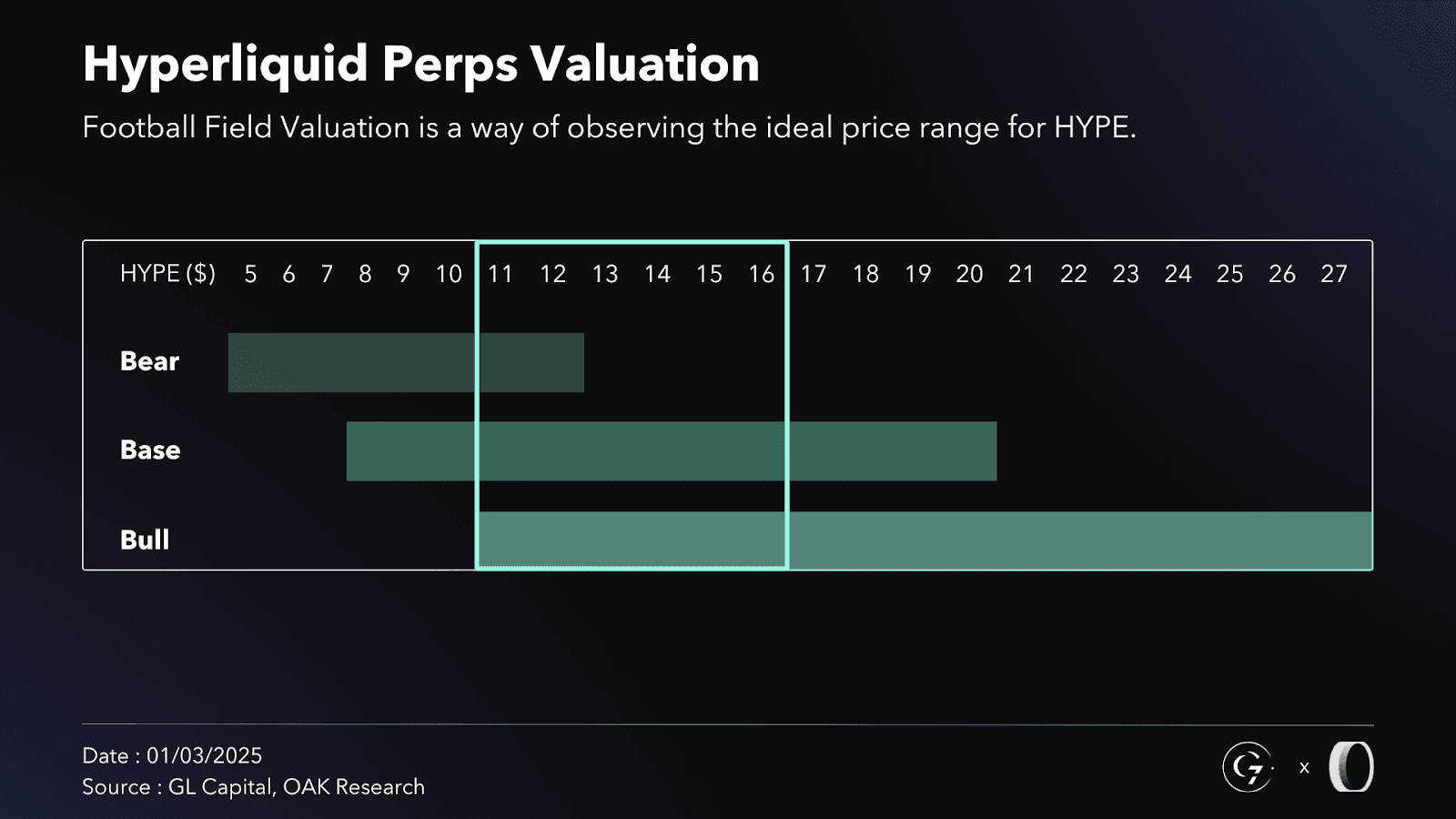

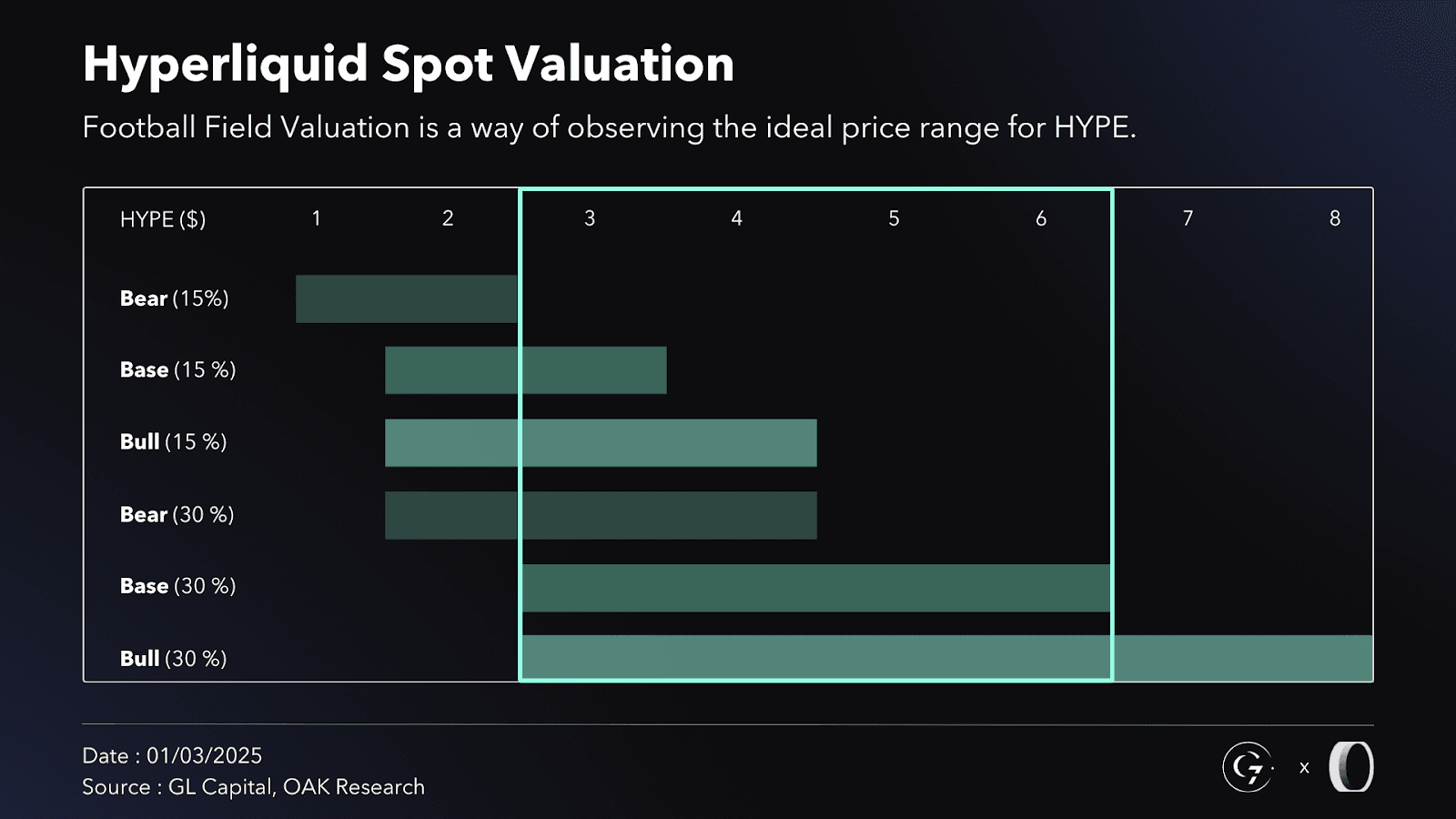

Football Field Valuation

Given the uncertainty surrounding the volume going forward, using a football field valuation allows us to identify the most likely valuation range for the Perps segment. As illustrated, only two price points—$11 and $12 per $HYPE—appear consistently across the three scenarios, making this range the most statistically probable outcome.

To refine this estimate, we extend the range to $16, aligning with our base case valuation. As a result, I consider $11 to $16 a realistic estimate of the current intrinsic value of the Perps DEX.

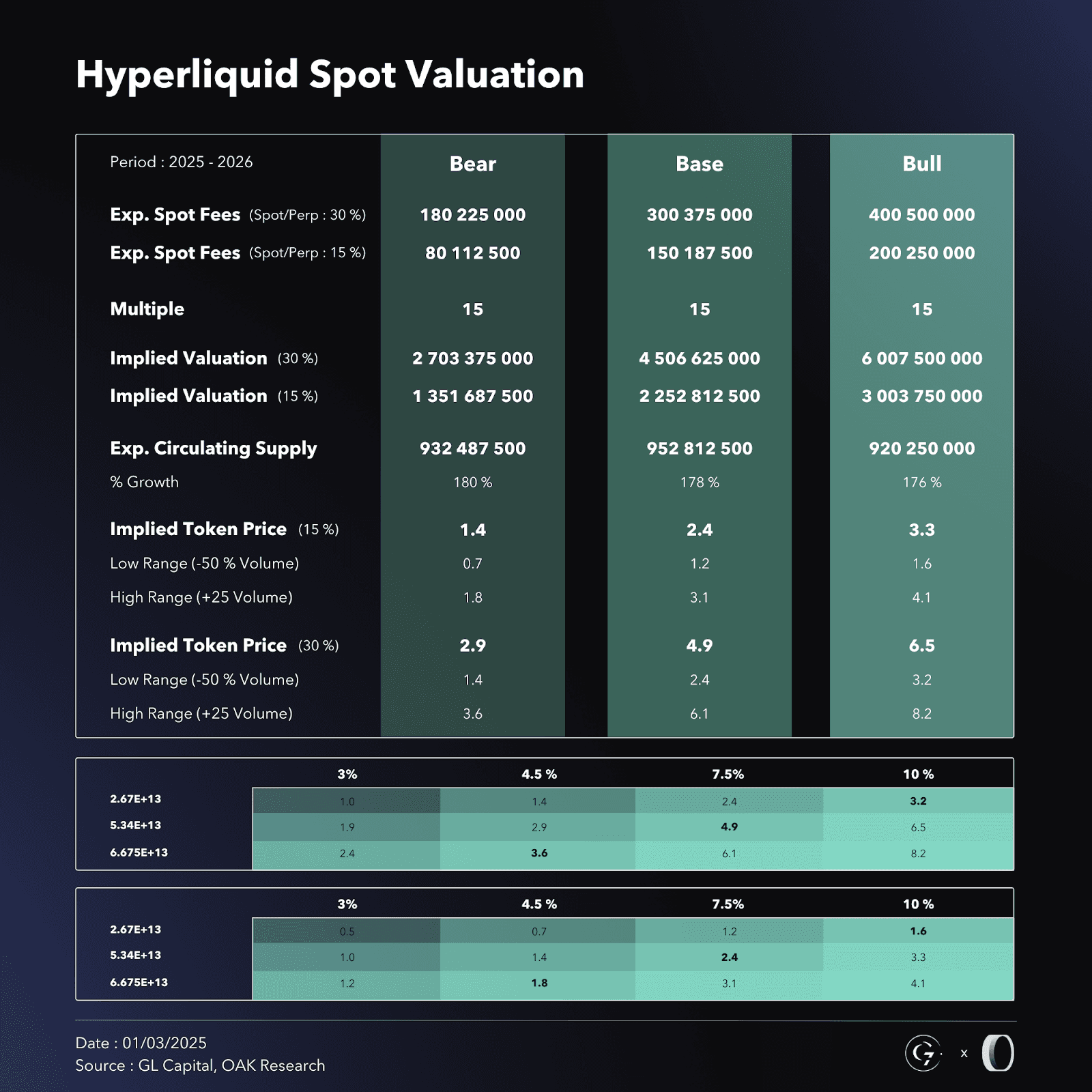

2. Spot Valuation

The Spot valuation is more straightforward. Among CEXs, spot trading volume typically represents around 18% to 30% of Perps volume. Based on this trend, we assume Hyperliquid’s Spot trading volume will reach between 15% and 30% of its Perps volume.

Since Spot and Perps fees are identical, we model two scenarios:

15% of Perps fees (conservative case)

30% of Perps fees (optimistic case)

We then apply the same sensitivity analysis to both, generating six different $HYPE price estimates per scenario—resulting in a total of six prices for the bear case, six for the base case, and six for the bull case.

Football Field Valuation

Using the football field valuation, it’s evident that $3 and $4 are the most consistent price points across different scenarios. However, we extended the range up to $6 per $HYPE for a key reason: the conservative fee assumptions.

Currently, Hyperliquid charges the same fees for Perps and Spot, whereas CEXs typically charge significantly higher fees for Spot trading. This is likely a strategic move to attract liquidity during the early stages of Spot trading. In reality, Hyperliquid could easily double its Spot trading fees while still maintaining a competitive edge over CEXs.

Given this potential for fee adjustments, we selected a final valuation range of $3 to $6 for the Spot segment.

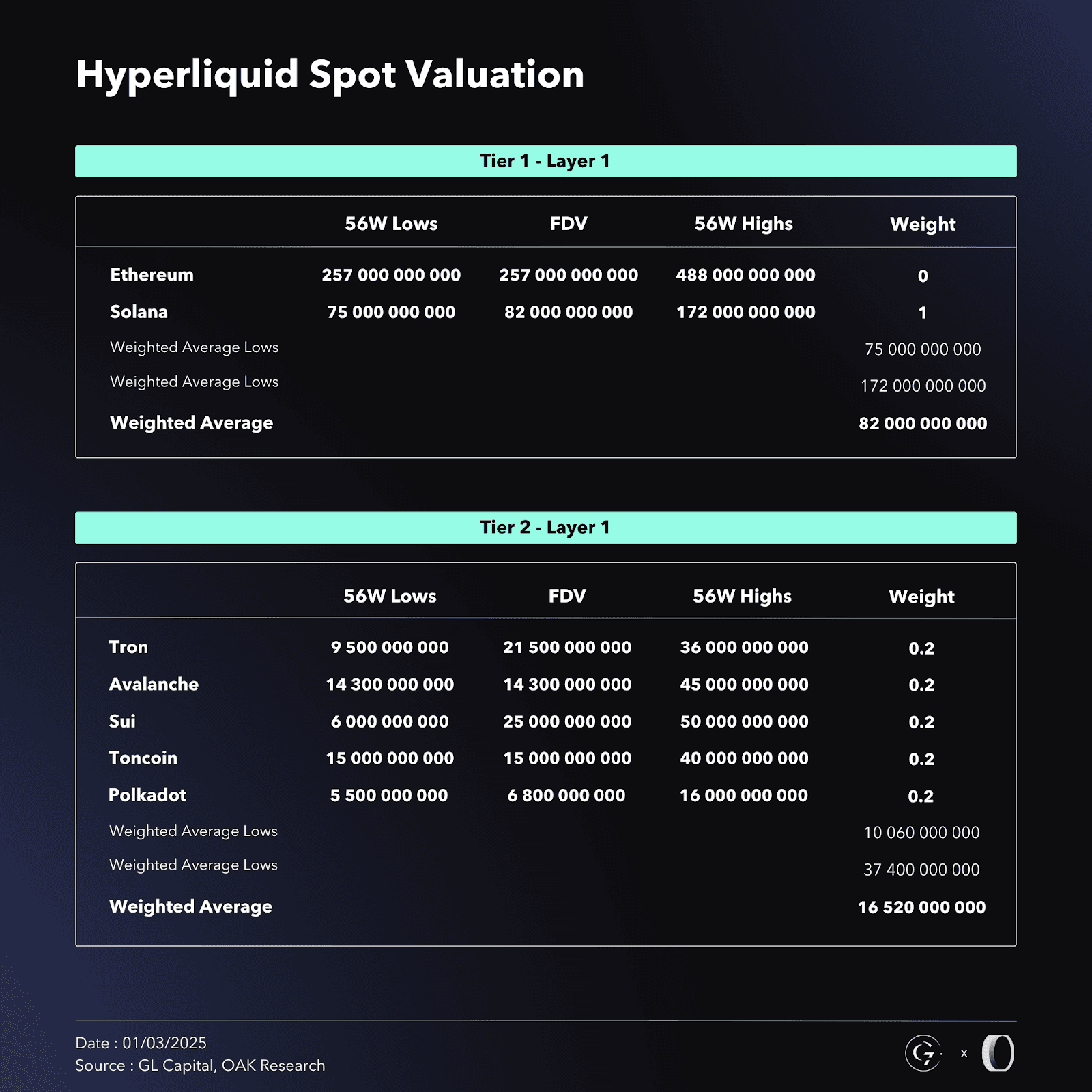

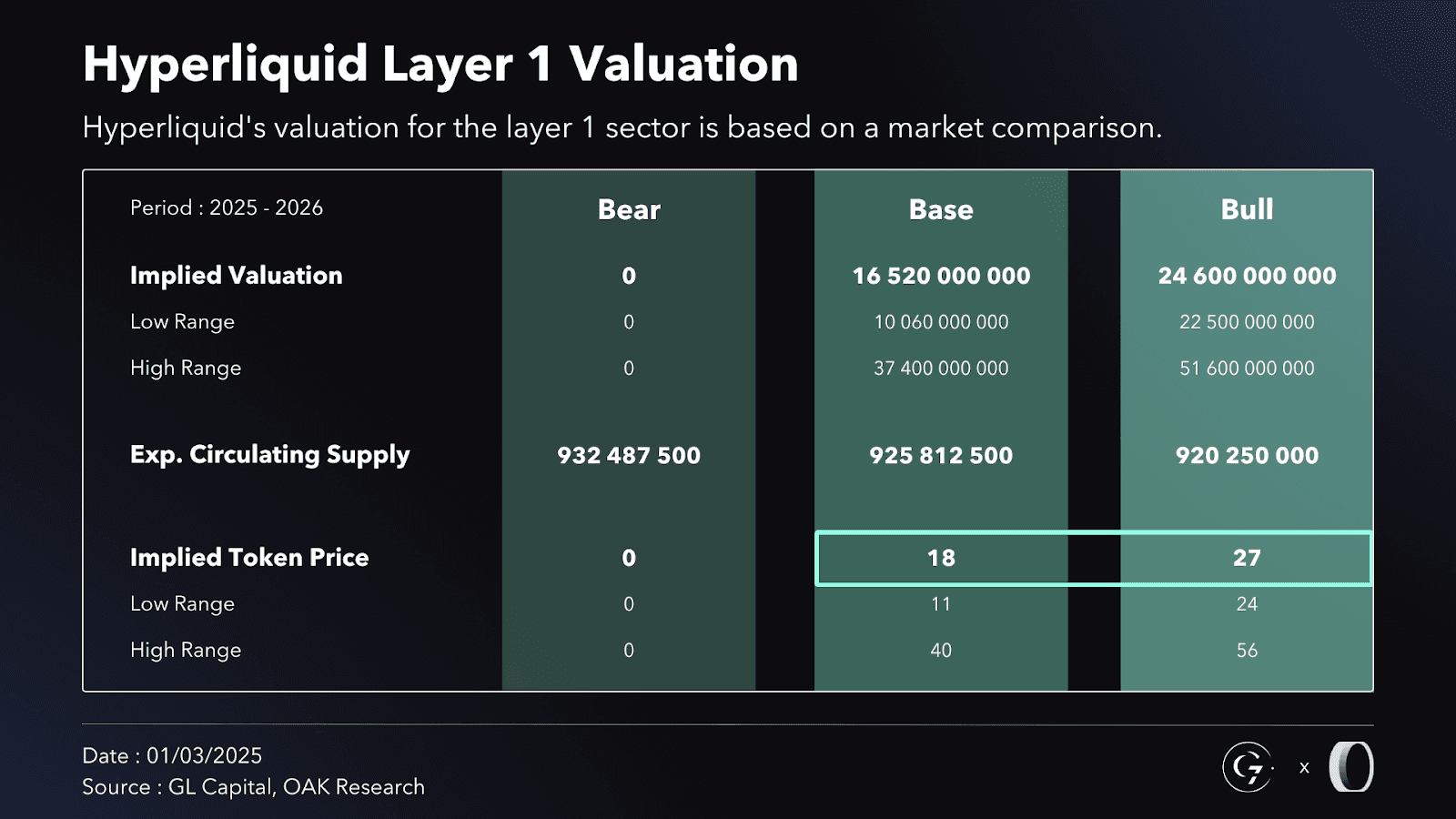

3. L1 Valuation

Valuing the L1 is inherently subjective, as there is no widely accepted financial model for pricing a network driven by network effects. Additionally, using current fee generation as a benchmark for L1 valuation doesn’t make sense, since Hyperliquid’s fees come entirely from Perps rather than the network itself.

Historically, the market has assigned massive premiums to L1s, often with little fundamental justification—some with virtually no activity still command tens of billions in valuation. At this stage, we believe the market is significantly underestimating the potential of Hyperliquid’s L1 and HyperEVM (which we’ll collectively refer to as L1).

With Perps already attracting substantial capital, and if Jeff and the team successfully execute their vision, the upside for Hyperliquid’s L1 is massive (see full article for details).

Bear case → $0 valuation, assuming no adoption (no builders, no users, no transaction fees)—which we don’t see as realistic but represents the worst-case scenario.

Base case → Hyperliquid’s L1 reaches the network effect of Tier 2 L1s, which we see as likely given the synergies between its apps and blockchain. We base this estimate on a weighted average of five Tier 2 L1s.

Bull case → Hyperliquid becomes the blockchain for all of finance, a trading hub with a large ecosystem of builders and users. While still early, we estimate it could reach 30% of Solana’s current valuation.

This part of the valuation carries subjectivity, but given how the market historically values L1s, these assumptions are reasonable. We estimate the L1 valuation to fall within a range of $18 to $27 per $HYPE.

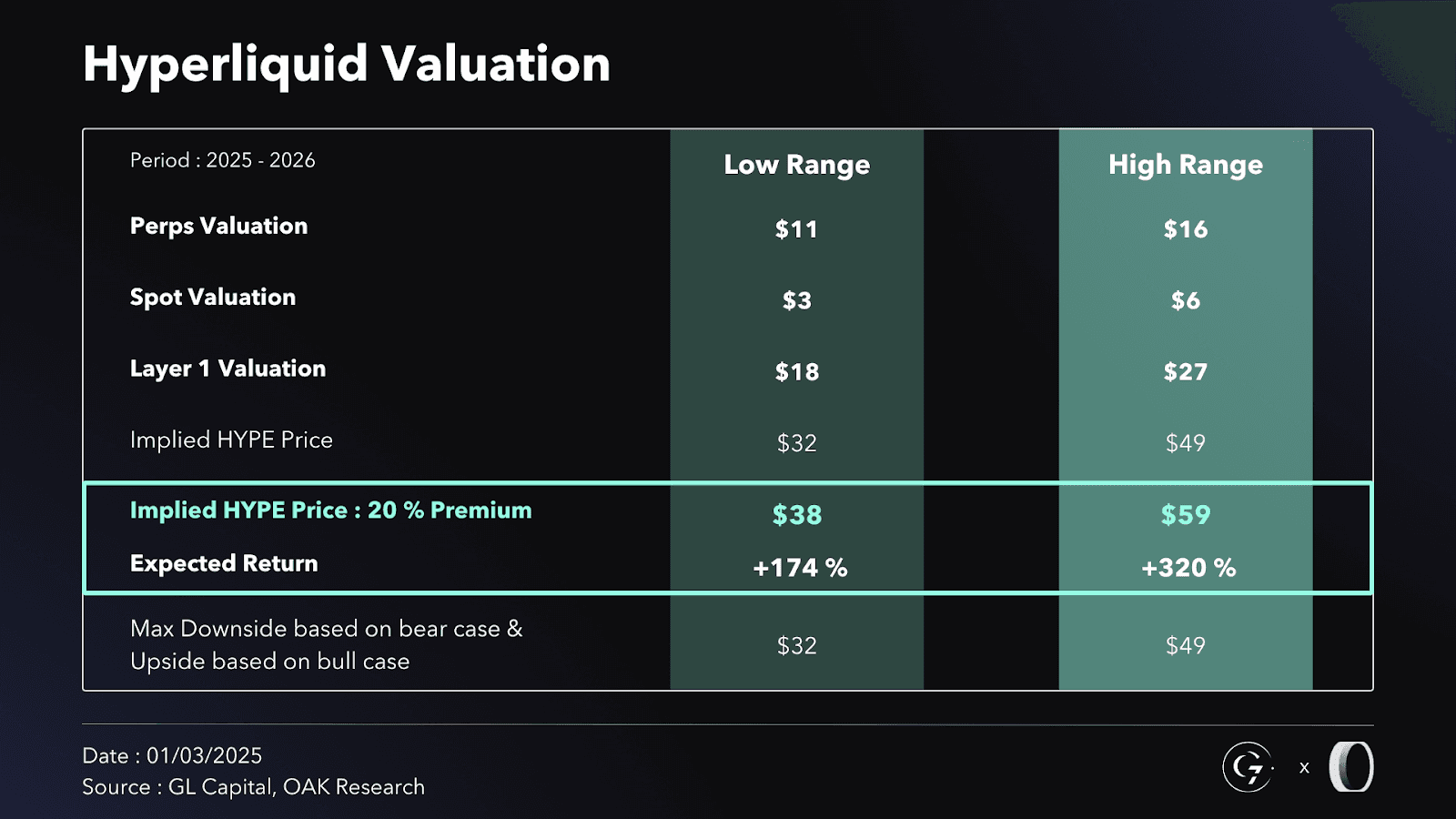

4. Sum of the Parts

We have now assigned a valuation range to each part of Hyperliquid, and it’s time to aggregate everything to determine the intrinsic value we currently assign to $HYPE.

Combining all components, our model—along with a degree of subjectivity—assigns a price range of $32 to $49 per $HYPE. Additionally, we factor in a 20% premium, recognizing that Hyperliquid has several catalysts that could further drive its valuation. We also believe that using a 15x multiple for such a high-potential company remains conservative.

Assessing downside risk is just as important. At the current price of $14, under the worst-case scenario—which assumes no market share growth, a 50% decline in total volume, and zero value assigned to the L1—we estimate a maximum downside of 55%.

Final Thoughts

Hyperliquid has positioned itself as a game-changer in decentralized trading, bridging the gap between CEXs and DEXs with a high-performance, fully on-chain ecosystem.

Unlike many projects reliant on speculative hype or VC funding, Hyperliquid has built a sustainable, revenue-generating business.

From a valuation standpoint, the upside potential is highly attractive, while the downside risk, though significant, presents an asymmetric R/R opportunity.

However, no investment comes without risk.

This valuation is based on projections that may not fully materialize. The main risk (see full research for more) is trading volume, as Hyperliquid’s fees are directly tied to overall market activity. A prolonged downturn could lead to lower fees, reduced buybacks, and a decline in ST value.

This valuation was conducted without assuming a specific market direction over the next two years, given the current global uncertainties.

However, even if we enter a bear market, the thesis remains intact. The “only” true PMF in this space is trading, and on average, leaving volatility aside, trading volume is expected to grow over the next five years.

Hyperliquid is well-positioned to continue capturing market share, regardless of short-term fluctuations.

That said, execution is key, and this is where our confidence in the Hyperliquid team stands out. They are among the most competent and innovative in the space.

Building an ecosystem of this scale takes time, but @HyperliquidX has a real shot at becoming “The House of Finance”

Hyperliquid.

Disclaimer

This research note has been prepared based on GLC & OAK current market outlook and convictions regarding the cryptocurrency market. It is critical to emphasize that investing in cryptocurrencies and digital assets involves significant risk due to their inherent volatility and unpredictability.

The information provided here is for educational and informational purposes only and should not be interpreted as financial or investment advice. Market trends and projections are subject to change due to unforeseen events, and short-term volatility may lead to substantial price fluctuations.

We strongly encourage you to perform your own due diligence and research before making any investment decisions. Nothing in this document should be considered an endorsement to buy or sell any particular asset. Never invest more than you are willing to lose and ensure that you fully understand the risks associated with this market.

GLC & OAK assumes no responsibility for any losses incurred as a result of using this information.